Explore Small Business Finance Topics

Discover our most popular topics for Canadian solopreneurs and small business owners. From income tax and GST/HST to QuickBooks tutorials and managing your business finances, these guides are designed to help you move from financial uncertainty to financial confidence.

Click on any topic and scroll down to see related articles.

📑Canadian Income Tax

Guidance on filing and planning your Canadian taxes, from T1 and T2 returns to instalments

📊Managing Business Finances

From cash flow to pricing and metrics — learn to manage your business finances with confidence.

🏢 Canadian Business Structure

Should you incorporate? Stay informed on sole proprietorships, corporations, and registrations.

💰 GST/HST & QST

Understand how to register, file, and maximize input tax credits while avoiding common mistakes.

🧾 Guides and Tutorials

Practical accounting processes like reconciliations, journal entries, and reporting.

📝 Deductions & Expenses

Learn which expenses are CRA deductible and how to track them for maximum tax savings.

Quebec Taxes & Business

QST, Revenu Québec filings, Quebec payroll, and provincial rules every entrepreneur should know.

👤 Paying Yourself

Salary vs dividends, management fees, and how to pay yourself from your corporation or small business.

💻 QuickBooks Online & Tools

Tutorials, guides and time-saving tips for using QuickBooks Online effectively.

🏦 Money & Personal Finance

Personal finance strategies for entrepreneurs, from RRSPs to saving for taxes.

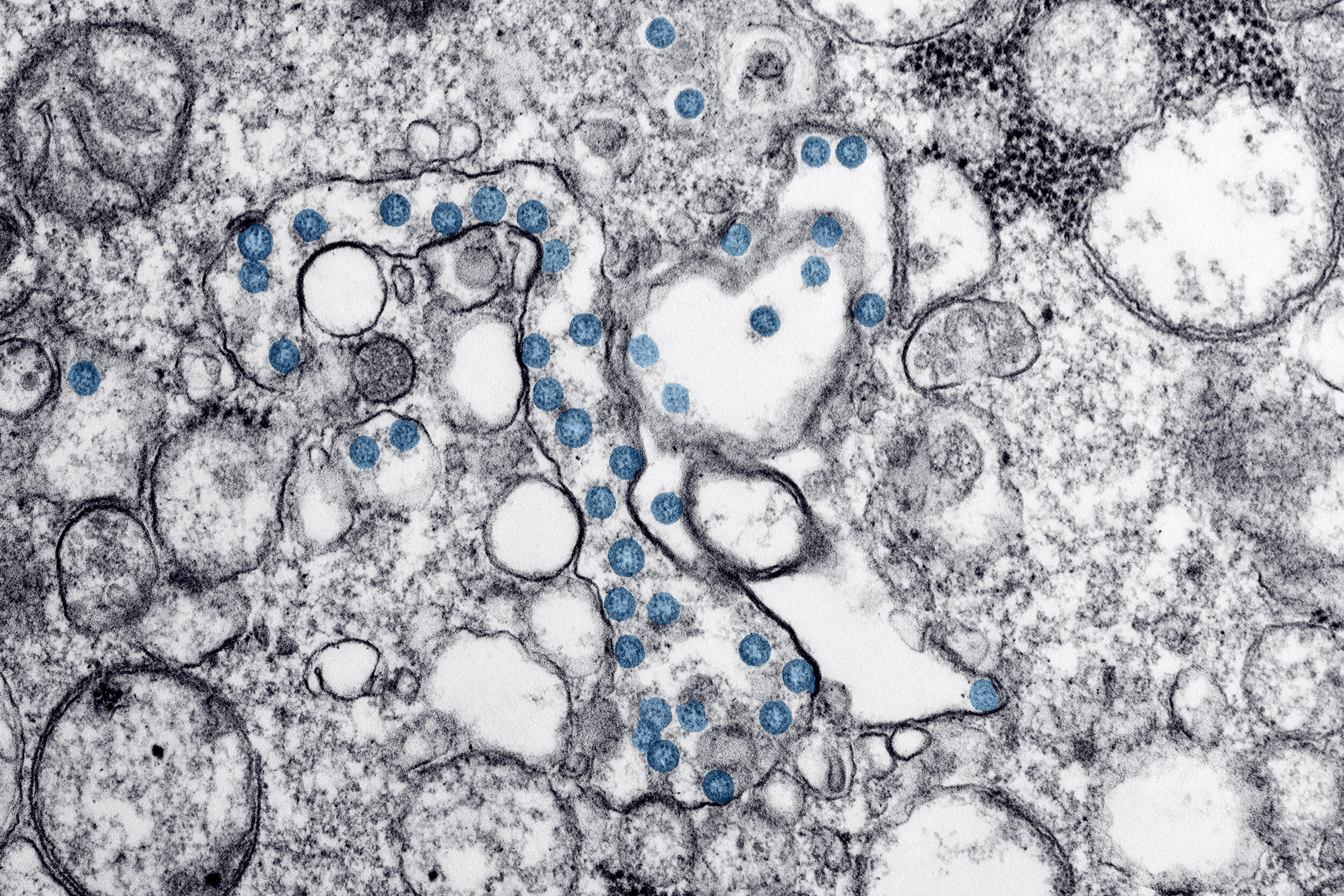

COVID-19: Financial and Tax Relief Measures for Small Business and Individuals (UPDATED)

UPDATED APRIL 27, 2020

In response to the financial pressure being felt by small business, employees and individuals as a result of COVID-19, a number of measures have been announced by governments and banks to alleviate this difficulty These are enumerated in this post and while details relating to eligibility, how to apply etc. on the measures announced by the federal government today are still forthcoming, small businesses and individuals now know what types of financial relief they may be eligible for and can start preparing accordingly.

Tips and Tools for Working from Home

Having a home based business has many advantages - there's no wearying commute to and from work, our sleep schedule is not beholden to an alarm clock and it allows us to work, if we so choose, when we are at our most productive or creative. An additional benefit is that expenses relating to our home office are tax deductible. Working from home can, however, also present a unique set of challenges. Given the proximity of distractions including our beds, fridges , tvs and perhaps worst of all, our computers, it requires a great deal of discipline and focus to actually get any work done.

3 Online Accounting Software Options for Small Business

As cloud computing becomes ubiquitous, the number of cloud based online accounting software options continues to grow. Many small business owners want a software that has an intuitive and easy-to-use interface that allows them to bill customers, enter expenses, record bank transactions and generate financial statements and other reports,. We also want to be able to access the software from anywhere (you never know when the desire to do your accounting strikes!) and not be tied down to a specific location Below is a summary of 3 cost effective, multi functional alternatives :

24 Cost Effective Ways to Promote Your Small Business

After thinking long and hard you have decided that is time to launch your own business. You have a great product or service, you’ve come up with a compelling business name, all the paperwork has been filed and you have picked out the perfect location (or setup a snazzy new home office). All pieces are in place for your new independent life as a business owner. And then you realize that nobody except your spouse, family members and possibly your cat knows about your new venture. So, how do you bring your fabulous new product or service to your target market's attention? One way is to use the “build it and they will come” approach. This is usually not particularly effective (even Google, who historically launches products with little fanfare, could benefit from a little more marketing). The other, more effective approach is to get out there and promote your business. Of course in the initial stages, marketing budgets tend to be minuscule. On the other hand, many new business owners have time on their hands, while they wait to be deluged by orders. Below is a list of 24 cost effective ways to promote your small business:

Are you Ready to Make the Transition to Self-Employment

There are many of to whom the promise of being one’s own boss as a self employed business owner seems extremely appealing (particularly if have an extensive set of "leisure"wear). You might crave the feeling of accomplishment that is no longer possible at your current place of employment or you seek greater flexibility and love the idea of working from home. Perhaps you feel that you are not being compensated adequately for your skills or the value that you add to your organization. Or you simply might find yourself bored and uninspired, scouring social media sites for hours on end, and realize that you need a change of pace.

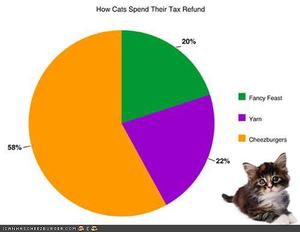

Understanding Payroll Deductions: Personal Income Tax Rates, CPP/QPP, EI and Basic Exemption

The automation of the tax preparation and filing process has been a boon to individuals and tax preparers alike. Gone are the days of struggling to find the right box on the return, adding everything up 5 times and still getting different results, and hoping that the CRA can read your chicken scrawl. Present day tax software not only guides you through every step of the process, it also helps to optimize your allocations thereby reducing your taxes payable. There is however at least one downside to automation: Since we are more removed from the actual calculations, our understanding of our tax situation is somewhat diminished. We have an idea of what we expect to pay, which we can see every week on our paycheques (or for self employed individuals, the breathtaking moment when we see the final result on our tax return), but often we are not really sure how these amounts are derived. Below is a discussion of the tax rates, deductions and maximums to improve our comprehension of this somewhat complex topic:

The Many Hats of Self Employment

Being self employed comes with many benefits. You can sleep in, work in your pyjamas and go shopping in the middle of the day. You no longer have to report to a boss who doesn't really understand what you do or deal with mindless workplace politics. It all sounds wonderful, but unfortunately there are also many challenges. Small business owners have to deal with uncertainty and risk. They need to be disciplined and deal with the many demands that being self employed can impose upon us. In the early stages of self employment, most of us have to take on the responsiblity of fulfilling the administrative functions that you find in a more established business. Some of the skills that you need to develop are:

Breaking Up with a (Likeable) Client

Many of us have clients who are annoying, cheap, stupid , high maintenance or some combination thereof. As a new business owner, we are often stuck with these clients because we need them. However, we look forward to the day when we will have the thriving business that we so deserve, and fantasize about the spectacular way in which are going to fire them (you can shove your business into your rear orifice etc.) This is actually a productive fantasy as can help to channel and concentrate anger. Of course, in the majority of cases, a firing should be conducted with slightly less vigour.

Small Business Survival Statistics and 9 Steps to Improve Your Chances of Sticking Around

The temptation to start a small business or venture into self employment can be strong particularly for those who are unhappy with their existing employment situation. The freedom and flexibility that being your own boss seems to offer can be seductive, as is the potential for growth which you, as the business owner, can have full control over. You may have an idea or a particular skill that you believe is desirable to a specific target market and you are confident that once this target market is aware of your existence they will all be banging down your door. Consequently, you start your business by offering an amazing product or services, only to realize that building up a customer base is more challenging than you thought. Additionally, there are a number of other obstacles for which you do not have the expertise (done by another department when you were an employee) whether it is marketing, website development, legal research and accounting. Finally, you realize that you actually need a fairly sizable source of cash to maintain the business, deal with growth opportunities, whilst ensuring that you are able to support yourself.

CJAD Finance Segment with Tommy Schnurmacher – Everything You Want to Know about Small Business

3 Invoicing Options for Small Businesses and Freelancers

If you are running a business of any size, it is essential that you have a system in place that allows you to get paid. A system can range in sophistication from a handwritten receipt to a software generated invoice which is part of an entity wide CRM system. To meet this need there are countless invoicing solutions available and many billions of dollars are spent annually on setting up systems to meet each business’ unique needs.

Almost all accounting software geared to small business owners and freelancers have built-in invoicing modules that integrate with your accounting. This is very useful when doing your books as you don’t have to worry about entering your invoicing manually and it allows you to track your accounts receivable and deposits into your bank account. There are also invoicing solutions that are not full-fledged accounting systems; however they usually integrate with the more popular software.

How to Update Wave Accounting for the 2012 QST Rate Increase

As of January 1st, 2012 the Quebec Sales Tax (QST Rate) which had gone up from 7.5% to 8.5% on January 1, 2011 will now increase to 9.5%. The effective sales tax in Quebec will go up from 13.925% to 14.975%. Since QST is calculated on the net amount + GST, the rate is not 14.5% but 14.975% . In other words the effective QST rate is 9.75%. Business owners will need to update their invoicing and accounting systems accordingly to ensure that the rate is properly reflected.

If you are using Wave Accounting, the update to the rates is fairly straightforward, with one little quirk. Since Wave, unlike Quickbooks, does not allow for the QST to be calculated on the GST, the effective rate has to entered manually. This is done as follows:

To update Quickbooks for the tax rate increase, please see “Updating Quickbooks for the 2011 QST Increase”. The procedure is essentially identical except for rates.

Quickbooks Online Banking: Setting Up, Deleting Matched Transactions and Manually Uploading Web Connect or Excel Files

15 Canadian Small Business Facts and Figures