What Types of Advertising/Marketing Expenses Can Small Businesses Deduct?

In the past advertising for small business owners mostly involved ads for print, television or radio (a catchy jingle was always a good way to go), cold calling (rarely a pleasant experience), sending out flyers or courting potential customers at a conference. Unfortunately, these types of advertising were problematic in that it is difficult to gage the direct impact of their effectiveness. Additionally, they were often fairly costly, which can especially difficult for small business owners to afford.

Over the past few years the avenues for advertising have grown exponentially. Many types of advertising don’t even cost anything, except time. You can buy ads on numerous social media outlets that appeal to your target market or if you want to go the free route, you can set up a social media account, post regularly and build an audience. Alternatively, you can set up a website which you can then optimize so that google and other search engines display it when someone is looking for your product or service. Email newsletters are also another effective and direct way of reaching potential buyers. One of the great benefits of these types of advertising is that you are better able to monitor the effectiveness of your chosen strategy.

20 Essential Tax Facts for Small Business Owners

Probably the most popular question posed to accountants and tax preparers (especially around this time of year) is what types of expenses are deductible. The short answer is that an expense is considered to be deductible if it has been incurred with the ultimate purpose of earning income. For example if you purchase a domain name with the intent of setting up a website to sell your goods or services, this would be a deductible expense. However, if the purpose of your website is simply a place to show pictures of your cat, this would not be considered a business and therefore not a deductible expense. Of course if your cat picture website starts to become popular and you decide that you want to actively build this business by advertising on the site or partnering up with cat product resellers, your non commercial hobby could then be considered a business. Since you now have the intent to build a business the income earned would have to be reported and expenses incurred to earn this income would be deductible.

Know Your Small Business Tax Deadlines For 2023

Somehow we are almost one month into 2023 (!) and it is time for business owners (and individuals) to start thinking about one of their favourite subjects i.e. taxes. I have compiled a list of the deadlines that all of you should know and also updated my annual business tax deadline calendar.

Sign up to download our free Canada unincorporated business tax deadline calendar for 2023 or Quebec unincorporated small business tax deadline calendar 2023.

How to Register a Small Business in Quebec

Budding entrepreneurs wanting to setting up a small business (or becoming self employed), either on a full time or part time basis, are often not sure where to start. The process of registering a business in Quebec, depending on your circumstances, can actually be quite straightforward . Below we look at the questions that you need answer to determine your business registration obligations:

What Independent Contractors Should Know About Personal Service Businesses

Many of you leave your full time jobs to become independent contractors. This could be for a variety of reasons: you might decide you want the freedom that comes with self employment, or your company might decide that they no longer want to maintain employees. In some cases, you are laid off and find another opportunity , but the business only offers contract positions.

This type of situation is particularly applicable to people in the IT industry but can also apply to a variety of other types of skill sets. Often, your client will require that you set up a corporation which then contracts with the client to provide services that are very similar to those you would provide if you were an employee. The corporation then bills your client either directly or through a third-party (often a recruiting agency).

7 Qualities of Highly Desirable Clients

When you are a business owner/freelancer, there are few things that are better than landing a great client. Ones that ask great questions, respect our work and make us feel happy to have chosen the entrepreneurial route. Conversely there are bad clients who have unrealistic expectations, are unimaginative and often just plain clueless.

Of course, as the service provider, it is also incumbent upon you to provide an exceptional service. Having a client is not dissimilar from being in a relationship and for both sides to get the most out of it, you must also be responsive, respectful, fair and transparent.

Two (and a Half) Options for Claiming Employee Home Office Expenses in 2020

As numerous employees shifted from their offices to their homes, Revenue Canada (CRA) and accountants were deluged with questions about how they could claim home office expenses. To stave off the complaints and questions, CRA decided to introduce a simplified method of claiming a tax deduction. It should be noted that employees have always been allowed to claim expenses relating to their employment as long as their employers completed and signed form T2200. The information from this form would then be entered on Schedule T777. The issue for this year is that filling out the form and completing the schedule is a somewhat tedious process and does not fit all employees’ who worked from home as a result of Covid imposed restrictions.

7 Lesser Know Facts About RRSPs

It is the time of year when everyone adult Canadian should be thinking about investing into their registered retirement savings plan (RRSP) prior to the deadline of March 1st. Many of you might think that you are young and have time or conversely that you are older and it’s too late. The truth is that it is never too early or late to start a RRSP. You simply need to set a goal and start doing it.

The great benefit of investing in RRSPs, which is the single best tax optimization strategy available to all Canadians, is that it reduces the amount of income taxes that you will have to pay. The tax savings is based on your marginal tax rate. Since everyone’s income is allocated to different tax brackets as your income increases, the marginal tax rate represents the highest tax bracket which applies to the top portion of your income.

Why Every Canadian Should File a Personal Tax Return

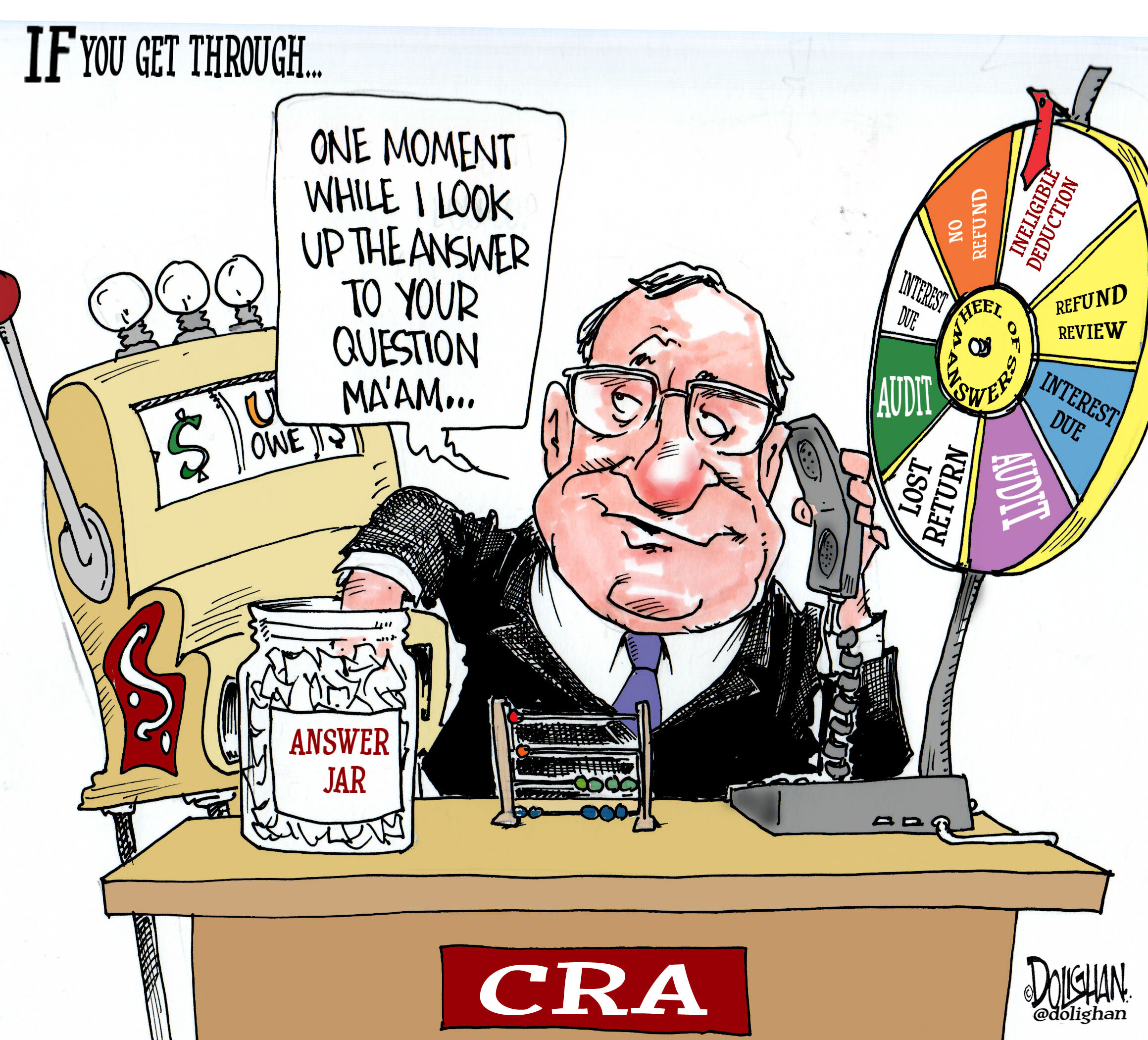

A friend of mine has been in a nightmare scenario with CRA. She hadn’t filed her tax return in a few years mostly because she had one T4, figured that she didn’t owe any tax and was simply procrastinating on an unenjoyable task. In 2020 she receive a notice of assessment from CRA indicating that she owed several thousand dollars, with no additional details except that they had added $25k to her actual income earned. Over the past year, she has called them numerous times to get an explanation and each time she is told that the file is being escalated and someone will get back to her. To date nobody has gotten back to her. To make matters worse, CRA passed this information i.e. additional income on to Revenue Quebec (without any details) which resulted in a significant assessment from them. She still has no idea why she was assessed this amount and is now in the unenviable position of calling both revenue agencies on a weekly basis to manage the situation.

Information on Filing T4s/RL-1s and T4As for Small Business Owners

When I was employee, I never really gave much thought to the T4 (and the Quebec equivalent RL-1) process. I knew that sometime around February an envelope would appear on my desk with a tax document which I would need to reflect on my tax return. I suppose I thought that someone, somewhere pressed a button and the T4s were generated. When I became a small business accountant, who was now either responsible for preparing this information or providing guidance to my clients, I realized that the process was somewhat more complicated.

Know Your Small Business Tax Deadlines For 2022

With the beginning of a new year upon us, tax submission deadlines for individuals and businesses are starting to loom. Every small business owner must adhere to these deadlines or risk facing penalties for late filing of returns plus interest on any overdue balances. Knowing these deadlines can help you ensure that you don’t simply waste your hard earned money and run afoul of CRA and RQ. I have compiled a list of deadlines for all unincorporated small business owners which includes sole proprietors and self employed individuals.

Note that the usual deadline for sales tax (GST/HST and QST) payments and income tax returns is April 30th. However, since this falls on a Saturday, the deadline is pushed to Monday, May 2nd, 2022.

Adopt These 9 Money Habits to Increase Your Net Worth

The approach of a new year tends to inspire the best intentions. We indulge over the holidays while resolving to be better, healthier, more financially disciplined etc as soon as the year is over. Unfortunately, resolutions tend to fade away as the year progresses and other stresses start to whittle down our willpower.

One way to make our resolutions a bit stickier is to celebrate small wins. If you eat slightly less junk food or exercise a bit more, you can count it as an accomplishment. The positive reinforcement helps to make us feel better, inspire confidence and slowly build habits that makes reaching our goals a bit easier. This is particularly true with financial discipline. It is important to recognize that, like any habit, it is a process that takes time. The good news is that there are tangible metrics to measure your success i.e. your increasing net worth.

21 Gift Ideas to Make Any Small Business Owner Happy

Most of us know at least one small business owner or entrepreneur who maintains an unconventional work schedule, is physically attached to their laptop, sees every get together as a networking opportunity and/or enjoys passionate discussions about spreadsheets. For many business owner, gifts that make their working lives easier and workspaces more efficient (and cozier) are often greatly appreciated since so much of their time is often spent immersed in their businesses. The list of gift ideas below, many of which are fairly inexpensive, may help to toggle some inspiration for the small business owner that you know:

How To Close Your Year End (or Period End)in QBO

Doing your own accounting in accounting software such as QuickBooks Online (QBO) is relatively straightforward especially if you have set up your QBO file optimally. You periodically enter invoices, expenses, bills and allocate transactions from the banking download. And while QBO is designed for non accountants, it is also equally appreciated by many accountants for its simplicity and user friendliness (although, as with any software product, there are grievances).

There does come a point, however, when you might notice that some things don’t look right. The bank balance or credit card balance might not match to the QuickBooks balance or your income and/or expenses might seem much too high or inconsistent with previous years. The solution to identifying and fixing these discrepancies is to perform what accountants refer to as year end (or month end) closing procedures, that if done properly, should correct any discrepancies that crop up. The ultimate goal of closing the books monthly or annually is to ensure that you can rely on the integrity of your data.