Why Every Canadian Should File a Personal Tax Return

A friend of mine has been in a nightmare scenario with CRA. She hadn’t filed her tax return in a few years mostly because she had one T4, figured that she didn’t owe any tax and was simply procrastinating on an unenjoyable task. In 2020 she receive a notice of assessment from CRA indicating that she owed several thousand dollars, with no additional details except that they had added $25k to her actual income earned. Over the past year, she has called them numerous times to get an explanation and each time she is told that the file is being escalated and someone will get back to her. To date nobody has gotten back to her. To make matters worse, CRA passed this information i.e. additional income on to Revenue Quebec (without any details) which resulted in a significant assessment from them. She still has no idea why she was assessed this amount and is now in the unenviable position of calling both revenue agencies on a weekly basis to manage the situation.

3 Tools that allow you to Remotely Connect to your Computer from Anywhere

The past few years, and especially the last year has changed the way many business owners and employees work. There has been a mass adoption of virtual workspaces where people are no longer tethered to their offices. Instead the technology to make working from anywhere has increased and improved significantly and is accessible by anyone who has a working internet connection. Business can be conducted from your home, an airport, a café or (if you are lucky) on the beach.

While many software, apps and programs are available in the cloud and can directly be accessed directly from your computer or smartphone internet browser, there are times when you need access to your actual desktop or another computer so that you can access the programs and data files that reside there. Luckily, there are numerous tools out there that allow small business owners to remotely connect to their computers . Three of these are discussed below:

Tax Return Checklist for Individuals and Unincorporated Business Owners

The deadline to file tax returns is starting to loom large, resulting in anxiety for some individuals and small business owners. The good news is that the stress can be managed fairly easily with some simple organization techniques. The best starting point is to evaluate your tax situation and prepare a checklist of all the documentation that you will need with respect to your specific tax situation. A checklist can help reduce (or eliminate) important items that might get forgotten in the rush to put everything together (and its always satisfying to cross something off the list). I have compiled a list of some of the more common income, deductions and credits that the majority of taxpayers are likely to have:

Business Tax Deadlines for Sole Proprietors for 2021

While many businesses got a break from some onerous tax deadlines back in the early days of Covid, unfortunately there are no such extensions for 2021. Almost all tax deadlines are now exactly as they were in previous years and small business owners must adhere to them or risk facing penalties for late filing plus interest on any overdue balances. That being said, it is possible that a greater amount of taxpayer relief will be available this year if you can demonstrate financial hardship due to Covid.

I have compiled a list of deadlines for all unincorporated small business owners which includes sole proprietors and self employed individuals. You can also sign up to get a calendar of tax due dates (for sole proprietors) for your ongoing reference.

What is your Net Worth?

There comes a point in many people's lives when they want to find out what they are worth. This is much more difficult to quantify on a metaphysical level; however on a tangible level most people can figure out how much wealth they have created over time. The definition of net worth is simply the total of all your assets (what you own) less your liabilities (what you owe).

9 Tax Facts about Charitable Donations for Individuals and Small Business Owners

Every good act is charity. A man's true wealth hereafter is the good that he does in this world to his fellows. - Moliere. Unfortunately, the Canada Revenue Agency (CRA) has specific criteria for what qualifies as a charitable donation and not all good acts qualify for a tax benefit. Growing a moustache (although not without its costs) or running a marathon, are generally not considered to be a charitable donations according to the tax code. Luckily there are a multitude of charitable organizations that do qualify the donors to receive a tax credit for their donations. Some facts about the tax credit are discussed below:

Understanding Payroll Deductions: Personal Income Tax Rates, CPP/QPP, EI and Basic Exemption

The automation of the tax preparation and filing process has been a boon to individuals and tax preparers alike. Gone are the days of struggling to find the right box on the return, adding everything up 5 times and still getting different results, and hoping that the CRA can read your chicken scrawl. Present day tax software not only guides you through every step of the process, it also helps to optimize your allocations thereby reducing your taxes payable. There is however at least one downside to automation: Since we are more removed from the actual calculations, our understanding of our tax situation is somewhat diminished. We have an idea of what we expect to pay, which we can see every week on our paycheques (or for self employed individuals, the breathtaking moment when we see the final result on our tax return), but often we are not really sure how these amounts are derived. Below is a discussion of the tax rates, deductions and maximums to improve our comprehension of this somewhat complex topic:

What Happened to Quebec Property Tax Refund?/ Preparing the RL31 and the solidarity tax credit

UPDATE: Beginning with the year ended December 31, 2015 landlords are required to provide tenants with an RL 31 slip which indicates the name of the tenant, the number of tenants at a particular address as well as the address of the tenant. Each individual listed on the lease must be issued an RL 31. Deadline for filing the form is February 28th following the year of residence and is only issued to tenants living at a particular dwelling December 31, 2019. The forms can be filed online through Revenue Quebec and is a fairly straightforward process. Failure to file the form by the landlord can result in a penalty. The form is then required to be used by the tenant to claim the portion of the solidarity tax credit relating to residence.

For Quebec taxpayers who have been trying to locate their RL-4 slips, the slip that your landlord usually provides, or the part on the tax forms or software where you would enter your property taxes (Schedule B), be advised that as of 2011, that this is no longer a specific tax credit. Prior to 2011, both property owners and renters could claim a portion of property taxes paid. This reduced income taxes payable for taxpayers whose total family income was under approximately $50k

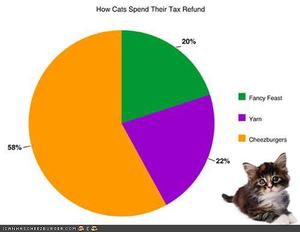

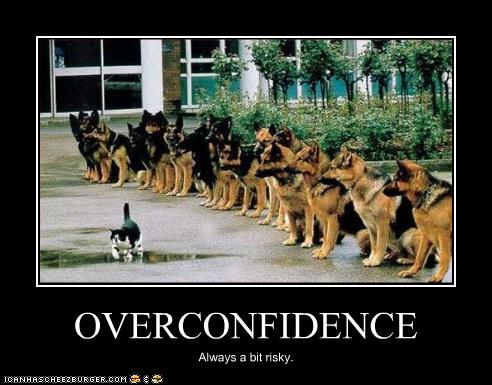

9 Psychological Traits that Affect Our Investing and Business Decisions

Modern portfolio theory assumes that we are rational investors and invest only in efficient and optimal portfolios that provide the maximum return for minimum risk. The truth (as posited by Behavioural Economists) is that we far from rational and are subject to a myriad of psychological influences and behaviours that prevent us from not only making optimal investment or business decisions, but can in some cases turn us into morons. We buy and hold too long or buy and sell too quickly; we refuse to accept losses assuming that we will recover our money or we sell losing investments way too soon; we are overconfident about our own abilities or place too much trust in “experts”; we maintain the status quo and do nothing or we change things too frequently. The dichotomies of investing behaviour are numerous and fascinating and have lead to creation of field of study referred to as Behavioural Ecomomics. Each of these behaviours also has a tremendous impact on our business decisions and are discussed below:

Invest in RRSPs or Repay your Mortgage?