Explore Small Business Finance Topics

Discover our most popular topics for Canadian solopreneurs and small business owners. From income tax and GST/HST to QuickBooks tutorials and managing your business finances, these guides are designed to help you move from financial uncertainty to financial confidence.

Click on any topic and scroll down to see related articles.

📑Canadian Income Tax

Guidance on filing and planning your Canadian taxes, from T1 and T2 returns to instalments

📊Managing Business Finances

From cash flow to pricing and metrics — learn to manage your business finances with confidence.

🏢 Canadian Business Structure

Should you incorporate? Stay informed on sole proprietorships, corporations, and registrations.

💰 GST/HST & QST

Understand how to register, file, and maximize input tax credits while avoiding common mistakes.

🧾 Guides and Tutorials

Practical accounting processes like reconciliations, journal entries, and reporting.

📝 Deductions & Expenses

Learn which expenses are CRA deductible and how to track them for maximum tax savings.

Quebec Taxes & Business

QST, Revenu Québec filings, Quebec payroll, and provincial rules every entrepreneur should know.

👤 Paying Yourself

Salary vs dividends, management fees, and how to pay yourself from your corporation or small business.

💻 QuickBooks Online & Tools

Tutorials, guides and time-saving tips for using QuickBooks Online effectively.

🏦 Money & Personal Finance

Personal finance strategies for entrepreneurs, from RRSPs to saving for taxes.

How To Close Your Year End (or Period End)in QBO

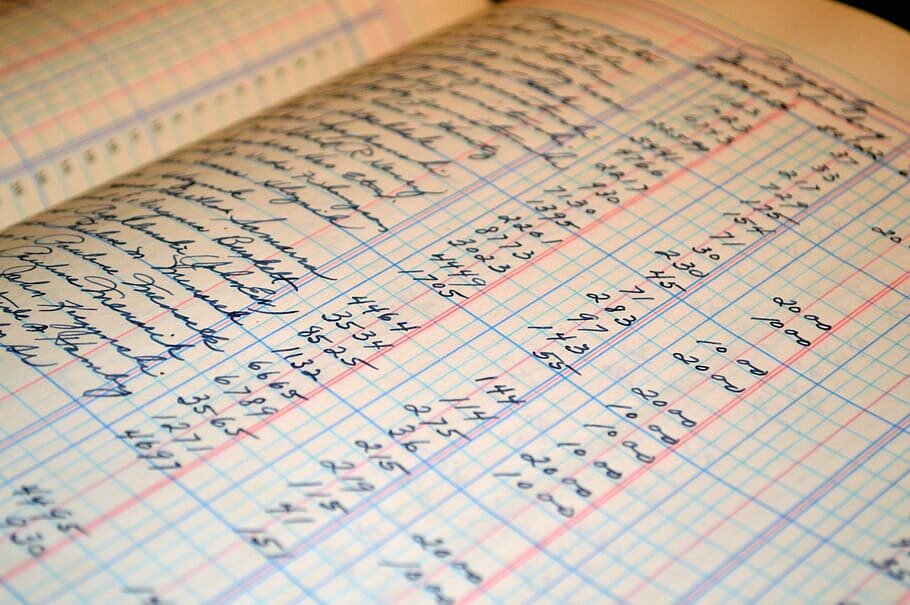

Doing your own accounting in accounting software such as QuickBooks Online (QBO) is relatively straightforward especially if you have set up your QBO file optimally. You periodically enter invoices, expenses, bills and allocate transactions from the banking download. And while QBO is designed for non accountants, it is also equally appreciated by many accountants for its simplicity and user friendliness (although, as with any software product, there are grievances).

There does come a point, however, when you might notice that some things don’t look right. The bank balance or credit card balance might not match to the QuickBooks balance or your income and/or expenses might seem much too high or inconsistent with previous years. The solution to identifying and fixing these discrepancies is to perform what accountants refer to as year end (or month end) closing procedures, that if done properly, should correct any discrepancies that crop up. The ultimate goal of closing the books monthly or annually is to ensure that you can rely on the integrity of your data.

How to Prepare a Small Business Budget

As a solopreneur or small business owner, you might not think a budget is necessary. And for some businesses, that may be true especially if you have a service based business with steady income and minimal expenses.

But for many small business owners, cash flow can be inconsistent from month to month. Your sales can be very high one month and much lower in other months. Similarly you might have to pay a significant expense in particular months, while others are much leaner. And while this uncertainty is part of what makes entrepreneurship exciting, it also makes it stressful.

One of the most effective ways to reduce that uncertainty is to create a cash-flow budget and update it as your actual numbers come in.

10 Year End Financial and Tax Tips for Your Small Business

As the end of the year approaches, many small businesses experience a natural slowdown. This makes it a practical time to review your business, financial, and tax position before year-end.

A year-end review allows you to identify planning opportunities, make adjustments before December 31, reduce last-minute tax preparation issues, and ensure you are properly prepared for the upcoming year. These tips are intended to help you assess your current situation and take action where needed.

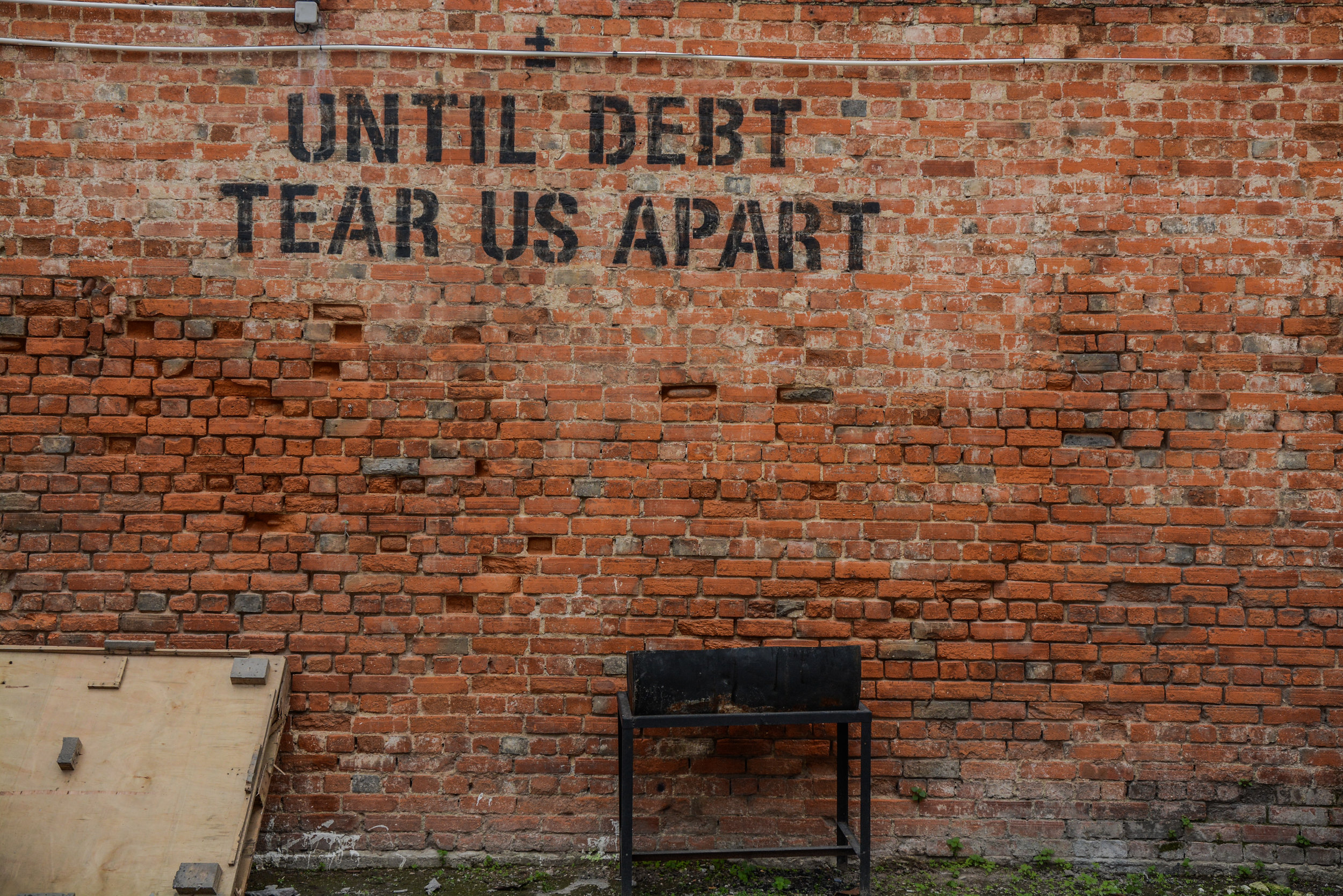

7 Reasons Why Debt is Good for Your Business

Debt is often perceived negatively. Debt can be “evil”, “crippling” and an “unforgiving master”( the last one from the Google query “Debt is…”;). It can suggest a lack of sufficient cash flow and an inability to fulfil your funding requirements. It also an indication of increased risk, as if you are unable to service your debt repayments, it could have dire consequences for your business.

There is however a good side to debt supported by the fact that the majority of the most successful businesses have some level of debt. It can be a great way for individuals and businesses to earn a return on their investment. And of course it is an integral part of the engine that drives the world economy.

For small business owners, debt can significantly improve your bottom line as long as it is managed responsibly.

What Types of Membership/Subscription Expenses Can You Deduct?

From an accounting and tax perspective, not all subscription costs are deductible, and deductibility depends on the nature of the expense and how it relates to earning business income.

This article explains which types of memberships and subscriptions are generally deductible, which are not, and how the Canada Revenue Agency (CRA) views common categories such as professional dues, software subscriptions, education platforms, and mixed personal-business services. I also discuss how to properly account for subscription expenses.

How to Account for Bad Debts and Record it in Quickbooks Online and Desktop

One of the more unpleasant aspects of being a business owner is having to chase clients that do not pay. It is frustrating, stressful and disheartening, while attempts to collect are an unproductive use of time and can have a significant impact on cash flow, particularly if you are unprepared. A bad debt, in accounting terms, refers to an amount charged to a customer that is never paid. While the original sale would have been reflected as revenue, the uncollectible bad debt would then have to be written off as a separate line item on the profit and loss statement

10 Tips to Help you Keep More Cash in Your Business

One of the biggest challenges for many small business owners, particularly in the initial and growth stage, is ensuring that they maintain sufficient cash flow. Many businesses with great potential have suffered an untimely demise due to their inability to pay their suppliers, employees and revenue agencies. In many cases, this can be prevented through a better understanding of your small business’ cash flow requirements and making sure that you implement relevant processes that can handle cash flow issues as they arise.

Should You Do Your Own Small Business Accounting?

Any potential business owner knows that there are some many facets to starting a small business that it is easy to be overwhelmed . Consequently we tend to focus on what is immediately important while we let some of the more technical aspects of our business be deferred until we can no longer avoid them . One of the often overlooked aspects of business is accounting, which arguably (I’m a bit biased) is one of the most important parts of running a business as a good accounting system will let you know if you are financial viable. While many business owners can cobble together a sense of their financial situation through (as a former boss of mine used to say)” back of the envelope” calculations and reviewing their bank balances, there is still a need for an accounting system which at its core can validate your calculations and provide you with data to ensure that your business is going in the right direction

4 Accounting Transactions that Use Journal Entries and How to Enter them in QBO

Accounting software has come a long way in the past few years. Although a good bookkeeper can be invaluable, It has become fairly easy for business owners and their support staff to take on the responsibility of entering day to day transactions while they employ accountants for the more complex aspects of their accounting and tax. While entering the majority of transactions in software, such as Quickbooks Online is fairly straightforward, there are transactions that require somewhat special treatment discussed below:

19 Features to Consider When Selecting Small Business Accounting Software

A good accounting software can be an invaluable tool for businesses. Before choosing an accounting software it helps to have a detailed understanding of what your accounting system can do for you . This involves analysing the key aspects of your business, determining what is essential (eg. invoicing, expenses, banking, reports) and what you would like to have (eg. time tracking, credit card payments, banking downloads etc.). By reviewing your requirements in advance and building a checklist, you can make a better decision about something that goes to the very foundation of your business. Below are some important features to consider:

Why a Separate Bank Account is Essential for Your Small Business

If you are self employed or a small business owner taking care of your own accounting and business finances, you have probably discovered that this can be time consuming and occasionally frustrating. It can sometimes be difficult to know if you are doing things correctly. Consequently, you procrastinate, which makes things worse at year end or tax time. To combat the problem it is important to have tools in place to facilitate the process and make it less painful, which could include accounting software and/or a bookkeeper as well as a good organization system for your documents, whether you have a paperless office or a manual filing system. Another very simple measure that you can take is to have a separate bank and credit card account for your business.

How The CRA AII Program Increases the Tax Deduction for Computers and Other Fixed Assets

In the fall of 2018, the federal government decided to introduce a tax incentive called the Accelerated Investment Incentive (AII). The purpose of this program was to stimulate business investment by increasing the amount of capital cost allowance (CCA) on depreciable property (the terminology, sadly, is a bit less stimulating). In layman’s terms, it means you could claim a higher amount of depreciation on assets such as computer, equipment, furniture etc, in the year of purchase, thereby reducing your taxes in the short term.

9 Tips for Building a Sales Forecast

Having a dynamic, regularly updated sales forecast can be essential to the success of a small business. By forecasting your sales revenue you are helping to control for its unpredictability, an inherent risk in any business venture, and prepare for the decisions that are essential to your business profitability. Whether your sales are increasing, decreasing or static, it is always better when decisions are made proactively rather than reactively.

Building your small business sales forecast can be as simple as you want it to be and does not require an accounting degree , particularly when your business is in the early and/or startup stages. Below are some tips to help you create your sales forecast:

How to Read a Profit and Loss Statement

Whether you're just starting out or a seasoned business owner, it is imperative to understand the financial health of your business. This can be done via a variety of different types of analyses. In terms of the big picture and overall performance of your business, the reports that are collectively referred to as the financial statements are the most crucial .

The financial statements typically comprise three reports: the balance sheet, profit and loss statement and statement of cash flows.

Some of you might be intimidated by the technical terminology of accounting. But, in reality , the profit and loss statement (also know as the income statement) is actually quite easy to read and understand especially as it relates to your own business.

5 Reasons Your Small Business Needs an Accounting System

So, what exactly is an accounting system? At its core, an accounting system is a method of organizing your financial data. There are various types of accounting systems out there, ranging from complex enterprise solutions to simple small business accounting software like QuickBooks. You can even use a spreadsheet if your business is straightforward with minimal transactions. The key is to have some system in place to manage your finances effectively.

Now, let’s explore the five reasons why every small business, including yours, needs an accounting system.