Explore Small Business Finance Topics

Discover our most popular topics for Canadian solopreneurs and small business owners. From income tax and GST/HST to QuickBooks tutorials and managing your business finances, these guides are designed to help you move from financial uncertainty to financial confidence.

Click on any topic and scroll down to see related articles.

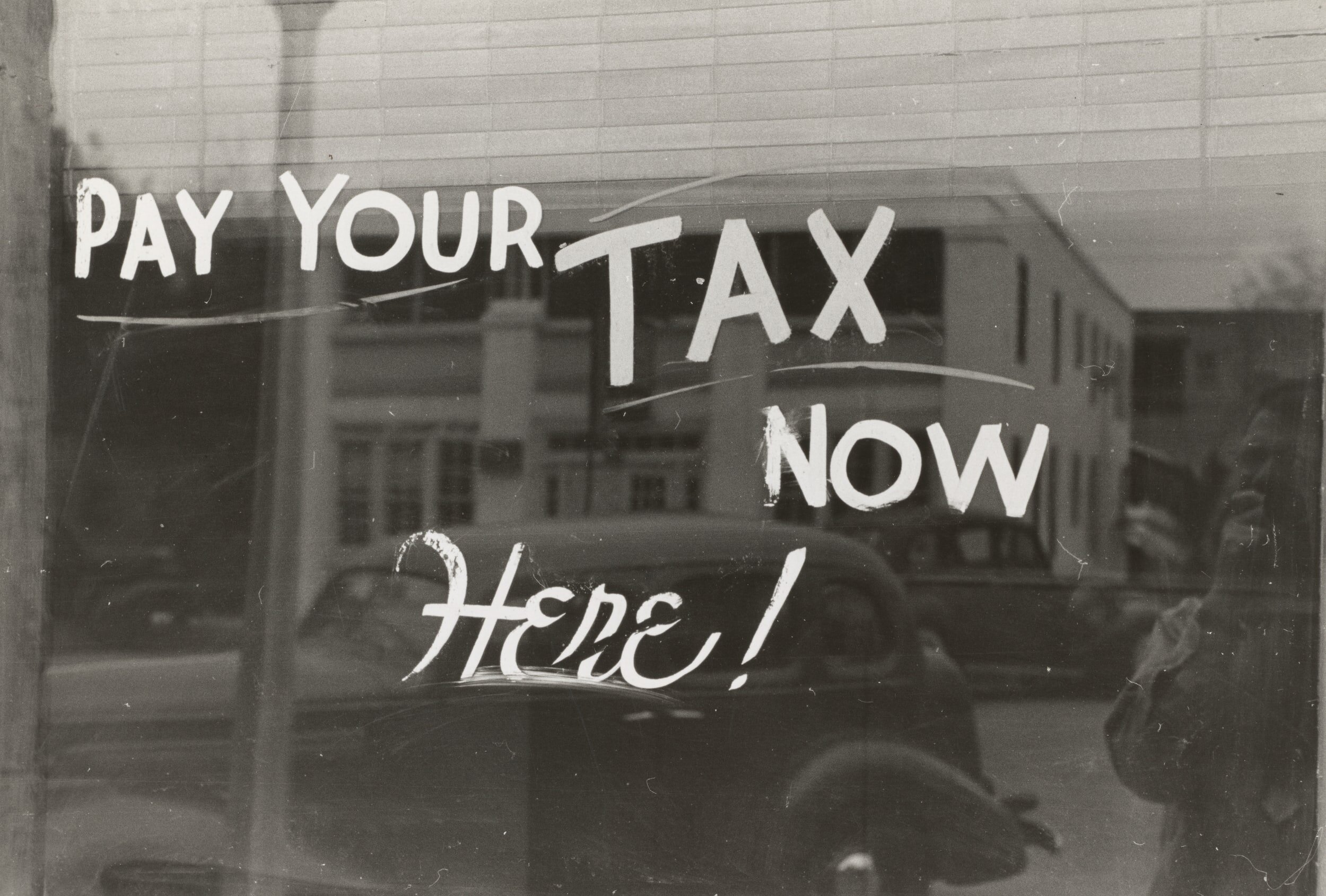

📑Canadian Income Tax

Guidance on filing and planning your Canadian taxes, from T1 and T2 returns to instalments

📊Managing Business Finances

From cash flow to pricing and metrics — learn to manage your business finances with confidence.

🏢 Canadian Business Structure

Should you incorporate? Stay informed on sole proprietorships, corporations, and registrations.

💰 GST/HST & QST

Understand how to register, file, and maximize input tax credits while avoiding common mistakes.

🧾 Guides and Tutorials

Practical accounting processes like reconciliations, journal entries, and reporting.

📝 Deductions & Expenses

Learn which expenses are deductible and how to track them for maximum tax savings.

Quebec Taxes & Business

QST, Revenu Québec filings, Quebec payroll, and provincial rules every entrepreneur should know.

👤 Paying Yourself

Salary vs dividends, management fees, and how to pay yourself from your corporation or small business.

💻 QuickBooks Online & Tools

Tutorials, guides and time-saving tips for using QuickBooks Online effectively.

🏦 Money & Personal Finance

Personal finance strategies for entrepreneurs, from RRSPs to saving for taxes.

What is Capital Cost Allowance and How Does it Impact Your Business

Frequently a client of mine will purchase a high ticket item such as a computer or a piece of furniture and will simply show it as an expense on their profit and loss. Since you purchased something that relates to your business, it should be considered to be a deduction and classified as an expenses.

Unfortunately, accountants and revenue agencies do not see it this way. From their perspective, an item that is purchased for a business, whose value extends beyond one year, is actually an asset that should be depreciated over the useful life of the asset. In other words, the expense that you can claim for the asset is only the portion of the asset that is used in the year that you claim it.

While accountants refer to the amount of the asset that is expensed each year as depreciation, Revenue Canada refers to this as capital cost allowance or CCA.

How to Pay Dividends: Completing the T5 Slip and Summary

If you are the owner of a Canadian corporation, you can choose to pay yourself (and other shareholders) dividends instead of a salary. Alternatively, some shareholders also take dividends in addition to a salary depending on their tax planning strategy. If you do decide to pay yourself dividends, it is important to ensure that you prepare the proper documentation for Revenue Canada (CRA) and if you live in Quebec, Revenue Quebec (MRQ) since this must be reported as investment income on your personal tax return in the calendar year in which the dividends are paid. If you are paying dividends to a Canadian shareholder, you must issue a T5 slip while non resident shareholders receive an NR4 slip. The T5 dividend slips are generally due by February 28th of the calendar year following the year in which the dividend was paid Although no income taxes are due at the time of filing the T5 slips with the government, interest and penalties apply for late filing . The process of submitting preparing and submitting the dividend declarations and the documents that need to be filled out and returned to the CRA and MRQ are discussed below:

What Happens When You Contribute Excess Amounts to your RRSP

Being able to contribute to an RRSP is one of the great tax saving strategies available to all Individual Canadian Taxpayers who generate “earned income” which is essentially income earned from employment (salaries) or self employment. It is extremely important to know that there are unfortunately limits to how much you can contribute and Revenue Canada (CRA) actually imposes penalties on overcontributions to your RRSP.

Note that passive income like dividends and interest is ineligible and does not factor into the calculation for how much you can contribute to an RRSP.

4 Alternatives for Preparing Your Small Business Payroll

Paying salaries to employees (or yourself) requires more than just determining the gross amount to be paid. The Canada Revenue Agency and Revenue Quebec require that employers calculate a variety of taxes on the salaries paid, remit them to the federal and provincial governments and prepare annual reports demonstrating that the calculations are correct and all salary deductions have been paid. This can be a lot of work for business owners whose time is better spent generating sales and building their businesses. Luckily there are many options for small business owners to calculate their payroll and salary remittances, many of which simplify the process:

Consider These Factors When Deciding Whether to Take Salary or Dividends

One of the most common questions I get asked by corporate business owners is whether to take salary or dividends and how much tax can be saved by taking only dividends. The answer unfortunately, like most issues relating to tax, is that it depends on your circumstances. The concept of integration in the Canadian tax system theoretically strives to make taxes payable the same whether you take salary or dividends or a combination of both. In reality, there is always a difference as everyone’s tax situation is distinct.

Consider These Financial and Tax Implications When Buying a Home

The Canadian real estate market has performed well in recent years, though analysts and economists have long warned of its potential overvaluation.

Potential homeowners often find themselves seduced by their vision of the perfect home in the perfect neighbourhood and often end up in a difficult situation, referred to as “house poor”, where the majority of their disposable income goes to paying down their mortgages.

This can be avoided by ensuring that you realistically assess what you can afford and being financially responsible.

Know Your Small Business Tax Deadlines In 2025

As we approach the new year, it is time to start thinking about a subject near and dear to your heart i.e. taxes (insert appropriate emoji).

Below are the deadlines that all small businesses need to know for 2025.

5 Reasons to Change Your GST/HST/QST Reporting Period and How to Do It

When starting a business the selection of the GST/HST or QST reporting period i.e. how often to file your sales tax returns is often based on new business considerations. Many new business owners are quite enthusiastic and/or orderly and therefore would prefer to file their reports and pay the balance owing on a more regular basis. Conversely owners might be concentrating on the other aspects of running their business and do not want to be bothered with the administrative hassle of regular monthly or quarterly reporting. In this case, you might select the annual reporting option to make the year end reporting requirements as simple as possible. As time passes and your business evolves, you might realize that the option that you initially selected may no longer be the most optimal.

10 Year End Financial and Tax Tips for Your Small Business

As the end of the year approaches, some of us find ourselves overwhelmed by top 10 lists, the shopping masses and endless renditions of Christmas Music. Businesses tend to experience a slowdown, which makes it the perfect time for small business owners to take a closer look at their overall business, financial and tax situation. When you are not buying gifts for your customers, family and friends, a review and analysis of your business will allow you to optimize your current financial situation, implement some beneficial changes that can help avoid last minute tax preparation stress and also prepare for the future.

Revenue Canada Interest, Penalties and Payment Arrangements for Income Tax and GST/HST Returns

Whether you are an individual or a business in Canada, taxes are an inescapable part of your existence. All sources of income need to be calculated, tax returns needs to be filed and taxes owing must be paid. This is somewhat facilitated if you are an employee as your employer tends to take care of the majority of remittances. Self-employed individuals, sole proprietorships, partnerships and corporations on the other hand, must account for their income and expenses , determine taxes payable and remit the appropriate amounts. Additionally, businesses are also responsible for other filings including GST/HST and QST and payroll. A lack of knowledge, imperfect accounting systems and the business of running a business sometimes interfere with the timeliness of filings. The Canada Revenue Agency attempts to curb these tardy behaviours by imposing penalties and interest on late filings as follows:

Unincorporat

Is the Quick Method of Reporting GST/HST & QST the Right Choice for your Small Business

If you are self employed or a small business with annual sales between $30,000 and $400,000, it might make sense to select the Quick Method of reporting your GST/HST and QST, which is essentially a simplified method of reporting sales taxes . While regular reporting of sales taxes requires that you calculate all amounts collected and paid on eligible expenses, the quick method (or simplified method as it is also referred to)requires the application of a single reduced rate to your sales while GST/HST and QST paid on expenses is not deductible. The key details of the Quick Method and its suitability for your business are discussed below:

How The CRA AII Program Increases the Tax Deduction for Computers and Other Fixed Assets

In the fall of 2018, the federal government decided to introduce a tax incentive called the Accelerated Investment Incentive (AII). The purpose of this program was to stimulate business investment by increasing the amount of capital cost allowance (CCA) on depreciable property (the terminology, sadly, is a bit less stimulating). In layman’s terms, it means you could claim a higher amount of depreciation on assets such as computer, equipment, furniture etc, in the year of purchase, thereby reducing your taxes in the short term.

What Small Business Owners Should Know about Leasing vs Buying their Car, Corporate Ownership of Vehicles and Deducting Car Expenses

Should you Register or Incorporate Your Small Business?

When embarking on a new business venture one of the first decisions that has to be made is the type of legal structure best suits the needs of the new business. In Canada there are essentially two choices - business registration (sole proprietorship or partnership/unincorporated entity) or incorporation. Like many small business decisions, the answer in not necessarily straightforward and depends on the business owner’s specific set of circumstances:

Tax Deductions vs Tax Credits and 5 Tax Deductions to Help Reduce Your Tax Bill

Most taxpayers use the terms tax deduction and tax credit interchangeably. Since they are not accountants, this is perfectly fine unless you are particular about precision and strive for a greater understanding of tax. And while there a numerous technicalities and jargon in tax that are better left to tax professionals, this particular distinction is fairly straightforward , can useful to understand and might even save you some tax.

So, what is the difference? A tax deduction is a reduction of your net income on which your taxes payable are based, while a tax credit is a direct reduction of your taxes payable. These might sound very similar, but their impact on how much tax you pay is different. Since there are different tax brackets, a tax deduction results in a reduction of your taxes payable effectively at the highest tax bracket to which your income applies, while a tax credit (for simplicity we are only talking about the federal portion and not provincial) will only reduce your taxes by 15%, which corresponds to the lowest tax bracket. While this can get significantly more complicated, suffice it to say, if your income exceeds approximately $50k, tax deductions have a higher value i.e. they reduce your taxes by a greater amount than a tax credit since part of the $50k will be taxed based on a higher tax bracket.