How to Calculate CPP/QPP Contributions If You Are Self Employed

When you are self-employed, you are essentially taking on the role of employer and employee. As such self-employed individuals are required to remit both portions of the CPP or QPP to Revenue Canada or Revenue Quebec respectively, which is calculated on your earnings for the year. This only applies to unincorporated business who declare business income as part of their personal tax return (T1)

12 Tax Tips for the Self Employed

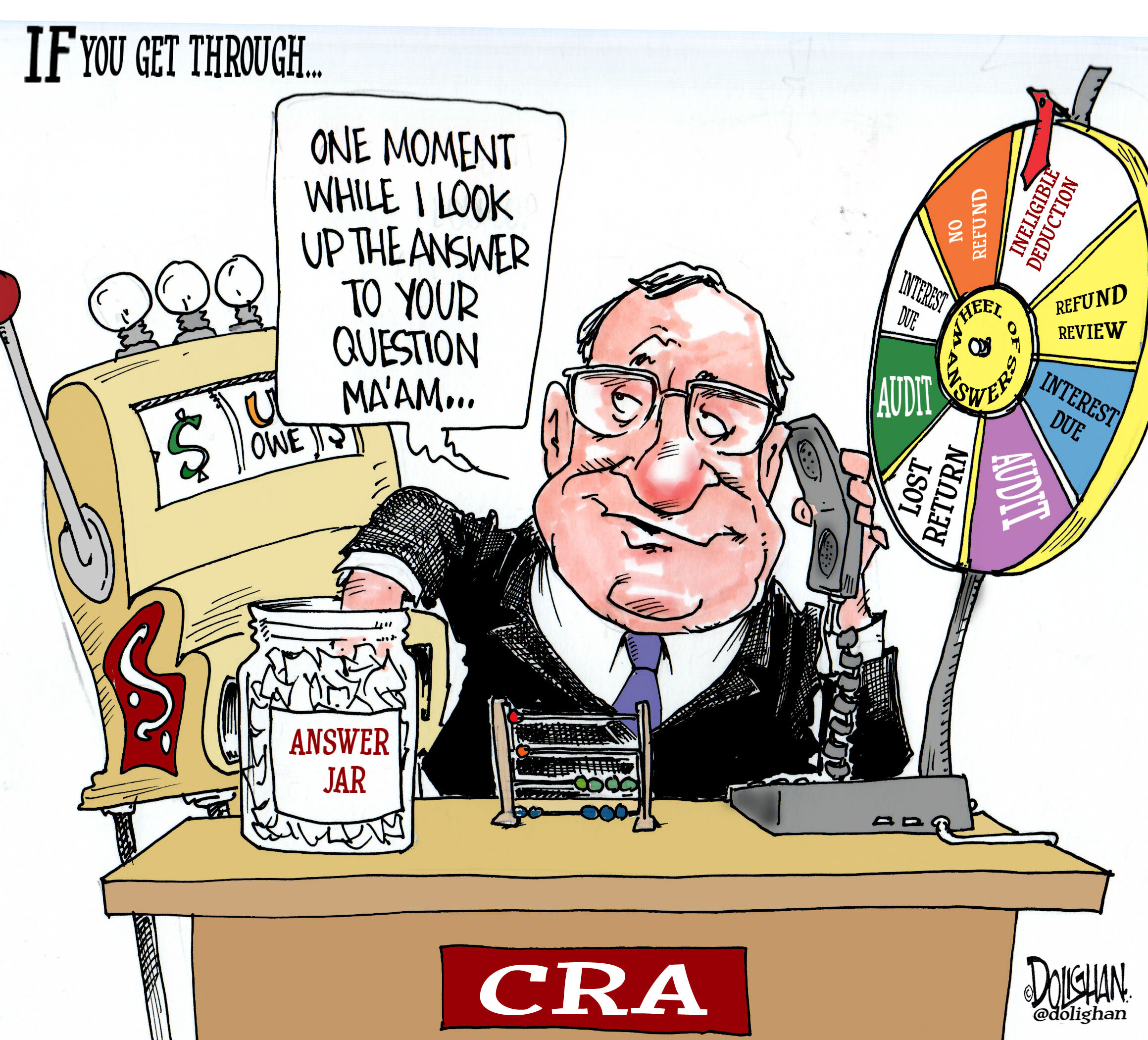

The self-employed lifestyle holds great promise when you first start being self employed, however you quickly find yourself doing things that you would never have dreamed of. You are expected to take on role of salesperson, market researcher, accountant, lawyer and social media expert, while not getting paid for any of it. Your available funds do not allow for outsourcing and at times you are not even aware of what you don’t know. Luckily the internet provides a wealth of tips and tricks to make these tasks easier, and you might actually find that you enjoy taking on some of these challenges. Ensuring that you keep on top of your finances and tax obligations is among the most important of these tasks for which it is essential to have a system in place so that you can maximize tax deductions, minimize taxes payable and reduce amounts that you have to pay to CRA and RQ.

Should you register for GST/HST and QST and What it Means to Be Zero Rated

When starting your new Canadian small business or launching into self employment, it is essential to determine whether you are required to register for GST/HST (and QST if you have a started a business in Quebec). The simple answer is that if you anticipate that your annual gross revenues (total sales) are going to exceed $30,000 and your products or services do not qualify as Exempt or Zero rated (explained below) , then you are required to register for GST/HST and collect sales taxes from your Canadian customers and clients. The $30,000 limit applies to the last 4 quarters of revenues. If you decide not to register for sales tax upon the inception of your business/self employment, then you must monitor your sales revenues over a rolling 4 quarter period and register once you are close.

Accounting and Tax Treatment of Computer Hardware and other Fixed Assets

Investment in capital items such as computers, furniture, equipment and cars can cause confusion for small business owners. Since these are purchases that affect the cash flow of the business, it seems that they should be accounted for as expenses similar to office supplies or rent. There are however special rules for any acquisitions that qualify as “fixed assets”. A fixed asset, simply speaking, is an acquisition that provides a long term economic benefit to the business. In other words, any business purchases that has a useful life that extends beyond one year, will usually qualify as a fixed asset. Below I discuss the accounting and tax treatment of fixed assets.

Excel for Small Business Owners

As a confirmed excel nerd, there is something about large amounts of data that I am inextricably drawn towards . I suppose it has something to do with an affinity for organization combined with a love of numbers and the innate desire to solve problems. As an accountant and financial consultant , I am often presented with the task of organizing and analysing data into a format that allows for greater insight into my clients businesses . And although good accounting software is important for most small business owners, especially once they reach a certain size, a great deal of analysis and reporting is done most effectively in excel.

13 Ways an Effective Accounting System Can Improve Business Decisions

An accounting system can be an extremely powerful tool for business owners. When structured with the specific needs of the business in mind, it has the power (through the magic of debits and credits) to convert data into a format that tells an interactive, completely personalized story about your business. By providing feedback on how your business is doing it allows you to understand its strengths and weaknesses which ultimately helps you to improve profitability, cash flow and growth of your business.

Should You Transition to a Paperless Office (and What CRA Has to Say about It)

Imagine having an office without clutter, free from sad looking boxes and filing cabinets filled to the brim, where you don’t have to rifle through unlabeled containers to find a receipt for a computer that you bought three years ago. . An office where you can make Marie Kondo proud by getting rid of (almost) anything that does not bring you joy and surrounding it instead with items that inspire (or at least improve productivity). This is all possible with a few apps, sufficient digital space and a shift in your mindset and processes.

How to customize a Chart of Accounts for optimal financial reporting

A chart of accounts is the structural framework for any business accounting system. It is analogous to a filing system. If you wanted to, you could dump all your documents into one giant file in your filing cabinet (or a file folder on your computer). Of course, if you did do it this way, you would likely have a hard time locating your documents. Alternatively, you could create a series of folders, based on an organization system that makes sense for you and your business. This type of structure would make it much easier and (as long as you remember your system), much more efficient to find what you are looking for. The more precise your system, the more time you save and the easier your documents become to access. Similarly, a chart of accounts is a type of categorization arrangement for your financial data. You slot everything into a category with the ultimate goal of getting financial reports such as your balance sheet and profit-loss statement that provides valuable info to the business owner as well as the other other stakeholders of the business. It should be noted that while each chart of accounts has commonalities and some specific conventions that should be followed, there is no one size fits all. Consequently, it is important to spend some time thinking about a chart of accounts that fits the profile of your business. If you are using Quickbooks Online, you can read this in conjunction with our article on setting up QBO for the first time and watch my video on working with chart of accounts in QuickBooks Online.

How to Account for Bad Debts and Record it in Quickbooks Online and Desktop

One of the more unpleasant aspects of being a business owner is having to chase clients that do not pay. It is frustrating, stressful and disheartening, while attempts to collect are an unproductive use of time and can have a significant impact on cash flow, particularly if you are unprepared. A bad debt, in accounting terms, refers to an amount charged to a customer that is never paid. While the original sale would have been reflected as revenue, the uncollectible bad debt would then have to be written off as a separate line item on the profit and loss statement

Know Your Small Business Tax Deadlines For 2023

Somehow we are almost one month into 2023 (!) and it is time for business owners (and individuals) to start thinking about one of their favourite subjects i.e. taxes. I have compiled a list of the deadlines that all of you should know and also updated my annual business tax deadline calendar.

Sign up to download our free Canada unincorporated business tax deadline calendar for 2023 or Quebec unincorporated small business tax deadline calendar 2023.

What Independent Contractors Should Know About Personal Service Businesses

Many of you leave your full time jobs to become independent contractors. This could be for a variety of reasons: you might decide you want the freedom that comes with self employment, or your company might decide that they no longer want to maintain employees. In some cases, you are laid off and find another opportunity , but the business only offers contract positions.

This type of situation is particularly applicable to people in the IT industry but can also apply to a variety of other types of skill sets. Often, your client will require that you set up a corporation which then contracts with the client to provide services that are very similar to those you would provide if you were an employee. The corporation then bills your client either directly or through a third-party (often a recruiting agency).

Information on Filing T4s/RL-1s and T4As for Small Business Owners

When I was employee, I never really gave much thought to the T4 (and the Quebec equivalent RL-1) process. I knew that sometime around February an envelope would appear on my desk with a tax document which I would need to reflect on my tax return. I suppose I thought that someone, somewhere pressed a button and the T4s were generated. When I became a small business accountant, who was now either responsible for preparing this information or providing guidance to my clients, I realized that the process was somewhat more complicated.

Know Your Small Business Tax Deadlines For 2022

With the beginning of a new year upon us, tax submission deadlines for individuals and businesses are starting to loom. Every small business owner must adhere to these deadlines or risk facing penalties for late filing of returns plus interest on any overdue balances. Knowing these deadlines can help you ensure that you don’t simply waste your hard earned money and run afoul of CRA and RQ. I have compiled a list of deadlines for all unincorporated small business owners which includes sole proprietors and self employed individuals.

Note that the usual deadline for sales tax (GST/HST and QST) payments and income tax returns is April 30th. However, since this falls on a Saturday, the deadline is pushed to Monday, May 2nd, 2022.

What Are Bank Reconciliations and Why Every Business Should Do Them

Many small business and self employed owners take on the responsibility of doing their own accounting. You may do all of your own accounting from set up to preparing your own small business tax return OR you may have an accountant who simply takes care of your year end and tax reporting. Accounting software has made doing your own accounting much simpler and allows for most business owners to do it, regardless of whether they have some sort of accounting background. There is however a learning curve and certain accounting steps that not everyone is aware of and that are very important to ensure the accuracy of your books. One of these is are bank reconciliations.

3 Tools that allow you to Remotely Connect to your Computer from Anywhere

The past few years, and especially the last year has changed the way many business owners and employees work. There has been a mass adoption of virtual workspaces where people are no longer tethered to their offices. Instead the technology to make working from anywhere has increased and improved significantly and is accessible by anyone who has a working internet connection. Business can be conducted from your home, an airport, a café or (if you are lucky) on the beach.

While many software, apps and programs are available in the cloud and can directly be accessed directly from your computer or smartphone internet browser, there are times when you need access to your actual desktop or another computer so that you can access the programs and data files that reside there. Luckily, there are numerous tools out there that allow small business owners to remotely connect to their computers . Three of these are discussed below: