18 Accounting Terms that every new business owner should know.

When starting a new business, you will be subjected to a variety of financial jargon. This can come from your bank, Revenue Canada or Revenue Quebec, suppliers, customers and various other business partners. If you are unfamiliar with this terminology, these requests which are often quite straightforward, can become stressful if you are not exactly sure what they mean. It is important, therefore, to arm yourself with at least a basic vocabulary of the most common financial and accounting terminology that will give you a better understanding of your business and therefore be well equipped to answer any questions that come your way.

9 Year End Tax Planning Tips for Small Business Owners

For numerous people around the world, the end of this year cannot come soon enough. It has been an unprecedented few months, the effects of which will be felt for many years to come. And while it has been extremely difficult for some small business owners such as restaurants and storefront retail, others have seen their businesses flourish. e.g. toilet paper manufacturers, Amazon and Zoom. Many businesses were able to pivot their business models to provide goods and services that cater to the “new normal” in interesting and creative ways. Some started selling masks while others increased their online course offerings. Beleaguered restaurants started expanding their delivery menus and offerings. To a dispassionate business analyst, this year has been somewhat fascinating and will provide a great deal of data to economists and analysts alike in the years to come.

It is time for business owners everywhere to start contemplating some end of year tax planning tips to not only ensure that they can maximize their tax deductions and reduce taxes payable, but to streamline the tax filing process in the New Year. Even if you are incorporated and your year end date is not December 31st, it is a good time to take advantage of calendar year deadlines for personal tax planning purposes.

How to Use QBO Class and Location Tracking to Better Analyze Your Data

A powerful, but lesser know feature of QBO is the ability to organize your data by using two separate features which are location tracking and class tracking. These features allow business owners to effectively create a higher level of categorization, in addition to their accounts, which allows for significantly better reporting and analysis.

Class and location tracking are essentially classification mechanisms that allow for reporting by an additional layer of categorization. The primary way to categorize transactions in any accounting system is to assign them to specific accounts eg. sales, purchases, computer equipment, travel, meals, office expenses etc. This is referred to as a “Chart of Accounts”. There does, however, exist two additional layers ways to categorize your transactions in QBO which work on top of the chart of accounts allowing each transaction can be grouped into a broader category. This is particularly useful for companies that have separate locations and/or divisions where they might want to see their results grouped together for deeper analysis and a better understanding of the performance of your business or organization.

4 Simple Financial Metrics to Help Measure the Success of Your Small Business

Most small business owners want insights into their business performance to get a sense of what they are doing well while also trying to understand their areas of weakness. Unfortunately a big picture view does not always immediately reveal itself– a thorough understanding of your business generally requires a more thorough analysis and introspection. You may be tempted to look at cash (or lack thereof) in your bank account or your net profit , however these are not always reliable indicators of success or failure , particularly when taken in isolation. Every small business owner should identify the specific needs and constraints of their business to determine the optimal analysis required to assess its financial performance. Some general analysis that most businesses can benefit from are presented below:

How to Prepare a Business Budget

One of the primary challenges facing a small business owner is uncertainty about the future. (It is also what makes entrepreneurship exciting). We may have an amazing product or service, but we can’t be sure whether this will actually translate into a profitable business model. A budget is an excellent tool to manage uncertainty and, contrary to popular belief, can actually be fairly straightforward to prepare, particularly for small businesses that do not have to worry about different departments, product lines and geographic areas .

A budget, very simply, is a tool that helps you predict your sales, expenses and profitability as well as your cash flow needs. It is based on estimates, which in turn are based on a combination of experience, history and industry knowledge. In terms of presentation, a budget should essentially mirror your financial statements and will include the following main categories:

The Importance of Breakeven Analysis for Business Owners

When embarking on your new business venture, one of the first and most important concepts that you will be introduced to is break-even analysis which, very simply, is the amount of revenues you need to generate to cover your direct and indirect expenses. A good grasp of this is essential for business owners since even businesses with significant sales revenues can incur losses if they are not able to cover their costs. While break even analysis tends to be used more for businesses that sell physical products, it can also help to the determine the price for services

What Is a Capital Dividend and How Does It Benefit Your Corporation

When an individual sells some property, investments or other assets (perhaps you have a Picasso lying around that's appreciated in value), only 50% of the gain is subject to tax. For example if you sell a rental property and realize a gain, after brokerage and expenses, of $100,000, only $50,000 will be taxable. (The actual tax that you pay will depend on your marginal tax rate at the time). The other 50% of the capital gain is a non taxable gain. For a corporation, however, this distinction is a little more complex. In order to allow corporations the same benefit as individuals with respect to capital gains and losses, the 50% non taxable portion of the gain on a corporate capital transaction is allocated to what is referred to as a Capital Dividend Account or CDA. The balance in the CDA, which is a cumulative balance over the lifetime of a corporation, is then available to the shareholders on a tax free basis.

How to Set Up a Small Business Accounting System

Many small business owners (myself included) tend to focus on the more glamourous aspects of their business eg. sales, marketing and product/service development. As a result, accounting often does not get the attention it deserves. In addition to the perception that an accounting system does not necessarily add value, it can also be a little intimidating. However, there are numerous benefits to setting up an accounting system and it can actually be fairly straightforward especially if you have some help with setting it up. A good accounting software tends to handle most of the complexity of accounting as long as the data is compiled and entered accurately.

Accounting for Non Accountants : Debit, Credits and Financial Statements

When people hear the term accounting, there is an involuntary reaction whereby the comprehension centres (the medical term) of their brains tend to shut down, and sleep mode is activated. This is unfortunate, as accounting, especially to a small business owner, can actually be quite interesting. It is one of the primary tools by which business owners and other interested parties can gage the success of their business, as well as identify areas that require attention andneed improvement. To understand accounting, business owners need to have a basic understanding of how it works (debits and credits) and it's results (financial statements), explained below:

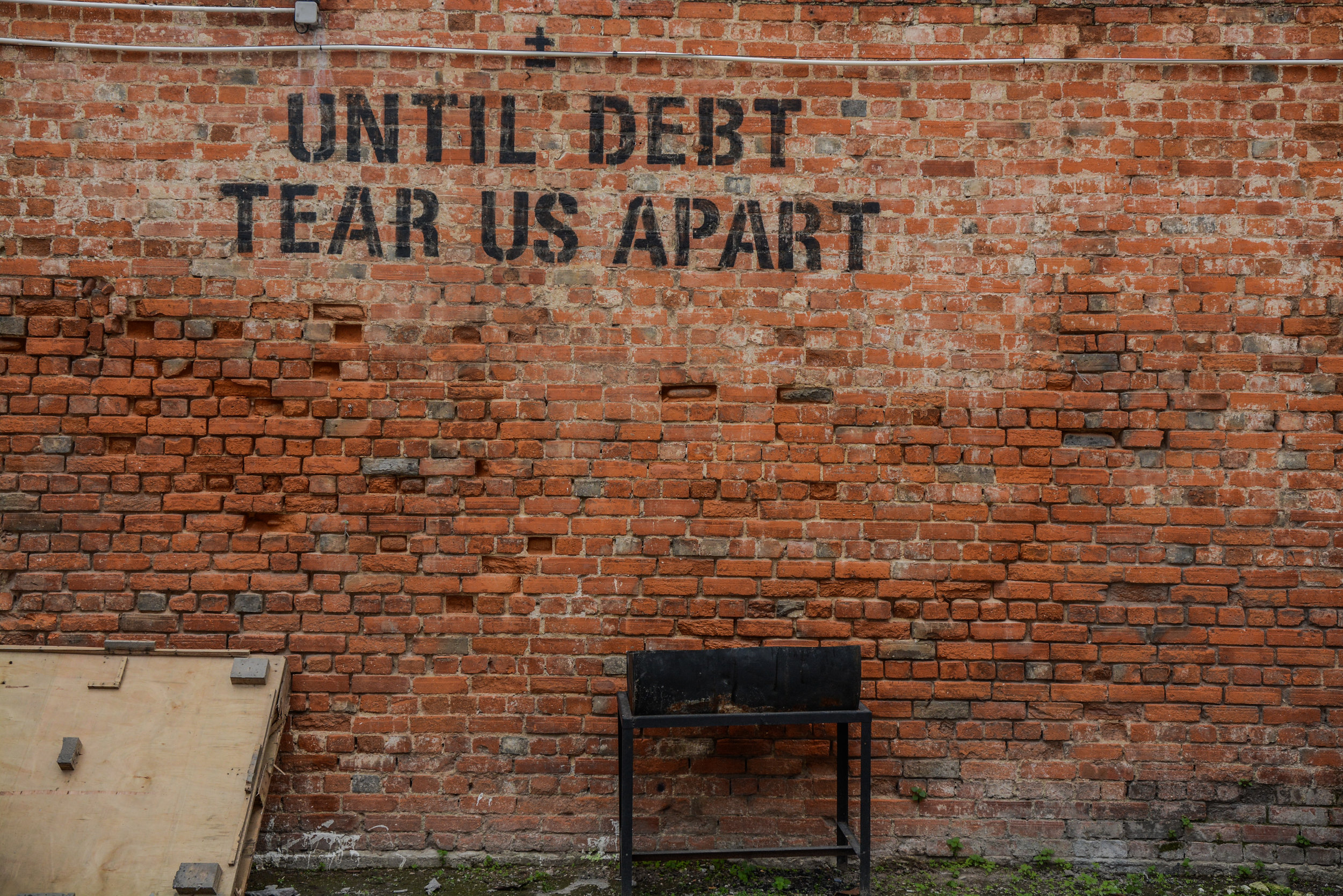

7 Reasons Why Debt is Good for Your Business

Debt is often perceived negatively. Debt can be “evil”, “crippling” and an “unforgiving master”( the last one from the Google query “Debt is…”;). It suggests a lack of sufficient cash flow and an inability to fulfil your funding requirements. It also an indication of increased risk, as if you are unable to service your debt repayments, it could have dire consequences for your business (see American Apparel). There is however another side to debt. The majority of large corporations have some level of debt. It can be a great way for individuals to earn a return on their investment. And of course it is an integral part of the engine that drives the world economy. For small business owners, debt can actually provide some great benefits as long as it is managed responsibly. Some of these are discussed below:

Why an Understanding of Fixed Vs Variable Costs Is Important for Small Business Profitability

One of the burdens of being a business owner is that you have to develop an understanding of accounting terminology. This might seem sleep inducing and potentially unnecessary, particularly if you have an accountant, however being able to distinguish between fixed and variable costs is actually key to better financial insights into your business and can influence how you determine pricing, help you understand how much you need to sell to start turning a profit and contribute to better cash flow reporting. Additionally it can actually be quite interesting and easy to grasp once you are able to see how it applies to your business.

4 Metrics to Help Improve Your Small Business Cash Flow

n a recent study by TD Bank Financial Group it was determined that one of the primary challenges facing small business was cash flow (The other two were managing clients and government red tape). This probably comes as no surprise to most small business owners, especially in the early stages. The simple answer to this problem would be a limitless source of cash. Since this is usually not possible, we need to do the next best thing: analyze our cash flow requirements and find the most cost effective and easily available solution for any shortfalls. Even the most successful business can find itself shutting its doors if it is not able to manage it's cash flow needs.

Below are 4 financial metrics, which if understood and monitored regularly, can actually help improve your business' cash flow: