Employee vs. Self Employed: Criteria and Considerations

For the majority of income earners, employment status is pretty evident. If you are going to the same place every day, have an assigned cubicle with a computer and a corporate stapler, and you have a boss that tells you what you need to do, chances are you are an employee. Conversely if you have several clients, use your own laptop, and are worried about where your next sale is going to come from, you are probably self employed.

There are, however, some workers whose status is not that apparent. For example you may work from home and use your own computer, but you report to one entity, where someone supervises and directs your work. In these cases a determination needs to be made as to whether you are an employee or self employed. It is not enough for the person paying you to determine your classification ; often, payers are biased as they may not want to take on the financial costs and responsibilities of having an employee (explained below). As such, when in doubt about your status, it is helpful to answer the following questions:

The Importance of Breakeven Analysis for Business Owners

When embarking on your new business venture, one of the first and most important concepts that you will be introduced to is break-even analysis which, very simply, is the amount of revenues you need to generate to cover your direct and indirect expenses. A good grasp of this is essential for business owners since even businesses with significant sales revenues can incur losses if they are not able to cover their costs. While break even analysis tends to be used more for businesses that sell physical products, it can also help to the determine the price for services

24 Cost Effective Ways to Promote Your Small Business

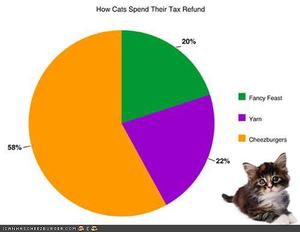

After thinking long and hard you have decided that is time to launch your own business. You have a great product or service, you’ve come up with a compelling business name, all the paperwork has been filed and you have picked out the perfect location (or setup a snazzy new home office). All pieces are in place for your new independent life as a business owner. And then you realize that nobody except your spouse, family members and possibly your cat knows about your new venture. So, how do you bring your fabulous new product or service to your target market's attention? One way is to use the “build it and they will come” approach. This is usually not particularly effective (even Google, who historically launches products with little fanfare, could benefit from a little more marketing). The other, more effective approach is to get out there and promote your business. Of course in the initial stages, marketing budgets tend to be minuscule. On the other hand, many new business owners have time on their hands, while they wait to be deluged by orders. Below is a list of 24 cost effective ways to promote your small business:

What Is a Capital Dividend and How Does It Benefit Your Corporation

When an individual sells some property, investments or other assets (perhaps you have a Picasso lying around that's appreciated in value), only 50% of the gain is subject to tax. For example if you sell a rental property and realize a gain, after brokerage and expenses, of $100,000, only $50,000 will be taxable. (The actual tax that you pay will depend on your marginal tax rate at the time). The other 50% of the capital gain is a non taxable gain. For a corporation, however, this distinction is a little more complex. In order to allow corporations the same benefit as individuals with respect to capital gains and losses, the 50% non taxable portion of the gain on a corporate capital transaction is allocated to what is referred to as a Capital Dividend Account or CDA. The balance in the CDA, which is a cumulative balance over the lifetime of a corporation, is then available to the shareholders on a tax free basis.

Investment Strategies for Your Incorporated Small Business

One of the benefits of having an incorporated small business is that after paying yourself a salary or dividend any excess funds can be invested directly through the corporation. Since small businesses often cannot predict how their business will perform from year to year, the ability to retain funds in the corporation allows for a cushion to smooth out fluctuations in earnings which can then be paid out in lower performing years. By keeping the funds in the corporation, the business is able to defer tax since usually the small business tax rate is lower than the personal tax rate. Some points to consider:

How to Set Up a Small Business Accounting System

Many small business owners (myself included) tend to focus on the more glamourous aspects of their business eg. sales, marketing and product/service development. As a result, accounting often does not get the attention it deserves. In addition to the perception that an accounting system does not necessarily add value, it can also be a little intimidating. However, there are numerous benefits to setting up an accounting system and it can actually be fairly straightforward especially if you have some help with setting it up. A good accounting software tends to handle most of the complexity of accounting as long as the data is compiled and entered accurately.

Accounting for Non Accountants : Debit, Credits and Financial Statements

When people hear the term accounting, there is an involuntary reaction whereby the comprehension centres (the medical term) of their brains tend to shut down, and sleep mode is activated. This is unfortunate, as accounting, especially to a small business owner, can actually be quite interesting. It is one of the primary tools by which business owners and other interested parties can gage the success of their business, as well as identify areas that require attention andneed improvement. To understand accounting, business owners need to have a basic understanding of how it works (debits and credits) and it's results (financial statements), explained below:

Are you Ready to Make the Transition to Self-Employment

There are many of to whom the promise of being one’s own boss as a self employed business owner seems extremely appealing (particularly if have an extensive set of "leisure"wear). You might crave the feeling of accomplishment that is no longer possible at your current place of employment or you seek greater flexibility and love the idea of working from home. Perhaps you feel that you are not being compensated adequately for your skills or the value that you add to your organization. Or you simply might find yourself bored and uninspired, scouring social media sites for hours on end, and realize that you need a change of pace.

7 Reasons Why Debt is Good for Your Business

Debt is often perceived negatively. Debt can be “evil”, “crippling” and an “unforgiving master”( the last one from the Google query “Debt is…”;). It suggests a lack of sufficient cash flow and an inability to fulfil your funding requirements. It also an indication of increased risk, as if you are unable to service your debt repayments, it could have dire consequences for your business (see American Apparel). There is however another side to debt. The majority of large corporations have some level of debt. It can be a great way for individuals to earn a return on their investment. And of course it is an integral part of the engine that drives the world economy. For small business owners, debt can actually provide some great benefits as long as it is managed responsibly. Some of these are discussed below:

Understanding Payroll Deductions: Personal Income Tax Rates, CPP/QPP, EI and Basic Exemption

The automation of the tax preparation and filing process has been a boon to individuals and tax preparers alike. Gone are the days of struggling to find the right box on the return, adding everything up 5 times and still getting different results, and hoping that the CRA can read your chicken scrawl. Present day tax software not only guides you through every step of the process, it also helps to optimize your allocations thereby reducing your taxes payable. There is however at least one downside to automation: Since we are more removed from the actual calculations, our understanding of our tax situation is somewhat diminished. We have an idea of what we expect to pay, which we can see every week on our paycheques (or for self employed individuals, the breathtaking moment when we see the final result on our tax return), but often we are not really sure how these amounts are derived. Below is a discussion of the tax rates, deductions and maximums to improve our comprehension of this somewhat complex topic:

Why an Understanding of Fixed Vs Variable Costs Is Important for Small Business Profitability

One of the burdens of being a business owner is that you have to develop an understanding of accounting terminology. This might seem sleep inducing and potentially unnecessary, particularly if you have an accountant, however being able to distinguish between fixed and variable costs is actually key to better financial insights into your business and can influence how you determine pricing, help you understand how much you need to sell to start turning a profit and contribute to better cash flow reporting. Additionally it can actually be quite interesting and easy to grasp once you are able to see how it applies to your business.

4 Metrics to Help Improve Your Small Business Cash Flow

n a recent study by TD Bank Financial Group it was determined that one of the primary challenges facing small business was cash flow (The other two were managing clients and government red tape). This probably comes as no surprise to most small business owners, especially in the early stages. The simple answer to this problem would be a limitless source of cash. Since this is usually not possible, we need to do the next best thing: analyze our cash flow requirements and find the most cost effective and easily available solution for any shortfalls. Even the most successful business can find itself shutting its doors if it is not able to manage it's cash flow needs.

Below are 4 financial metrics, which if understood and monitored regularly, can actually help improve your business' cash flow:

Quebec Parental Benefits for Self Employed Workers

In Canada parental benefits are administered by Service Canada. Since they fall under the EI program, self employed workers must opt in tothe EI plan for self employed individuals to receive benefits. In Quebec however, unlike the rest of Canada (a common theme with Quebec), parental benefits are administered by the Quebec Parental Insurance Plan (QPIP), which does not specifically require opt in. Instead all workers in Quebec whether self employed or employees are required to pay premiums, based (similar to QPP) on their insurable earnings. For the self employed, premiums are payable at a rate of 0.86% upto maximum insurable earnings of $62,000, and are reflected in your annual tax return. As such all workers in Quebec are eligible for Parental Benefits.

The William Shatner Guide to Business Diversification

I recently spent “an evening with William Shatner” in Montreal , courtesy of a Groupon deal which offered tickets at less than half of the face price. Not being a trekkie or a rabid fan, I was not intimately familiar with his body of work. I had however seen enough of him to know that he was a funny and charismatic man, so I was interested to see what an “evening” with him would entail.

The show, which was 3 hours long (far exceeding my expectations) had the 80 year old Shatner recounting carefully selected stories about his past, while an interviewer occasionally prodded and guided him. Mr. Shatner did not disappoint – he was self-deprecating, eloquent and entertaining. And, while the stories were meant to reflect positively on his life, his career and choices were also indicative of an extremely ambitious individual who had spent a lifetime seizing opportunities. The results of his attitude of saying “Yes”, which he is trying to inspire in others through his show and latest book "Shatner Rules", have contributed to a fascinating, multi-faceted career and, perhaps unexpectedly, have led to a very diverse set of properties and holdings, some of which include: