Ready to Become more financially confident?

Join my small Business newsletter.

Your 2026 Tax Season Roadmap

For Canadian self employed/business owners, “tax season” isn’t just one date in April. It’s a series of deadlines that, for many of you, starts earlier. If you're incorporated, these deadlines are not limited to "tax season" but can occur throughout the year.

Tax changes for 2026 (with lots of numbers :))

In this post I highlight important tax changes for 2026 for both individuals and self employed/small business owners and their impact on your bottom line.

A Financial Reset for the Year Ahead

In my conversations with many of you, I often encounter some of these themes:

An ongoing worry about “doing something wrong” e.g. missing a deadline, filing incorrectly, or audits by CRA or Revenue Québec.

A feeling of being left to figure things out alone, especially after past experiences with unresponsive or ineffective professional help.

Frustration with tools like QuickBooks, where instead of feeling supported, you feel like you’re missing something obvious and second-guessing yourself.

Uncertainty about whether you are claiming everything you can and paying too much tax.

And, underlying this, there's a desire to feel like a business owner who understands their numbers, feels in control, and can make decisions confidently.

Reflections as We Close Out the Year

From irregular income to shiny object syndrome, these five year-end reflections highlight common money challenges facing solopreneurs and how to approach them with clarity.

Three Numbers for Financial Clarity

Whether you’re self-employed or not, these three simple numbers can bring clarity, reduce financial stress, and help you make smarter money decisions.

Your Top Year End Money Questions

It is hard to believe that we're so close to the end of 2025 (and coming up to tax season!). While the natural topic of interest at this time of year would be year end finance/tax tips, I have a video about that and I'm also doing a free workshop at YES Montreal in mid December (stay tuned for more details).

Budget 2025: What You Need to Know.

The Canadian federal budget is usually released in March but was delayed by several months this year, ostensibly due to the election. Many people were waiting with anticipation, but the result itself was somewhat anticlimactic. There aren’t sweeping tax changes or new programs, particularly for individual taxpayers or small business owners, so there isn’t really too much to get excited (or conversely, worried) about.

But, as with every annual budget, it’s useful to understand the more relevant changes.

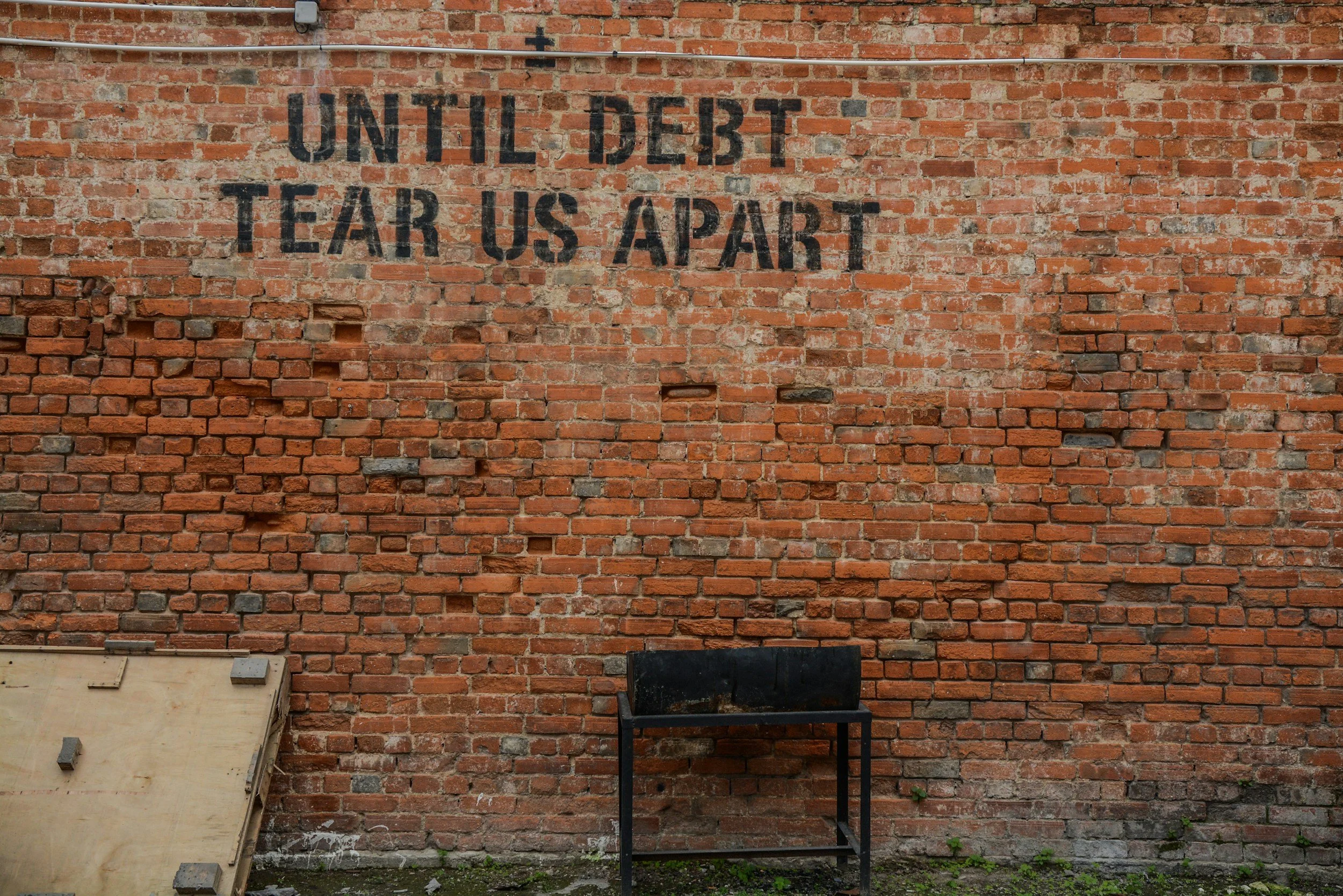

Good Debt vs Bad Debt

A young colleague of mine recently purchased a house. His mortgage payments are going to be less than the rent he is currently paying and he will now own an asset that will likely increase in value over time. However, despite these clear positives, he is feeling a psychological burden that is impacting his financial decisions.

What Makes a Membership Valuable?

As I’ve been building my own membership, I’ve been thinking a lot about what makes a membership valuable.

As I wrote in my blog post this week, we have seen a significant shift from paying for a service in one lump sum to a monthly (or annual) fee. This might simply seem like a revenue grab, but customers have also become much more savvy and selective. And there is a lot more competition.

The Joys (and Tax Benefits) of Moving

For those of you planning to move, I don't recommend it 😅

I recently moved and while I love my new place, it has been a challenging couple of months.

First, there is the time that it takes (pro tip: it is much longer than you think) to arrange everything, pack and make sure you are ready for the day. Then, there are all the decisions that you have to make. Should you keep those pants that you haven't worn in 5 years? Are you actually ever going to make a fondue? Do you really need all those instruction manuals that you have literally never looked at?

Next comes figuring out where everything is going to be stored in the new place. If you are moving into an older home, closet space is usually at a premium. So you hack storage solutions in an effort to empty a box and hope to figure it out later. (which of course means that you can't really find anything).

My (Late) Summer Reading Recs

I was recently invited to be on a podcast to talk about books that have had a significant influence on me and my business. Sadly, given the limited amount of time, I was only able to discuss a couple. I thought I would talk about them and some others here.

Do You Need an Accountant?

I frequently hear a similar sentiment from consultees who are also looking for accountants i.e. they want someone who can take away the friction and the stress that comes with tax obligations. This doesn’t seem like a big ask but the accountants they meet with often seem lacklustre or, worse, ghost them. The consequence? Their tax returns are late, the stress accumulates, and the overwhelm of it all leads to avoiding the problem altogether.

Your Mid-Year Business Finances Checklist

Many of us are in summer mode, contemplating vacations and staycations while procrastination seems to be rising at the same rate as the temperature. (insert groan here)

Finances tend to be the primary victim of summer indolence. So I've prepared a checklist (that you can also download) to help you stay on track .

Unexpected Business Lessons From a Creator Conference

Last week, I was in Boise attending the Craft + Commerce conference which brought together a variety of creators, educators, and entrepreneurs.

This kind of conference isn’t usually in my wheelhouse since it wasn’t finance-related. I quickly realized, thought, that I had more in common with many of the attendees than I often do at accounting conferences as the way we’re building our businesses, and the goals we're hoping to achieve, are much more aligned.

Earned vs Passive Income and Why it Matters

A common concept that I find myself explaining, when I talk to people about their taxes, relates to earned vs passive income.

This might sound a bit yawn inducing, but (like marginal tax rates), the type of income you earn determines how it’s taxed, how much you can contribute to your RRSP, and even what benefits you qualify for.

Are You Financially Confident?

Many of us struggle to feel like we have control over our finances.

This can be due to a variety of reasons:

We don’t feel like we know enough about finances

We grew up in a household where money was scarce

We’ve been told (or believe) that we’re not good with numbers

We never seem to have enough money

We’ve made financial mistakes in the past and fear repeating them

We feel overwhelmed by the complexity of financial systems

We didn’t learn about money in school or through formal education

What to Do After Tax Season to Prepare for Next Year

As we move past tax season, many of us can breathe a collective sigh of relief (at least with respect to taxes).

Some of us may have resolved to make sure that next tax season is less stressful, but thinking about that now seems a bit premature. After all, we have many months to prepare and we can just do that "soon", once we have taken care of our other responsibilities and perhaps after we've had some time to enjoy the summer.

Of course, time passes very quickly, and the force of procrastination is strong. So, our good intentions might tend to fall by the wayside as there is always something a little more pressing to do.

We often procrastinate to avoid being overwhelmed. There are however some simple processes you can put into place now that can help make next tax season far less overwhelming and stressful. The key is to develop habits around them.

Tax Time: Frequently Asked Questions

The deadline to file your taxes is speedily approaching - April 30th if you are a regular taxpayer or corporation owner that takes a salary or dividend. (Self employed/small business owners still have some breathing room until June 16th).

For those of you who have done your taxes, you can give yourself a huge pat on the back and enjoy the feeling of being stress free.

For those of us who haven’t (myself included), there’s still time. If you’re planning to file on your own, the weekend is a great opportunity. Simply gather your tax documents (T4s, T5s, RRSPs, medical expenses, donations, etc.), choose your tax software, and find a quiet place to get it done.

What Happens After You File Your Taxes

CRA (Revenue Canada) typically processes electronically filed returns within two weeks (and sometimes even immediately!). Your NOA confirms whether you’re getting a refund, owe taxes, or have a zero balance. It might also include adjustments or a request for more information.

You can check your NOA through CRA’s My Account, or wait for it to arrive in the mail, if you are not signed for my account.

Your NOA also includes your updated RRSP contribution room—something to keep in mind when planning current-year contributions.

What You Do (and Don’t) Have to Report as Income

One of my ongoing challenges is defining what it means to be a small business owner.

From a tax perspective, whether you’re a self-employed gig worker, freelancer, independent contractor, or solopreneur, you are essentially seen as a small business. What this effectively means is, if you’re unincorporated, you’ll report your business income and expenses on the T2125 form (statement of business activities) as part of your personal tax return. If incorporated, you’ll file a T2 corporate return.

In addition to small business income, the question arises, what other types of income do you have to report and what is non taxable?