Explore Small Business Finance Topics

Discover our most popular topics for Canadian solopreneurs and small business owners. From income tax and GST/HST to QuickBooks tutorials and managing your business finances, these guides are designed to help you move from financial uncertainty to financial confidence.

Click on any topic and scroll down to see related articles.

📑Canadian Income Tax

Guidance on filing and planning your Canadian taxes, from T1 and T2 returns to instalments

📊Managing Business Finances

From cash flow to pricing and metrics — learn to manage your business finances with confidence.

🏢 Canadian Business Structure

Should you incorporate? Stay informed on sole proprietorships, corporations, and registrations.

💰 GST/HST & QST

Understand how to register, file, and maximize input tax credits while avoiding common mistakes.

🧾 Guides and Tutorials

Practical accounting processes like reconciliations, journal entries, and reporting.

📝 Deductions & Expenses

Learn which expenses are CRA deductible and how to track them for maximum tax savings.

Quebec Taxes & Business

QST, Revenu Québec filings, Quebec payroll, and provincial rules every entrepreneur should know.

👤 Paying Yourself

Salary vs dividends, management fees, and how to pay yourself from your corporation or small business.

💻 QuickBooks Online & Tools

Tutorials, guides and time-saving tips for using QuickBooks Online effectively.

🏦 Money & Personal Finance

Personal finance strategies for entrepreneurs, from RRSPs to saving for taxes.

4 Simple Financial Metrics to Help Measure the Success of Your Small Business

Most small business owners want insights into their business performance to get a sense of what they are doing well while also trying to understand their areas of weakness. Unfortunately a big picture view does not always immediately reveal itself– a thorough understanding of your business generally requires a more thorough analysis and introspection. You may be tempted to look at cash (or lack thereof) in your bank account or your net profit , however these are not always reliable indicators of success or failure , particularly when taken in isolation. Every small business owner should identify the specific needs and constraints of their business to determine the optimal analysis required to assess its financial performance. Some general analysis that most businesses can benefit from are presented below:

Top 6 Signs Your Small Business Might Need a New Accountant

I met with a small business owner recently who had just purchased a retail business and was looking for a new accountant. It seems that the current accountant was reviewing her books on a quarterly basis, preparing financial statements and doing the year-end tax returns – all typical accountant stuff. The problem was that the accountant, while charging this small business a fairly significant amount of money, was not really adding any value to their business. The bookkeeping, which was done by the previous business owner, was still being entered manually in ledgers (!). The quarterly accounting review consisted of checking the ledgers for mathematical accuracy and ensuring no major deductions had been missed without any discussion regarding the performance of the business. Worst of all, the accountant was not responding to the client’s requests for a meeting to discuss the financial performance of the business

How to Pay Dividends to Non Resident Shareholders

Anytime a Canadian corporation makes a dividend payment to its shareholders it is required to follow certain procedures. For Canadian shareholders, corporations must prepare a T5 dividend slip for each shareholder that receives a dividend and submit the T5s to Revenue Canada. (Similarly Quebec Corporations must issue an RL1 ). The process for issuing dividends to Non resident (foreign) shareholders who own shares in Canadian companies is different and is discussed below:

COVID-19 Details on Canada 75% Wage Subsidy for Businesses with Employees (CEWS)

Businesses who have employees that are on payroll (i.e. for whom deductions at source is being remitted and T4s/RL1s are being issued) are entitled to a Wage Subsidy of 75% of the employees’ gross payroll up to a maximum of $847 per week referred to as Canadian Emergency Wage Subsidy or CEWS. This should prove to be very helpful to businesses who don’t want to let employees go but due to reductions (or complete stoppage) of revenues may not be able to afford to pay them. It provides for business continuity and financial relief to a significant subsection of the population.

COVID-19: Financial and Tax Relief Measures for Small Business and Individuals (UPDATED)

UPDATED APRIL 27, 2020

In response to the financial pressure being felt by small business, employees and individuals as a result of COVID-19, a number of measures have been announced by governments and banks to alleviate this difficulty These are enumerated in this post and while details relating to eligibility, how to apply etc. on the measures announced by the federal government today are still forthcoming, small businesses and individuals now know what types of financial relief they may be eligible for and can start preparing accordingly.

Tips and Tools for Working from Home

Having a home based business has many advantages - there's no wearying commute to and from work, our sleep schedule is not beholden to an alarm clock and it allows us to work, if we so choose, when we are at our most productive or creative. An additional benefit is that expenses relating to our home office are tax deductible. Working from home can, however, also present a unique set of challenges. Given the proximity of distractions including our beds, fridges , tvs and perhaps worst of all, our computers, it requires a great deal of discipline and focus to actually get any work done.

Small Business Tax Filing Deadlines for 2019 (UPDATED)

As the year end approaches, small businesses should be aware of the deadlines, imposed by Revenue Canada and Revenue Quebec, for their various tax obligations. Ensuring that these are done on a timely basis can result in significant savings , that can be put to better use in the business , by avoiding interest and penalties. It also helps to prevent aggressive notices from revenue agencies and reduces the red flags that tend to accompany habitually late filers. Below are the deadlines that businesses should be aware of:

Impact of COVID-19 on Small Business and Their Employees(UPDATED): EI Sickness and EI Regular Benefits

Updated on March 30, 2020 for CERB which will replace the EI benefits in the short term.

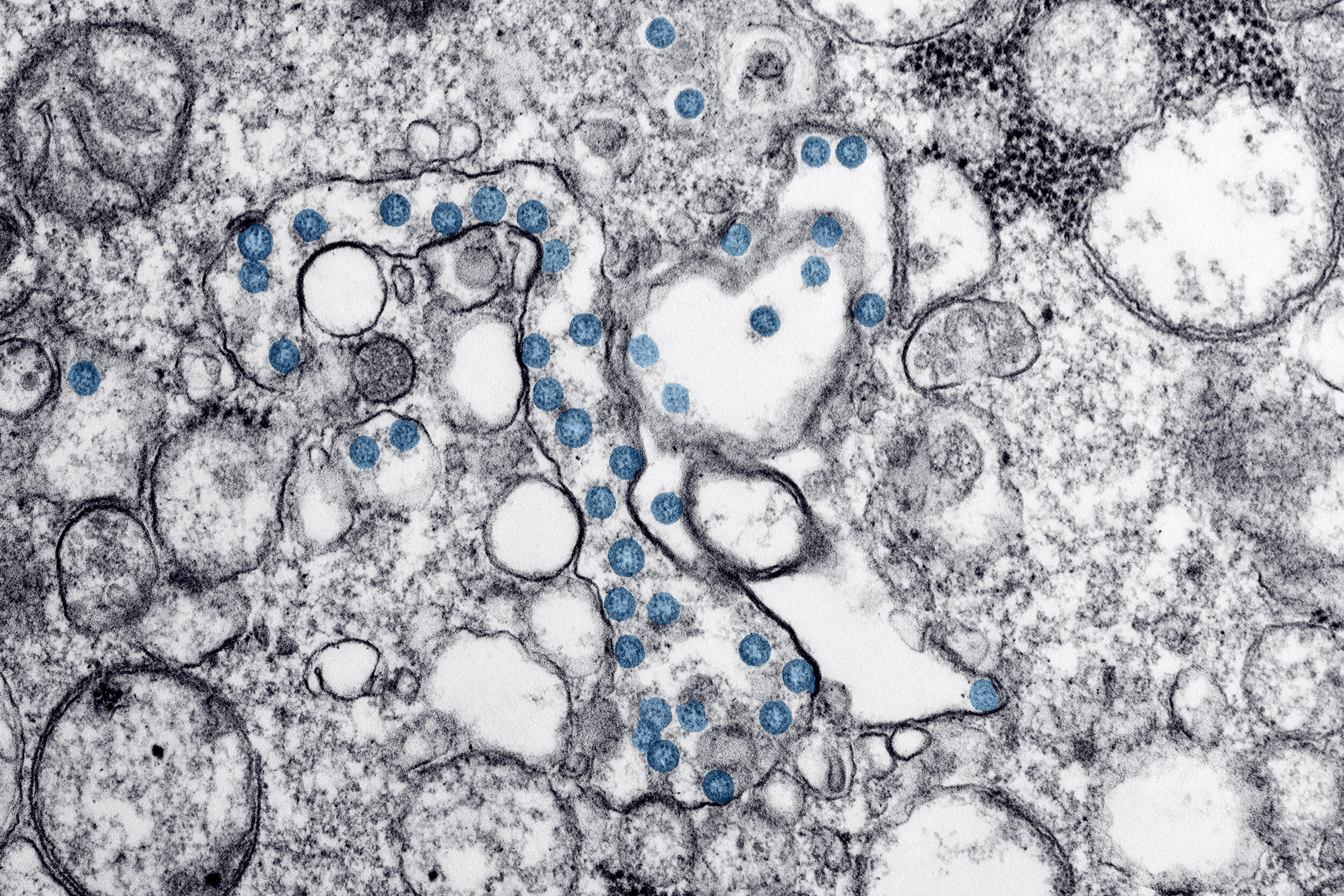

The impact of Covid 19 (caused by the CoronaVirus) is being felt deeply all across the world right now as individuals, businesses, healthcare institutions and governments try to cope with the ongoing and evolving implications. It is a difficult time as individuals try not to panic and governments are endeavouring to decide the best course of action for their citizens. Small businesses are experiencing are experiencing dramatic slowdowns or are being forced to close as customers stay at home.

Businesses who have employees that are quarantining themselves due travel or potential contact with the Coronavirus as well as employees who are laid off are entitled to EI Benefits. While there have been some changes to the sickness benefits in the face of Covid 19, EI benefits currently remain the same and are explained below:

3 Online Accounting Software Options for Small Business

As cloud computing becomes ubiquitous, the number of cloud based online accounting software options continues to grow. Many small business owners want a software that has an intuitive and easy-to-use interface that allows them to bill customers, enter expenses, record bank transactions and generate financial statements and other reports,. We also want to be able to access the software from anywhere (you never know when the desire to do your accounting strikes!) and not be tied down to a specific location Below is a summary of 3 cost effective, multi functional alternatives :

Business and Tax Implications of Owning Rental Property

A great many fortunes have been made in real estate. Conversely, as was evidenced in 2008 with the deflation of the housing bubble, many fortunes have also been spectacularly lost. Fortunes aside, owning real estate is one of the best ways to build equity. If you own your home, you are already one step ahead. With rental property, you can further augment your net worth if after investing the necessary down payment the rental income covers and/or exceeds the mortgage payment and related expenses, (Leaving you free to move on to buying your next property). This is not a decision to take lightly as with any investment there are several business and tax factors to consider before taking the plunge:

What is your Net Worth?

There comes a point in many people's lives when they want to find out what they are worth. This is much more difficult to quantify on a metaphysical level; however on a tangible level most people can figure out how much wealth they have created over time. The definition of net worth is simply the total of all your assets (what you own) less your liabilities (what you owe).

How to Prepare a Business Budget

One of the primary challenges facing a small business owner is uncertainty about the future. (It is also what makes entrepreneurship exciting). We may have an amazing product or service, but we can’t be sure whether this will actually translate into a profitable business model. A budget is an excellent tool to manage uncertainty and, contrary to popular belief, can actually be fairly straightforward to prepare, particularly for small businesses that do not have to worry about different departments, product lines and geographic areas .

A budget, very simply, is a tool that helps you predict your sales, expenses and profitability as well as your cash flow needs. It is based on estimates, which in turn are based on a combination of experience, history and industry knowledge. In terms of presentation, a budget should essentially mirror your financial statements and will include the following main categories:

Employment Insurance for Small Business Owners and Self Employed Individuals

One of the benefits allowed employees working in Canada is that have access to employment insurance. A specific amount is withdrawn from each employees paycheques each pay period along with an employer portion and remitted to Revenue Canada. This entitles them to wage loss replacement, in the event that they are laid off, as well as other benefits. This can be extremely useful in difficult times and has been used by millions of Canadians.

Unfortunately, taxpayers who are considered self employed are not entitled to the same benefits. A self employed individual also includes anyone who owns 40% of a corporation and usually extends to family members of self employed people. By the same token, self employed taxpayers (whether they are sole proprietorships or owners of corporations) are also not required to pay employment insurance (EI) premiums.

Quebec’s Small Business Tax Deduction and How It Relates to Payroll Hours

Revenue Quebec, in the March 2017 budget (or economic plan as they like to call it) decided that a small business wasn’t a small business for the purposes of the tax deduction, unless a minimum number of payroll hours was worked by employees of the business. Initially they had wanted to impose a minimum number of 3 full time employees to qualify for the deduction, however, after realizing that many businesses had several part time employees during the year, they changed the requirement to a minimum number of hours worked to 5,500 hours per year. This could be a combination of full time and part time employees. Consequently, many businesses that had qualified for the small business tax rate were no longer eligible.

Employee vs. Self Employed: Criteria and Considerations

For the majority of income earners, employment status is pretty evident. If you are going to the same place every day, have an assigned cubicle with a computer and a corporate stapler, and you have a boss that tells you what you need to do, chances are you are an employee. Conversely if you have several clients, use your own laptop, and are worried about where your next sale is going to come from, you are probably self employed.

There are, however, some workers whose status is not that apparent. For example you may work from home and use your own computer, but you report to one entity, where someone supervises and directs your work. In these cases a determination needs to be made as to whether you are an employee or self employed. It is not enough for the person paying you to determine your classification ; often, payers are biased as they may not want to take on the financial costs and responsibilities of having an employee (explained below). As such, when in doubt about your status, it is helpful to answer the following questions: