Explore Small Business Finance Topics

Discover our most popular topics for Canadian solopreneurs and small business owners. From income tax and GST/HST to QuickBooks tutorials and managing your business finances, these guides are designed to help you move from financial uncertainty to financial confidence.

Click on any topic and scroll down to see related articles.

📑Canadian Income Tax

Guidance on filing and planning your Canadian taxes, from T1 and T2 returns to instalments

📊Managing Business Finances

From cash flow to pricing and metrics — learn to manage your business finances with confidence.

🏢 Canadian Business Structure

Should you incorporate? Stay informed on sole proprietorships, corporations, and registrations.

💰 GST/HST & QST

Understand how to register, file, and maximize input tax credits while avoiding common mistakes.

🧾 Guides and Tutorials

Practical accounting processes like reconciliations, journal entries, and reporting.

📝 Deductions & Expenses

Learn which expenses are deductible and how to track them for maximum tax savings.

Quebec Taxes & Business

QST, Revenu Québec filings, Quebec payroll, and provincial rules every entrepreneur should know.

👤 Paying Yourself

Salary vs dividends, management fees, and how to pay yourself from your corporation or small business.

💻 QuickBooks Online & Tools

Tutorials, guides and time-saving tips for using QuickBooks Online effectively.

🏦 Money & Personal Finance

Personal finance strategies for entrepreneurs, from RRSPs to saving for taxes.

Know Your Small Business Tax Deadlines For 2024

As we approach the new year, it will be time soon to start working on everyone’s favourite activity i.e. getting your tax stuff in order :) . Below are the deadlines that all small businesses need to know for 2024.

Download our free Canada unincorporated business tax deadline calendar for 2024 (both Federal and Quebec).

Guidelines For Deducting Conference and Training Expenses

Attending conferences and investing in ongoing training can be a great way for small business owners and the self employed to keep current on industry developments, ensure ongoing professional development and improve their skills. It also allows for networking opportunities and occasionally includes trips to exotic locations, which can be a welcome change in environment from working at your office. As an added bonus ,the cost of conferences, conventions and seminars as well as corresponding travel expenses are deductible against your business income, subject to specific guidelines.

A Guide to Navigating Taxes in the Gig Economy

In a recent study by H&R Block, nearly 28% of Canadians reported taking on a side hustle in the “gig economy” to boost their income. This is a significant increase from 2022 in which the analogous percentage was 13%. This is likely a result of inflationary pressures and the expansion of opportunities available for flexible work.

The gig economy, popularized by Uber, refers to work that is flexible and usually incorporates digital apps or platforms.

Gig workers tend to be independent contractors who usually decide when they are going to work, often bring their own “tools” (such as a car or a computer) and are required to report their earnings to tax authorities.

Guidance on Registering for Payroll and Remitting Source Deductions

There comes a time for many small business owners when they decide that they need to hire employees. This is usually an excellent sign as it means a) the business is growing and b) the small business owner has learned to delegate. It also means that additional paperwork needs to be filled out and additional taxes need to be paid. The simplest option when deciding to augment your workforce is to have the new worker invoice the business, based on hours worked or some other formula. Unfortunately, there are very specific rules as to who qualifies as a self employed contractor. Essentially, if your have someone that works full time, has little flexibility with respect to the hours that they work and you provide the tools such as a desk/office, computer etc, then there is a good chance that the tax authorities will classify them as an employee. In this case, where your worker is clearly an employee, you must register for payroll, pay them a salary and submit regular, periodic payroll reports and payments to the Canada Revenue Agency (CRA). As usual, if you live in Quebec, you must submit to Revenue Quebec (MRQ) as well.

How to Calculate CPP/QPP Contributions If You Are Self Employed

When you are self-employed, you are essentially taking on the role of employer and employee. As such self-employed individuals are required to remit both portions of the CPP or QPP to Revenue Canada or Revenue Quebec respectively, which is calculated on your earnings for the year. This only applies to unincorporated business who declare business income as part of their personal tax return (T1)

12 Tax Tips for the Self Employed

The self-employed lifestyle holds great promise when you first start being self employed, however you quickly find yourself doing things that you would never have dreamed of. You are expected to take on role of salesperson, market researcher, accountant, lawyer and social media expert, while not getting paid for any of it. Your available funds do not allow for outsourcing and at times you are not even aware of what you don’t know. Luckily the internet provides a wealth of tips and tricks to make these tasks easier, and you might actually find that you enjoy taking on some of these challenges. Ensuring that you keep on top of your finances and tax obligations is among the most important of these tasks for which it is essential to have a system in place so that you can maximize tax deductions, minimize taxes payable and reduce amounts that you have to pay to CRA and RQ.

16 Common Financial and Tax Mistakes That Affect Your Small Business’ Bottom Line

Starting a business is hard work. In addition to creating your core product or service , you also need to have a working knowledge of numerous other facets of business including marketing, IT, accounting and operations . In the early stages cost constraints may prevent you from hiring additional staff or even outside contractors to handle some of these roles may not be an option. Consequently, you are faced with the daunting task of having to learn as much as possible in a short period of time. And although there is a great deal of information available via an internet search, it is easy to overlook something or make mistakes given a lack of experience and expertise or simply the right questions to ask. This is especially true with respect to the more technical aspects of business such as accounting and tax.

Accounting and Tax Treatment of Computer Hardware and other Fixed Assets

Investment in capital items such as computers, furniture, equipment and cars can cause confusion for small business owners. Since these are purchases that affect the cash flow of the business, it seems that they should be accounted for as expenses similar to office supplies or rent. There are however special rules for any acquisitions that qualify as “fixed assets”. A fixed asset, simply speaking, is an acquisition that provides a long term economic benefit to the business. In other words, any business purchases that has a useful life that extends beyond one year, will usually qualify as a fixed asset. Below I discuss the accounting and tax treatment of fixed assets.

Should You Transition to a Paperless Office (and What CRA Has to Say about It)

Imagine having an office without clutter, free from sad looking boxes and filing cabinets filled to the brim, where you don’t have to rifle through unlabeled containers to find a receipt for a computer that you bought three years ago. . An office where you can make Marie Kondo proud by getting rid of (almost) anything that does not bring you joy and surrounding it instead with items that inspire (or at least improve productivity). This is all possible with a few apps, sufficient digital space and a shift in your mindset and processes.

Earned Income and Your RRSPs

In honour of Canada day, I thought it would be very exciting to discuss tax concepts that you can then share with your friends and family perhaps at a celebratory barbecue or party (this is particularly effective if you want some alone time:))

The idea of earned income is important largely as it relates to RRSP contribution room and is closely related to active income. RRSPs, as you might know, are the single most effective tax savings vehicle available to Canadians. As such, ideally, you want to maximize the amount that you can contribute each year. This is beneficial, even if you can’t contribute the full amount, as your contribution room is cumulative i.e. anything you don’t contribute gets carried forward to a future year.

Know Your Small Business Tax Deadlines For 2023

Somehow we are almost one month into 2023 (!) and it is time for business owners (and individuals) to start thinking about one of their favourite subjects i.e. taxes. I have compiled a list of the deadlines that all of you should know and also updated my annual business tax deadline calendar.

Sign up to download our free Canada unincorporated business tax deadline calendar for 2023 or Quebec unincorporated small business tax deadline calendar 2023.

What Independent Contractors Should Know About Personal Service Businesses

Many of you leave your full time jobs to become independent contractors. This could be for a variety of reasons: you might decide you want the freedom that comes with self employment, or your company might decide that they no longer want to maintain employees. In some cases, you are laid off and find another opportunity , but the business only offers contract positions.

This type of situation is particularly applicable to people in the IT industry but can also apply to a variety of other types of skill sets. Often, your client will require that you set up a corporation which then contracts with the client to provide services that are very similar to those you would provide if you were an employee. The corporation then bills your client either directly or through a third-party (often a recruiting agency).

Two (and a Half) Options for Claiming Employee Home Office Expenses in 2020

As numerous employees shifted from their offices to their homes, Revenue Canada (CRA) and accountants were deluged with questions about how they could claim home office expenses. To stave off the complaints and questions, CRA decided to introduce a simplified method of claiming a tax deduction. It should be noted that employees have always been allowed to claim expenses relating to their employment as long as their employers completed and signed form T2200. The information from this form would then be entered on Schedule T777. The issue for this year is that filling out the form and completing the schedule is a somewhat tedious process and does not fit all employees’ who worked from home as a result of Covid imposed restrictions.

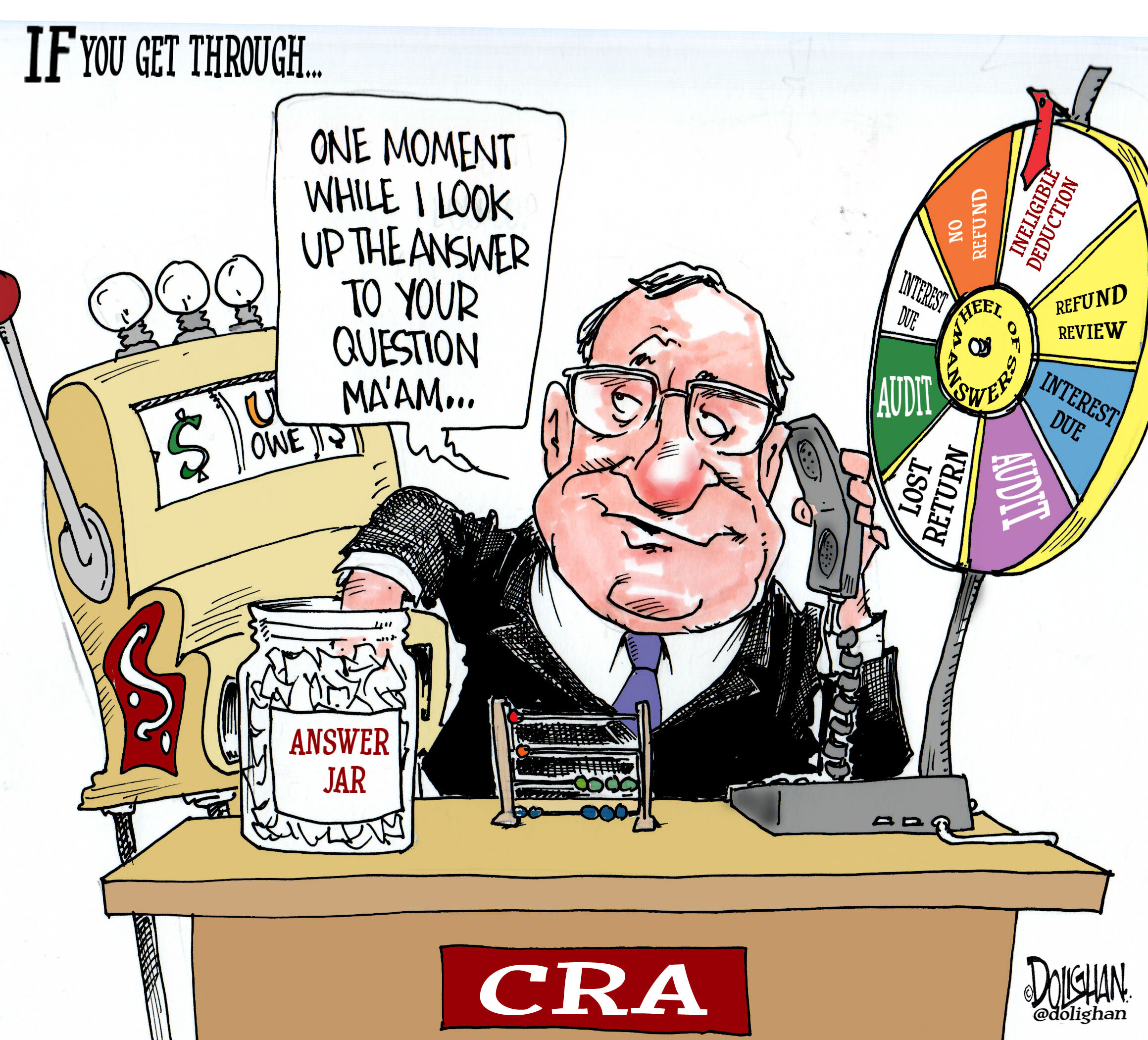

Why Every Canadian Should File a Personal Tax Return

A friend of mine has been in a nightmare scenario with CRA. She hadn’t filed her tax return in a few years mostly because she had one T4, figured that she didn’t owe any tax and was simply procrastinating on an unenjoyable task. In 2020 she receive a notice of assessment from CRA indicating that she owed several thousand dollars, with no additional details except that they had added $25k to her actual income earned. Over the past year, she has called them numerous times to get an explanation and each time she is told that the file is being escalated and someone will get back to her. To date nobody has gotten back to her. To make matters worse, CRA passed this information i.e. additional income on to Revenue Quebec (without any details) which resulted in a significant assessment from them. She still has no idea why she was assessed this amount and is now in the unenviable position of calling both revenue agencies on a weekly basis to manage the situation.

Information on Filing T4s/RL-1s and T4As for Small Business Owners

When I was employee, I never really gave much thought to the T4 (and the Quebec equivalent RL-1) process. I knew that sometime around February an envelope would appear on my desk with a tax document which I would need to reflect on my tax return. I suppose I thought that someone, somewhere pressed a button and the T4s were generated. When I became a small business accountant, who was now either responsible for preparing this information or providing guidance to my clients, I realized that the process was somewhat more complicated.