3 Tools that allow you to Remotely Connect to your Computer from Anywhere

The past few years, and especially the last year has changed the way many business owners and employees work. There has been a mass adoption of virtual workspaces where people are no longer tethered to their offices. Instead the technology to make working from anywhere has increased and improved significantly and is accessible by anyone who has a working internet connection. Business can be conducted from your home, an airport, a café or (if you are lucky) on the beach.

While many software, apps and programs are available in the cloud and can directly be accessed directly from your computer or smartphone internet browser, there are times when you need access to your actual desktop or another computer so that you can access the programs and data files that reside there. Luckily, there are numerous tools out there that allow small business owners to remotely connect to their computers . Three of these are discussed below:

8 Inexpensive Ways to Market Your Services

One of the most daunting aspects of starting a new small service based business is building a client base (and nothing is quite so exciting as getting those first few clients). When trying to generate new business, it is important to cast a wide net as you never know where potential clients may be lurking. Once you have established your business, you will discover the methods that work best for you and you can finesse your marketing strategy. You can also choose to be more selective as you determine which type of client is the best fit for your business.

There are many ways to build a client base, even with limited resources, some of which are discussed below:

Tax Return Checklist for Individuals and Unincorporated Business Owners

The deadline to file tax returns is starting to loom large, resulting in anxiety for some individuals and small business owners. The good news is that the stress can be managed fairly easily with some simple organization techniques. The best starting point is to evaluate your tax situation and prepare a checklist of all the documentation that you will need with respect to your specific tax situation. A checklist can help reduce (or eliminate) important items that might get forgotten in the rush to put everything together (and its always satisfying to cross something off the list). I have compiled a list of some of the more common income, deductions and credits that the majority of taxpayers are likely to have:

9 Year End Tax Planning Tips for Small Business Owners

For numerous people around the world, the end of this year cannot come soon enough. It has been an unprecedented few months, the effects of which will be felt for many years to come. And while it has been extremely difficult for some small business owners such as restaurants and storefront retail, others have seen their businesses flourish. e.g. toilet paper manufacturers, Amazon and Zoom. Many businesses were able to pivot their business models to provide goods and services that cater to the “new normal” in interesting and creative ways. Some started selling masks while others increased their online course offerings. Beleaguered restaurants started expanding their delivery menus and offerings. To a dispassionate business analyst, this year has been somewhat fascinating and will provide a great deal of data to economists and analysts alike in the years to come.

It is time for business owners everywhere to start contemplating some end of year tax planning tips to not only ensure that they can maximize their tax deductions and reduce taxes payable, but to streamline the tax filing process in the New Year. Even if you are incorporated and your year end date is not December 31st, it is a good time to take advantage of calendar year deadlines for personal tax planning purposes.

4 Simple Financial Metrics to Help Measure the Success of Your Small Business

Most small business owners want insights into their business performance to get a sense of what they are doing well while also trying to understand their areas of weakness. Unfortunately a big picture view does not always immediately reveal itself– a thorough understanding of your business generally requires a more thorough analysis and introspection. You may be tempted to look at cash (or lack thereof) in your bank account or your net profit , however these are not always reliable indicators of success or failure , particularly when taken in isolation. Every small business owner should identify the specific needs and constraints of their business to determine the optimal analysis required to assess its financial performance. Some general analysis that most businesses can benefit from are presented below:

Top 6 Signs Your Small Business Might Need a New Accountant

I met with a small business owner recently who had just purchased a retail business and was looking for a new accountant. It seems that the current accountant was reviewing her books on a quarterly basis, preparing financial statements and doing the year-end tax returns – all typical accountant stuff. The problem was that the accountant, while charging this small business a fairly significant amount of money, was not really adding any value to their business. The bookkeeping, which was done by the previous business owner, was still being entered manually in ledgers (!). The quarterly accounting review consisted of checking the ledgers for mathematical accuracy and ensuring no major deductions had been missed without any discussion regarding the performance of the business. Worst of all, the accountant was not responding to the client’s requests for a meeting to discuss the financial performance of the business

COVID-19 Details on Canada 75% Wage Subsidy for Businesses with Employees (CEWS)

Businesses who have employees that are on payroll (i.e. for whom deductions at source is being remitted and T4s/RL1s are being issued) are entitled to a Wage Subsidy of 75% of the employees’ gross payroll up to a maximum of $847 per week referred to as Canadian Emergency Wage Subsidy or CEWS. This should prove to be very helpful to businesses who don’t want to let employees go but due to reductions (or complete stoppage) of revenues may not be able to afford to pay them. It provides for business continuity and financial relief to a significant subsection of the population.

COVID-19: Financial and Tax Relief Measures for Small Business and Individuals (UPDATED)

UPDATED APRIL 27, 2020

In response to the financial pressure being felt by small business, employees and individuals as a result of COVID-19, a number of measures have been announced by governments and banks to alleviate this difficulty These are enumerated in this post and while details relating to eligibility, how to apply etc. on the measures announced by the federal government today are still forthcoming, small businesses and individuals now know what types of financial relief they may be eligible for and can start preparing accordingly.

Tips and Tools for Working from Home

Having a home based business has many advantages - there's no wearying commute to and from work, our sleep schedule is not beholden to an alarm clock and it allows us to work, if we so choose, when we are at our most productive or creative. An additional benefit is that expenses relating to our home office are tax deductible. Working from home can, however, also present a unique set of challenges. Given the proximity of distractions including our beds, fridges , tvs and perhaps worst of all, our computers, it requires a great deal of discipline and focus to actually get any work done.

Impact of COVID-19 on Small Business and Their Employees(UPDATED): EI Sickness and EI Regular Benefits

Updated on March 30, 2020 for CERB which will replace the EI benefits in the short term.

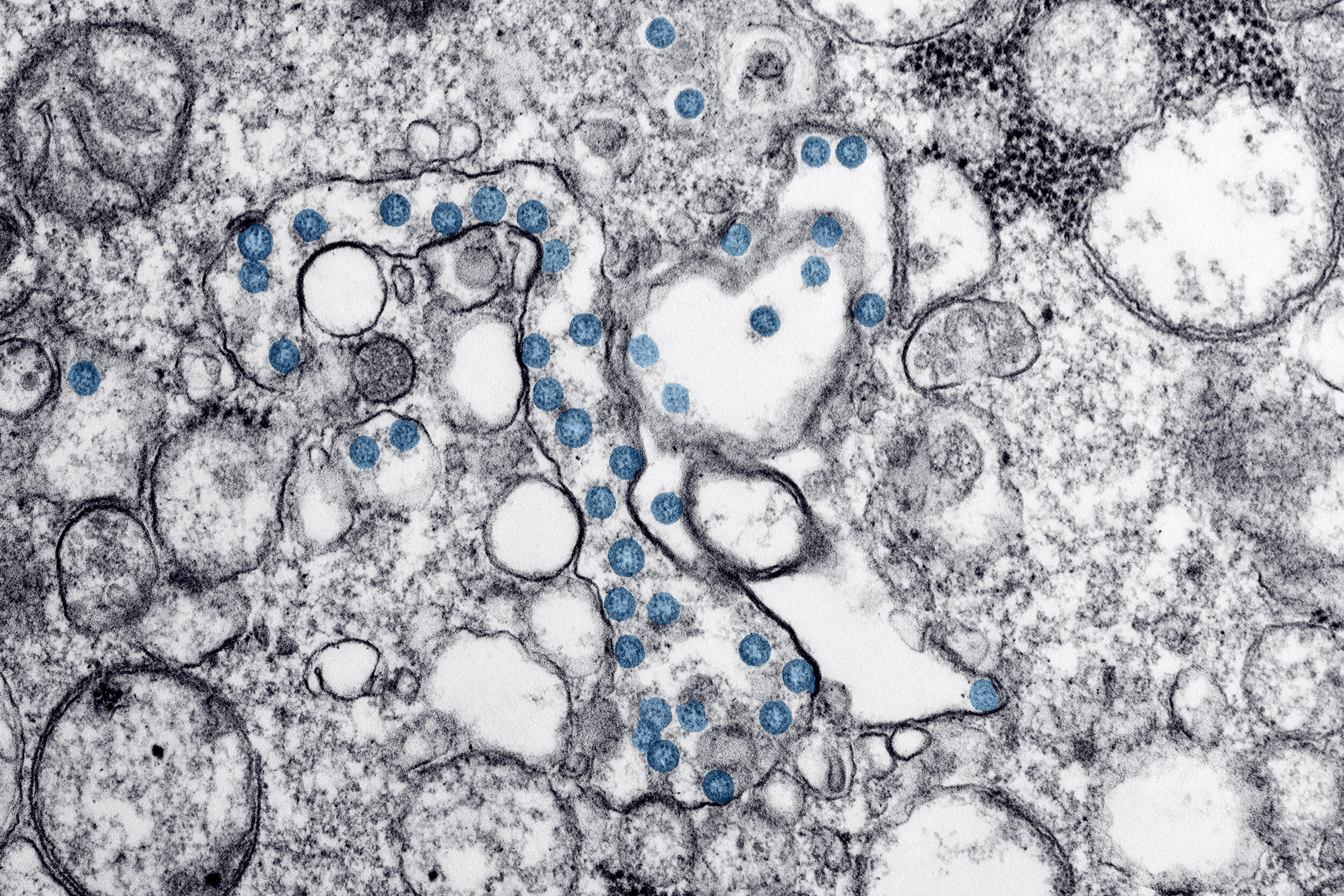

The impact of Covid 19 (caused by the CoronaVirus) is being felt deeply all across the world right now as individuals, businesses, healthcare institutions and governments try to cope with the ongoing and evolving implications. It is a difficult time as individuals try not to panic and governments are endeavouring to decide the best course of action for their citizens. Small businesses are experiencing are experiencing dramatic slowdowns or are being forced to close as customers stay at home.

Businesses who have employees that are quarantining themselves due travel or potential contact with the Coronavirus as well as employees who are laid off are entitled to EI Benefits. While there have been some changes to the sickness benefits in the face of Covid 19, EI benefits currently remain the same and are explained below:

Business and Tax Implications of Owning Rental Property

A great many fortunes have been made in real estate. Conversely, as was evidenced in 2008 with the deflation of the housing bubble, many fortunes have also been spectacularly lost. Fortunes aside, owning real estate is one of the best ways to build equity. If you own your home, you are already one step ahead. With rental property, you can further augment your net worth if after investing the necessary down payment the rental income covers and/or exceeds the mortgage payment and related expenses, (Leaving you free to move on to buying your next property). This is not a decision to take lightly as with any investment there are several business and tax factors to consider before taking the plunge:

Employment Insurance for Small Business Owners and Self Employed Individuals

One of the benefits allowed employees working in Canada is that have access to employment insurance. A specific amount is withdrawn from each employees paycheques each pay period along with an employer portion and remitted to Revenue Canada. This entitles them to wage loss replacement, in the event that they are laid off, as well as other benefits. This can be extremely useful in difficult times and has been used by millions of Canadians.

Unfortunately, taxpayers who are considered self employed are not entitled to the same benefits. A self employed individual also includes anyone who owns 40% of a corporation and usually extends to family members of self employed people. By the same token, self employed taxpayers (whether they are sole proprietorships or owners of corporations) are also not required to pay employment insurance (EI) premiums.

9 Tax Facts about Charitable Donations for Individuals and Small Business Owners

Every good act is charity. A man's true wealth hereafter is the good that he does in this world to his fellows. - Moliere. Unfortunately, the Canada Revenue Agency (CRA) has specific criteria for what qualifies as a charitable donation and not all good acts qualify for a tax benefit. Growing a moustache (although not without its costs) or running a marathon, are generally not considered to be a charitable donations according to the tax code. Luckily there are a multitude of charitable organizations that do qualify the donors to receive a tax credit for their donations. Some facts about the tax credit are discussed below:

24 Cost Effective Ways to Promote Your Small Business

After thinking long and hard you have decided that is time to launch your own business. You have a great product or service, you’ve come up with a compelling business name, all the paperwork has been filed and you have picked out the perfect location (or setup a snazzy new home office). All pieces are in place for your new independent life as a business owner. And then you realize that nobody except your spouse, family members and possibly your cat knows about your new venture. So, how do you bring your fabulous new product or service to your target market's attention? One way is to use the “build it and they will come” approach. This is usually not particularly effective (even Google, who historically launches products with little fanfare, could benefit from a little more marketing). The other, more effective approach is to get out there and promote your business. Of course in the initial stages, marketing budgets tend to be minuscule. On the other hand, many new business owners have time on their hands, while they wait to be deluged by orders. Below is a list of 24 cost effective ways to promote your small business:

Investment Strategies for Your Incorporated Small Business

One of the benefits of having an incorporated small business is that after paying yourself a salary or dividend any excess funds can be invested directly through the corporation. Since small businesses often cannot predict how their business will perform from year to year, the ability to retain funds in the corporation allows for a cushion to smooth out fluctuations in earnings which can then be paid out in lower performing years. By keeping the funds in the corporation, the business is able to defer tax since usually the small business tax rate is lower than the personal tax rate. Some points to consider: