Explore Small Business Finance Topics

Discover our most popular topics for Canadian solopreneurs and small business owners. From income tax and GST/HST to QuickBooks tutorials and managing your business finances, these guides are designed to help you move from financial uncertainty to financial confidence.

Click on any topic and scroll down to see related articles.

📑Canadian Income Tax

Guidance on filing and planning your Canadian taxes, from T1 and T2 returns to instalments

📊Managing Business Finances

From cash flow to pricing and metrics — learn to manage your business finances with confidence.

🏢 Canadian Business Structure

Should you incorporate? Stay informed on sole proprietorships, corporations, and registrations.

💰 GST/HST & QST

Understand how to register, file, and maximize input tax credits while avoiding common mistakes.

🧾 Guides and Tutorials

Practical accounting processes like reconciliations, journal entries, and reporting.

📝 Deductions & Expenses

Learn which expenses are CRA deductible and how to track them for maximum tax savings.

Quebec Taxes & Business

QST, Revenu Québec filings, Quebec payroll, and provincial rules every entrepreneur should know.

👤 Paying Yourself

Salary vs dividends, management fees, and how to pay yourself from your corporation or small business.

💻 QuickBooks Online & Tools

Tutorials, guides and time-saving tips for using QuickBooks Online effectively.

🏦 Money & Personal Finance

Personal finance strategies for entrepreneurs, from RRSPs to saving for taxes.

6 Tax Deductible Expenses Every Self-Employed Business Owner Should Know

Many self-employed business owners under-claim tax deductions simply because they’re unsure of the rules. This post outlines six common tax-deductible expenses ( plus one expense that isn’t deductible) so you can claim expenses confidently and correctly.

How To Close Your Year End (or Period End)in QBO

Doing your own accounting in accounting software such as QuickBooks Online (QBO) is relatively straightforward especially if you have set up your QBO file optimally. You periodically enter invoices, expenses, bills and allocate transactions from the banking download. And while QBO is designed for non accountants, it is also equally appreciated by many accountants for its simplicity and user friendliness (although, as with any software product, there are grievances).

There does come a point, however, when you might notice that some things don’t look right. The bank balance or credit card balance might not match to the QuickBooks balance or your income and/or expenses might seem much too high or inconsistent with previous years. The solution to identifying and fixing these discrepancies is to perform what accountants refer to as year end (or month end) closing procedures, that if done properly, should correct any discrepancies that crop up. The ultimate goal of closing the books monthly or annually is to ensure that you can rely on the integrity of your data.

Is the Quick Method of Reporting GST/HST & QST the Right Choice for your Small Business

This post explains how the GST/HST and QST Quick Method works for Canadian self-employed individuals and small businesses, who it’s best suited for, and how to calculate whether it will save you time or money.

How to Prepare a Small Business Budget

As a solopreneur or small business owner, you might not think a budget is necessary. And for some businesses, that may be true especially if you have a service based business with steady income and minimal expenses.

But for many small business owners, cash flow can be inconsistent from month to month. Your sales can be very high one month and much lower in other months. Similarly you might have to pay a significant expense in particular months, while others are much leaner. And while this uncertainty is part of what makes entrepreneurship exciting, it also makes it stressful.

One of the most effective ways to reduce that uncertainty is to create a cash-flow budget and update it as your actual numbers come in.

10 Year End Financial and Tax Tips for Your Small Business

As the end of the year approaches, many small businesses experience a natural slowdown. This makes it a practical time to review your business, financial, and tax position before year-end.

A year-end review allows you to identify planning opportunities, make adjustments before December 31, reduce last-minute tax preparation issues, and ensure you are properly prepared for the upcoming year. These tips are intended to help you assess your current situation and take action where needed.

How Long to Keep Your Business Documents According to CRA

If you are self-employed or have been in business for some time, it is important to understand how long business records should be kept. These records include invoices, receipts, bank statements, and other documents that you use to support your income and expenses.

Business records cannot be simply be discarded at any time. The Canada Revenue Agency (CRA) sets specific requirements regarding how long records must be kept, where they must be stored, and a process to follow if records are destroyed before the end of the required retention period.

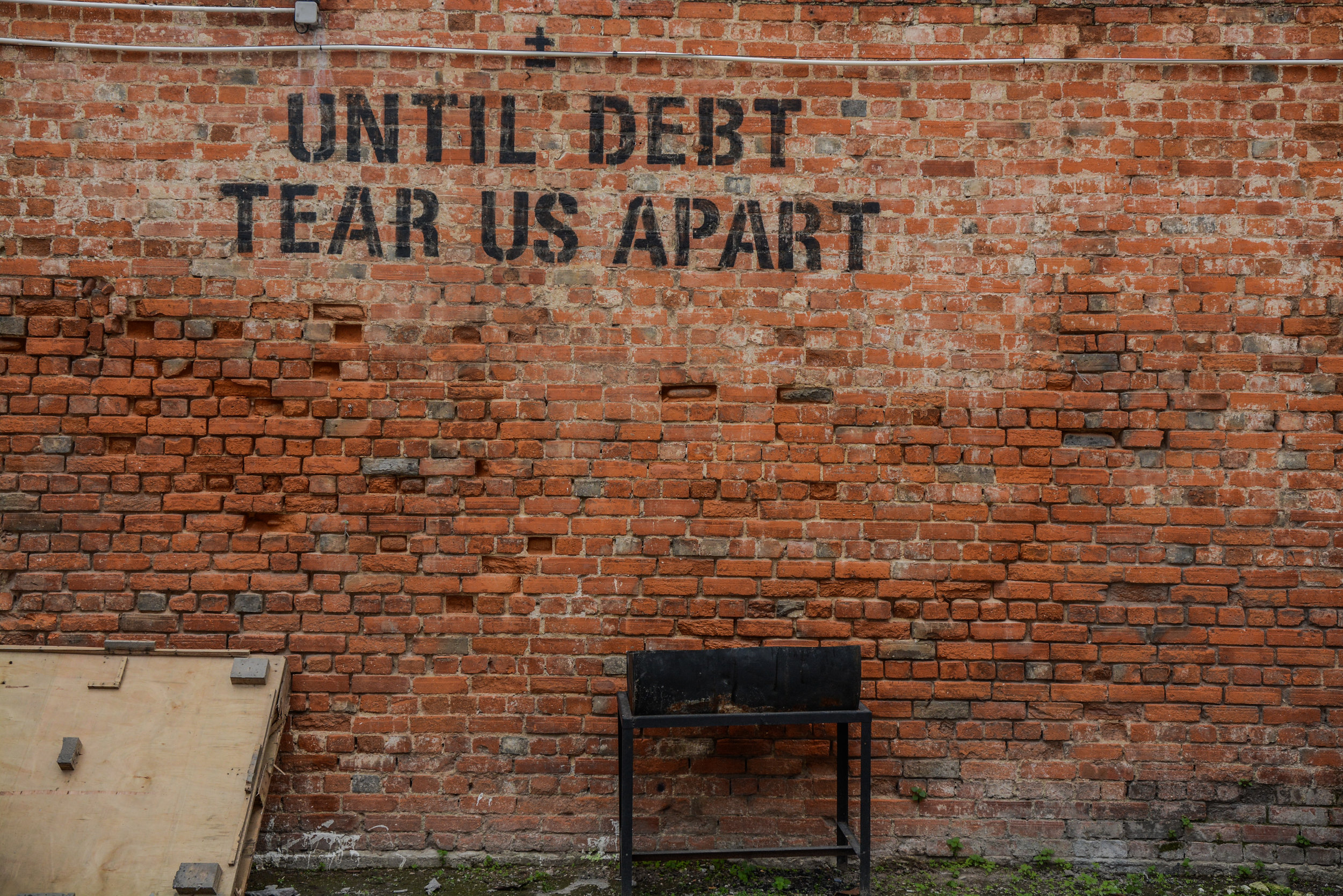

7 Reasons Why Debt is Good for Your Business

Debt is often perceived negatively. Debt can be “evil”, “crippling” and an “unforgiving master”( the last one from the Google query “Debt is…”;). It can suggest a lack of sufficient cash flow and an inability to fulfil your funding requirements. It also an indication of increased risk, as if you are unable to service your debt repayments, it could have dire consequences for your business.

There is however a good side to debt supported by the fact that the majority of the most successful businesses have some level of debt. It can be a great way for individuals and businesses to earn a return on their investment. And of course it is an integral part of the engine that drives the world economy.

For small business owners, debt can significantly improve your bottom line as long as it is managed responsibly.

9 Tax Facts about Charitable Donations for Individuals and Small Business Owners

Not all contributions or fundraising activities qualify as charitable donations for tax purposes. The Canada Revenue Agency (CRA) sets specific criteria for what is considered an eligible charitable donation and what documentation is required to claim a tax credit.

This article outlines key tax rules related to charitable donations, including what qualifies, who can issue official donation receipts, how donations are claimed by individuals and business owners, and common misconceptions.

What Types of Membership/Subscription Expenses Can You Deduct?

From an accounting and tax perspective, not all subscription costs are deductible, and deductibility depends on the nature of the expense and how it relates to earning business income.

This article explains which types of memberships and subscriptions are generally deductible, which are not, and how the Canada Revenue Agency (CRA) views common categories such as professional dues, software subscriptions, education platforms, and mixed personal-business services. I also discuss how to properly account for subscription expenses.

CPP for Self Employed Business Owners, Explained.

When you are an employee, your employer is responsible for withholding and remitting payroll deductions, including income tax and contributions to the Canada Pension Plan (CPP) or, in Quebec, the Quebec Pension Plan (QPP). Employers are also required to contribute an amount equal to the employee’s CPP or QPP contribution.

For self-employed individuals, there is no employer to withhold or contribute on their behalf. This resource explains how CPP/QPP contributions work for self-employed business owners, how contributions are calculated, when they are paid, and how they are reported on a personal tax return.

How to Record Shareholder Dividends in QBO

If you own a small business corporation in Canada, you’ve probably wondered: What’s the best way to pay yourself? The answer, in most cases, is either via salary (as an employee) or dividends (as a shareholder) or in limited cases, as a subcontractor with management fees.

I have a number of resources that delve into the best method of owner compensation. In this tutorial, however, I’m simply going to briefly review dividends and then show you how to record dividends in QuickBooks Online (QBO).

Guidance on Registering for Payroll and Remitting Source Deductions

There comes a time for many small business owners when they decide that they need to hire employees. This is usually an excellent sign as it means a) the business is growing and b) the small business owner has learned to delegate. It also means that additional paperwork needs to be filled out and additional taxes need to be paid. The simplest option when deciding to augment your workforce is to have the new worker invoice the business, based on hours worked or some other formula. Unfortunately, there are very specific rules as to who qualifies as a self employed contractor. Essentially, if your have someone that works full time, has little flexibility with respect to the hours that they work and you provide the tools such as a desk/office, computer etc, then there is a good chance that the tax authorities will classify them as an employee. In this case, where your worker is clearly an employee, you must register for payroll, pay them a salary and submit regular, periodic payroll reports and payments to the Canada Revenue Agency (CRA). As usual, if you live in Quebec, you must submit to Revenue Quebec (MRQ) as well.

Should you register for GST/HST and QST and What it Means to Be Zero Rated

When starting your new Canadian small business or launching into self employment, it is essential to determine whether you are required to register for GST/HST (and QST if you have a started a business in Quebec). The simple answer is that if you anticipate that your annual gross revenues (total sales) are going to exceed $30,000 and your products or services do not qualify as Exempt or Zero rated (explained below) , then you are required to register for GST/HST and collect sales taxes from your Canadian customers and clients.

The $30,000 limit applies to the last 4 quarters of revenues. If you decide not to register for sales tax upon the inception of your business/self employment, then you must monitor your sales revenues over a rolling 4 quarter period and register once you get close to this amount.

How to Account for Bad Debts and Record it in Quickbooks Online and Desktop

One of the more unpleasant aspects of being a business owner is having to chase clients that do not pay. It is frustrating, stressful and disheartening, while attempts to collect are an unproductive use of time and can have a significant impact on cash flow, particularly if you are unprepared. A bad debt, in accounting terms, refers to an amount charged to a customer that is never paid. While the original sale would have been reflected as revenue, the uncollectible bad debt would then have to be written off as a separate line item on the profit and loss statement

10 Options to Help Small Businesses Get Paid Faster

One of the numerous ways in which technology has benefitted small businesses has been to increase the number of payment options available. While conventional methods of payment like cash and cheque still exist, there are also a variety of other options like debit cards, internet transfers and mobile payments that have hugely simplified how small business owners, freelancers, gig workers and anyone with a side hustle can work with their customers.

The flipside is that every business owner must wade through the alternatives and decide what type of payment options are right for their customers without overwhelming them (or themselves).