Explore Small Business Finance Topics

Discover our most popular topics for Canadian solopreneurs and small business owners. From income tax and GST/HST to QuickBooks tutorials and managing your business finances, these guides are designed to help you move from financial uncertainty to financial confidence.

Click on any topic and scroll down to see related articles.

📑Canadian Income Tax

Guidance on filing and planning your Canadian taxes, from T1 and T2 returns to instalments

📊Managing Business Finances

From cash flow to pricing and metrics — learn to manage your business finances with confidence.

🏢 Canadian Business Structure

Should you incorporate? Stay informed on sole proprietorships, corporations, and registrations.

💰 GST/HST & QST

Understand how to register, file, and maximize input tax credits while avoiding common mistakes.

🧾 Guides and Tutorials

Practical accounting processes like reconciliations, journal entries, and reporting.

📝 Deductions & Expenses

Learn which expenses are CRA deductible and how to track them for maximum tax savings.

Quebec Taxes & Business

QST, Revenu Québec filings, Quebec payroll, and provincial rules every entrepreneur should know.

👤 Paying Yourself

Salary vs dividends, management fees, and how to pay yourself from your corporation or small business.

💻 QuickBooks Online & Tools

Tutorials, guides and time-saving tips for using QuickBooks Online effectively.

🏦 Money & Personal Finance

Personal finance strategies for entrepreneurs, from RRSPs to saving for taxes.

COVID-19 Details on Canada 75% Wage Subsidy for Businesses with Employees (CEWS)

Businesses who have employees that are on payroll (i.e. for whom deductions at source is being remitted and T4s/RL1s are being issued) are entitled to a Wage Subsidy of 75% of the employees’ gross payroll up to a maximum of $847 per week referred to as Canadian Emergency Wage Subsidy or CEWS. This should prove to be very helpful to businesses who don’t want to let employees go but due to reductions (or complete stoppage) of revenues may not be able to afford to pay them. It provides for business continuity and financial relief to a significant subsection of the population.

COVID-19: Financial and Tax Relief Measures for Small Business and Individuals (UPDATED)

UPDATED APRIL 27, 2020

In response to the financial pressure being felt by small business, employees and individuals as a result of COVID-19, a number of measures have been announced by governments and banks to alleviate this difficulty These are enumerated in this post and while details relating to eligibility, how to apply etc. on the measures announced by the federal government today are still forthcoming, small businesses and individuals now know what types of financial relief they may be eligible for and can start preparing accordingly.

Tips and Tools for Working from Home

Having a home based business has many advantages - there's no wearying commute to and from work, our sleep schedule is not beholden to an alarm clock and it allows us to work, if we so choose, when we are at our most productive or creative. An additional benefit is that expenses relating to our home office are tax deductible. Working from home can, however, also present a unique set of challenges. Given the proximity of distractions including our beds, fridges , tvs and perhaps worst of all, our computers, it requires a great deal of discipline and focus to actually get any work done.

Impact of COVID-19 on Small Business and Their Employees(UPDATED): EI Sickness and EI Regular Benefits

Updated on March 30, 2020 for CERB which will replace the EI benefits in the short term.

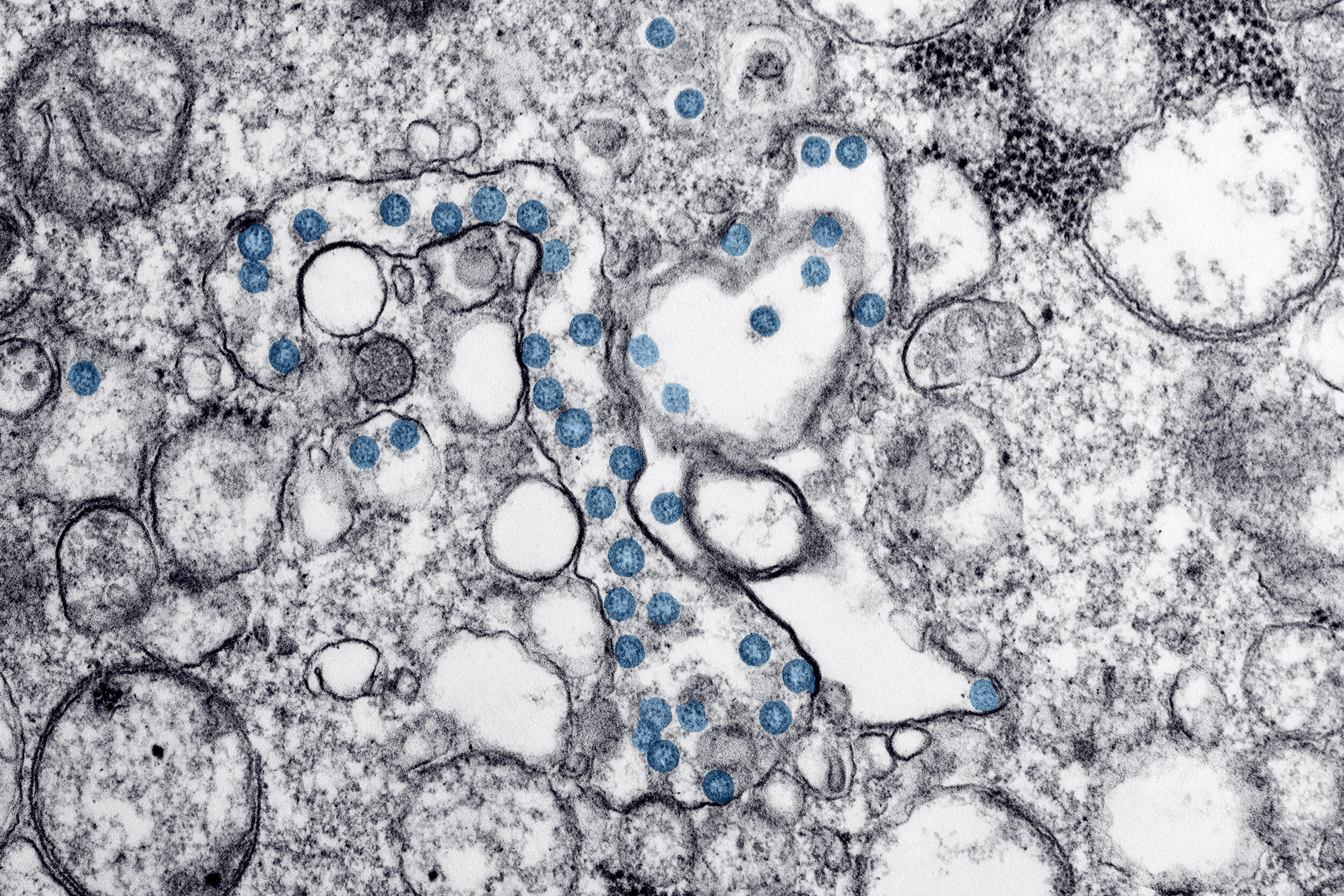

The impact of Covid 19 (caused by the CoronaVirus) is being felt deeply all across the world right now as individuals, businesses, healthcare institutions and governments try to cope with the ongoing and evolving implications. It is a difficult time as individuals try not to panic and governments are endeavouring to decide the best course of action for their citizens. Small businesses are experiencing are experiencing dramatic slowdowns or are being forced to close as customers stay at home.

Businesses who have employees that are quarantining themselves due travel or potential contact with the Coronavirus as well as employees who are laid off are entitled to EI Benefits. While there have been some changes to the sickness benefits in the face of Covid 19, EI benefits currently remain the same and are explained below:

24 Cost Effective Ways to Promote Your Small Business

After thinking long and hard you have decided that is time to launch your own business. You have a great product or service, you’ve come up with a compelling business name, all the paperwork has been filed and you have picked out the perfect location (or setup a snazzy new home office). All pieces are in place for your new independent life as a business owner. And then you realize that nobody except your spouse, family members and possibly your cat knows about your new venture. So, how do you bring your fabulous new product or service to your target market's attention? One way is to use the “build it and they will come” approach. This is usually not particularly effective (even Google, who historically launches products with little fanfare, could benefit from a little more marketing). The other, more effective approach is to get out there and promote your business. Of course in the initial stages, marketing budgets tend to be minuscule. On the other hand, many new business owners have time on their hands, while they wait to be deluged by orders. Below is a list of 24 cost effective ways to promote your small business:

Are you Ready to Make the Transition to Self-Employment

There are many of to whom the promise of being one’s own boss as a self employed business owner seems extremely appealing (particularly if have an extensive set of "leisure"wear). You might crave the feeling of accomplishment that is no longer possible at your current place of employment or you seek greater flexibility and love the idea of working from home. Perhaps you feel that you are not being compensated adequately for your skills or the value that you add to your organization. Or you simply might find yourself bored and uninspired, scouring social media sites for hours on end, and realize that you need a change of pace.

The Many Hats of Self Employment

Being self employed comes with many benefits. You can sleep in, work in your pyjamas and go shopping in the middle of the day. You no longer have to report to a boss who doesn't really understand what you do or deal with mindless workplace politics. It all sounds wonderful, but unfortunately there are also many challenges. Small business owners have to deal with uncertainty and risk. They need to be disciplined and deal with the many demands that being self employed can impose upon us. In the early stages of self employment, most of us have to take on the responsiblity of fulfilling the administrative functions that you find in a more established business. Some of the skills that you need to develop are:

It's Bad Business to Let the Killer Get Away With It: The Sam Spade Guide to Better Business

Sam Spade, the hard edged protagonist of The Maltese Falcon, is in some ways the quintessential small business owner. He is a private detective (or dick if you prefer) with an office, a partner, a secretary and a network that would make a social media climber swoon. As a small business owner he takes on the risks of running a business and enjoys the rewards. He sets his own prices which vary significantly depending on the client and the job. (Recovering the Maltese Falcon is worth thousands, while searching for someone’s sister is worth considerably less). And despite his womanizing and wayward ways, he also embodies qualities that would behoove business owners to emulate.

9 Psychological Traits that Affect Our Investing and Business Decisions

Modern portfolio theory assumes that we are rational investors and invest only in efficient and optimal portfolios that provide the maximum return for minimum risk. The truth (as posited by Behavioural Economists) is that we far from rational and are subject to a myriad of psychological influences and behaviours that prevent us from not only making optimal investment or business decisions, but can in some cases turn us into morons. We buy and hold too long or buy and sell too quickly; we refuse to accept losses assuming that we will recover our money or we sell losing investments way too soon; we are overconfident about our own abilities or place too much trust in “experts”; we maintain the status quo and do nothing or we change things too frequently. The dichotomies of investing behaviour are numerous and fascinating and have lead to creation of field of study referred to as Behavioural Ecomomics. Each of these behaviours also has a tremendous impact on our business decisions and are discussed below:

Breaking Up with a (Likeable) Client

Many of us have clients who are annoying, cheap, stupid , high maintenance or some combination thereof. As a new business owner, we are often stuck with these clients because we need them. However, we look forward to the day when we will have the thriving business that we so deserve, and fantasize about the spectacular way in which are going to fire them (you can shove your business into your rear orifice etc.) This is actually a productive fantasy as can help to channel and concentrate anger. Of course, in the majority of cases, a firing should be conducted with slightly less vigour.

Small Business Survival Statistics and 9 Steps to Improve Your Chances of Sticking Around

The temptation to start a small business or venture into self employment can be strong particularly for those who are unhappy with their existing employment situation. The freedom and flexibility that being your own boss seems to offer can be seductive, as is the potential for growth which you, as the business owner, can have full control over. You may have an idea or a particular skill that you believe is desirable to a specific target market and you are confident that once this target market is aware of your existence they will all be banging down your door. Consequently, you start your business by offering an amazing product or services, only to realize that building up a customer base is more challenging than you thought. Additionally, there are a number of other obstacles for which you do not have the expertise (done by another department when you were an employee) whether it is marketing, website development, legal research and accounting. Finally, you realize that you actually need a fairly sizable source of cash to maintain the business, deal with growth opportunities, whilst ensuring that you are able to support yourself.

CJAD Finance Segment with Tommy Schnurmacher – Everything You Want to Know about Small Business

3 Invoicing Options for Small Businesses and Freelancers

If you are running a business of any size, it is essential that you have a system in place that allows you to get paid. A system can range in sophistication from a handwritten receipt to a software generated invoice which is part of an entity wide CRM system. To meet this need there are countless invoicing solutions available and many billions of dollars are spent annually on setting up systems to meet each business’ unique needs.

Almost all accounting software geared to small business owners and freelancers have built-in invoicing modules that integrate with your accounting. This is very useful when doing your books as you don’t have to worry about entering your invoicing manually and it allows you to track your accounts receivable and deposits into your bank account. There are also invoicing solutions that are not full-fledged accounting systems; however they usually integrate with the more popular software.

What is the Hiring Credit for Small Business?

Recently, a client received a notice from the CRA indicating that he had received a credit of $265. The explanation was simply that it was a hiring credit. Upon further research, we determined that the credit was a result of the provision in the 2011 budget that gave a credit to small business for hiring additional employees.

To be eligible for the credit, small businesses are not required to prepare any additional reporting. The small business hiring credit is simply calculated based on the increase in employment insurance (EI) premiums paid in 2011 over 2010. The maximum amount that any business is eligible to receive is $1,000.

Since the calculation is based on amounts reported on your T4 slips for 2010 and 2011, you are only eligible if the slips have been filed for these calendar years.

It appears that the amount of the credit is 100% of the excess of 2011 EI premiums over the 2010 EI premiums, up to aforementioned limit of $1,000.

The credit will not actually be paid out immediately, but applied to your payroll account.

New businesses (like my client) will receive the credit. Their 2010 EI premiums will be calculated at $0.

Note that since the EI credit should reduce your payroll expense, it will reduce your business expense and by extension, increase profits. The journal entry is as follows:

Dr. Payroll (EI) Liability

Cr. Payroll Expense

Once you receive your payroll statement from Revenue Canada indicating the amount of the credit, you may reduce the payroll liability owing to them by the same amount. You cannot, however, estimate the amount of the credit before you have received notification from Revenue Canada.

How to Update Wave Accounting for the 2012 QST Rate Increase

As of January 1st, 2012 the Quebec Sales Tax (QST Rate) which had gone up from 7.5% to 8.5% on January 1, 2011 will now increase to 9.5%. The effective sales tax in Quebec will go up from 13.925% to 14.975%. Since QST is calculated on the net amount + GST, the rate is not 14.5% but 14.975% . In other words the effective QST rate is 9.75%. Business owners will need to update their invoicing and accounting systems accordingly to ensure that the rate is properly reflected.

If you are using Wave Accounting, the update to the rates is fairly straightforward, with one little quirk. Since Wave, unlike Quickbooks, does not allow for the QST to be calculated on the GST, the effective rate has to entered manually. This is done as follows:

To update Quickbooks for the tax rate increase, please see “Updating Quickbooks for the 2011 QST Increase”. The procedure is essentially identical except for rates.