Explore Small Business Finance Topics

Discover our most popular topics for Canadian solopreneurs and small business owners. From income tax and GST/HST to QuickBooks tutorials and managing your business finances, these guides are designed to help you move from financial uncertainty to financial confidence.

Click on any topic and scroll down to see related articles.

📑Canadian Income Tax

Guidance on filing and planning your Canadian taxes, from T1 and T2 returns to instalments

📊Managing Business Finances

From cash flow to pricing and metrics — learn to manage your business finances with confidence.

🏢 Canadian Business Structure

Should you incorporate? Stay informed on sole proprietorships, corporations, and registrations.

💰 GST/HST & QST

Understand how to register, file, and maximize input tax credits while avoiding common mistakes.

🧾 Guides and Tutorials

Practical accounting processes like reconciliations, journal entries, and reporting.

📝 Deductions & Expenses

Learn which expenses are CRA deductible and how to track them for maximum tax savings.

Quebec Taxes & Business

QST, Revenu Québec filings, Quebec payroll, and provincial rules every entrepreneur should know.

👤 Paying Yourself

Salary vs dividends, management fees, and how to pay yourself from your corporation or small business.

💻 QuickBooks Online & Tools

Tutorials, guides and time-saving tips for using QuickBooks Online effectively.

🏦 Money & Personal Finance

Personal finance strategies for entrepreneurs, from RRSPs to saving for taxes.

How to Register your Sole Proprietorship in Each Province

Once you have decided to start a new business and have concluded that the best structure for your business is a Sole Proprietorship, the next step is to determine if you need to register it. If you are using your exact first and last name, and only your exact first and last name, then you are not required to register your business, regardless of which province your are located in. However, if you are using a business name that is anything other than your own name, you are required to register your business in all provinces, with the exception of Newfoundland and Labrador where registration of Sole Proprietorships is not required.

7 Qualities of Highly Desirable Clients

When you are a business owner/freelancer, there is wonderful feeling of gratification when you land a great client. These are clients that ask great questions, respect our work and make us feel happy to have chosen the entrepreneurial route. Then there are the not so great clients who have unrealistic expectations, are unimaginative and often just plain clueless.

It should also go without saying that we must also do what it takes to be provide an excellent experience to our clients and customers. It is not dissimilar from being in a relationship with a partner or spouse and for both sides to get the most out of it, you as the service provider, must also be responsive, respectful, fair and transparent.

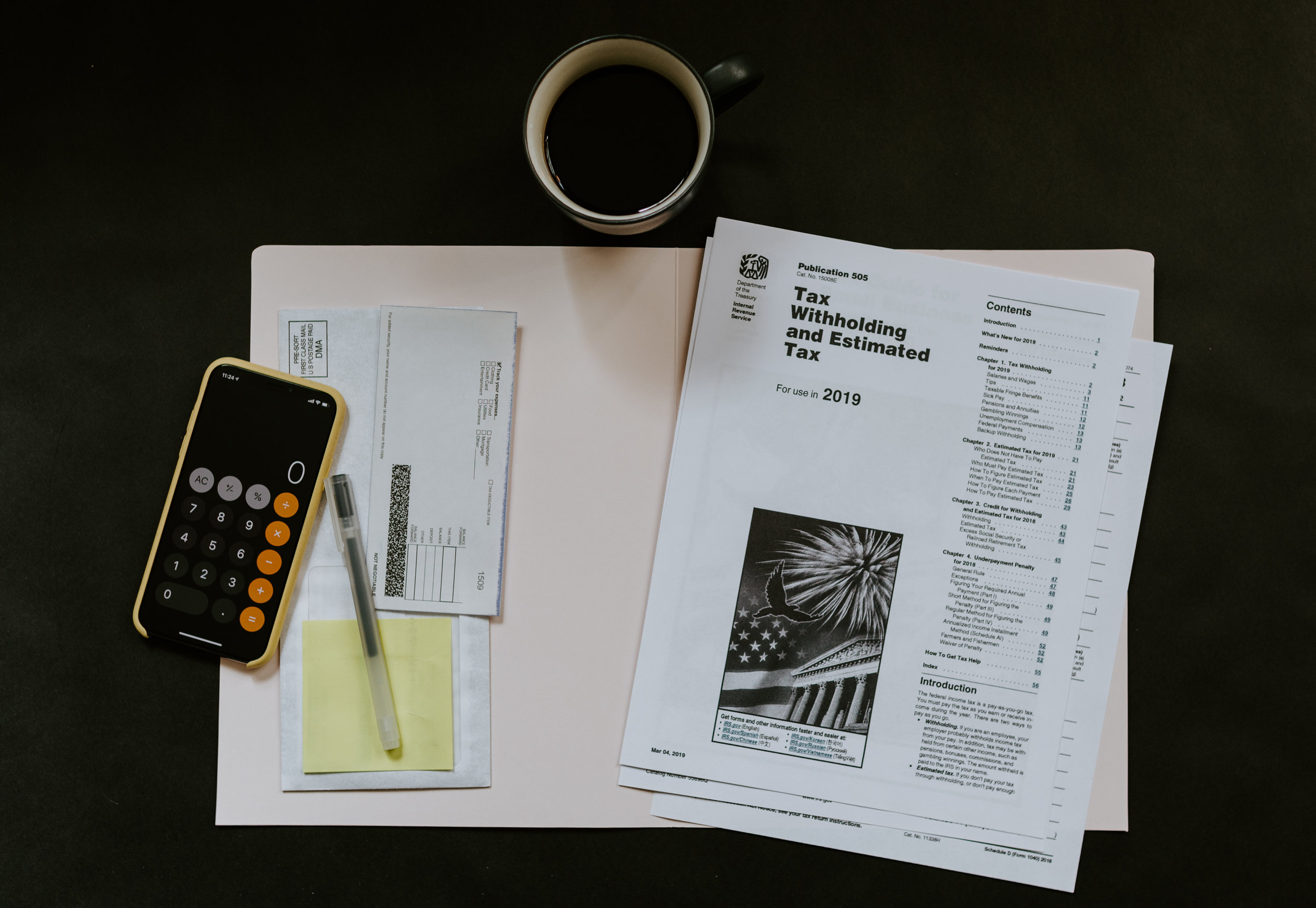

Tax Obligations Every Canadian Small Business Should Know

It is therefore prudent for both sole proprietorships and incorporated businesses to keep on top of their tax filings.

In this article I enumerate the tax obligations for most small businesses in Canada along with links to articles to help you understand each one better.

Adopt These 9 Money Habits to Increase Your Net Worth

One way to reinforce habits is to celebrate small wins. If you eat slightly less junk food or exercise a bit more, you can count it as an accomplishment. The positive reinforcement helps to make us feel better, inspire confidence and slowly build habits that makes reaching our goals a bit easier. This is particularly true with financial discipline. It is important to recognize that, like any habit, it is a process that takes time. The good news is that there are tangible metrics to measure your success e.g. when you have more in your investment accounts or a higher net worth.

Essential Facts about Shareholder Loans for Incorporated Small Business Owners

There are three primary ways in which you, as an owner-manager, can withdraw funds from your corporation. You can pay yourself a salary, you can declare a dividend or you can borrow money from the corporation. When you borrow money from your own corporation the Canada Revenue Agency (CRA) has put into place strict rules as to when you have to repay the loan to ensure that the owner-manager does not avoid paying taxes indefinitely.

How to Register a Small Business in Quebec

Budding entrepreneurs wanting to setting up a small business (or becoming self employed), either on a full time or part time basis, are often not sure where to start. The process of registering a business in Quebec, depending on your circumstances, can actually be quite straightforward . Below we look at the questions that you need answer to determine your business registration obligations:

Why and How to Transition from a Sole Proprietorship to a Corporation

When starting your new business, often it makes sense to choose the simplest structure which is the sole proprietorship. This allows you to test the viability of your business idea and to see if the lifestyle and the related stress that goes along with being a business owner suits your personality and is in line with your long term goals. Alternatively, you might want to keep everything simple and not add any unnecessary complexity. Registering and maintaining a sole proprietorship is fairly straightforward ; many business owners don’t put much thought into the financial aspects of it until tax time (when the mad scramble ensues). Once you have a corporation, however, the level of complexity and commitment increases

How To Account for Car Expenses and Reflect Personal Use

If you use your car for business then you will want to track car expenses more granularly to see what you have spent in the current period and to compare with prior periods and also to make it easier to reflect the breakdown on your small business taxes

Deferred Revenue and its Impact on your Small Business

Most small business owners are familiar with the concept of revenues, which is essentially the total sales of their product or service, to customers and clients, prior to deducting any costs. Revenues are a crucial component of business’ profit and loss statement and it is essential that they are accurate so that the business owners may effectively analyze the profitability of their businesses. Additionally there are third parties for which the accuracy of the revenues, and corresponding financial statements, is essential for effective decision making. Third parties include tax authorities, banks, partners and key employees (on which remuneration/bonuses might be based).

What Types of Advertising/Marketing Expenses Can Small Businesses Deduct?

In the past advertising for small business owners mostly involved ads for print, television or radio (a catchy jingle was always a good way to go), cold calling (rarely a pleasant experience), sending out flyers or courting potential customers at a conference. Unfortunately, these types of advertising were problematic in that it is difficult to gage the direct impact of their effectiveness. Additionally, they were often fairly costly, which can especially difficult for small business owners to afford.

Over the past few years the avenues for advertising have grown exponentially. Many types of advertising don’t even cost anything, except time. You can buy ads on numerous social media outlets that appeal to your target market or if you want to go the free route, you can set up a social media account, post regularly and build an audience. Alternatively, you can set up a website which you can then optimize so that google and other search engines display it when someone is looking for your product or service. Email newsletters are also another effective and direct way of reaching potential buyers. One of the great benefits of these types of advertising is that you are better able to monitor the effectiveness of your chosen strategy.

Frequently Asked Questions About Salary and Dividends by Owners of Corporations

As an accountant and small business financial consultant, one of the most common areas of confusion and questions by small business corporation owners revolves around how to pay themselves and if one way is preferable to another. I have addressed some of them in my blog posts on the factors to consider when choosing salary or dividends and the types of ways to structure your remuneration . There are however specific questions that common up frequently:

What Types of Car Expenses Can Business Owners Deduct

Access to a car can be crucial to running a small business effectively. Costs of ownership, however, can be high relative to your revenues, especially in the early stages when your business is not hugely profitable. Luckily, Revenue Canada (CRA) and Revenue Quebec (RQ) allow both unincorporated/self employed individuals and owners/employees of corporations, who use their cars to generate income, to deduct the relevant expenses. Both CRA and RQ provide detailed guidance and have specific rules relating to the write off of car expenses. I discuss some of the main provisions that impact small business owners in this article and provide guidance on the differences between unincorporated (self employed/small business) owners and corporations.

How to Calculate Your Automobile Taxable Benefits for the Purposes of the T4 and Rl1

The majority of businesses require the use of cars and other types of vehicles to meet with clients, and suppliers, purchase goods, make service calls and of course check in with their accountants. The usage of a car is not necessarily straightforward as many employees and business owners use their vehicles for both business and personal reasons. As such, Revenue Canada has had to implement tax legislation that ensures that the personal portion of automobile usage is properly adjusted and excluded from deductible businesses expenses.

How to Change Your Personal Tax Return After It Has Been Filed

Revenue Canada recommends that you should wait to receive your notice of assessment (NOA) before filing an amended return. Once you receive your NOA, you should review it to verify if the error or omission has been reflected on the assessment. If not, then you would proceed with submitting the amendment. Luckily, you are not required to redo your entire return; rather you just need to submit details regarding the specific changes. There are several ways in which you can file an amended return.

What is a notice of assessment and How to Handle a request for information

After you file your income tax return Revenue Canada (CRA) and Revenue Quebec (RQ) will send you an acknowledgement (somewhat like a report card) that the return has been received and a detailed breakdown of the tax return that was filed including any discrepancies. It also provides some information pertaining to future years such as limits and carryforwards. The NOA is also referred to as an “avis de cotisation” if your preferred language is French or when you receive one from RQ. Some of the information that can be found on a notice of assessment includes: