Explore Small Business Finance Topics

Discover our most popular topics for Canadian solopreneurs and small business owners. From income tax and GST/HST to QuickBooks tutorials and managing your business finances, these guides are designed to help you move from financial uncertainty to financial confidence.

Click on any topic and scroll down to see related articles.

📑Canadian Income Tax

Guidance on filing and planning your Canadian taxes, from T1 and T2 returns to instalments

📊Managing Business Finances

From cash flow to pricing and metrics — learn to manage your business finances with confidence.

🏢 Canadian Business Structure

Should you incorporate? Stay informed on sole proprietorships, corporations, and registrations.

💰 GST/HST & QST

Understand how to register, file, and maximize input tax credits while avoiding common mistakes.

🧾 Guides and Tutorials

Practical accounting processes like reconciliations, journal entries, and reporting.

📝 Deductions & Expenses

Learn which expenses are CRA deductible and how to track them for maximum tax savings.

Quebec Taxes & Business

QST, Revenu Québec filings, Quebec payroll, and provincial rules every entrepreneur should know.

👤 Paying Yourself

Salary vs dividends, management fees, and how to pay yourself from your corporation or small business.

💻 QuickBooks Online & Tools

Tutorials, guides and time-saving tips for using QuickBooks Online effectively.

🏦 Money & Personal Finance

Personal finance strategies for entrepreneurs, from RRSPs to saving for taxes.

COVID-19 Details on Canada 75% Wage Subsidy for Businesses with Employees (CEWS)

Businesses who have employees that are on payroll (i.e. for whom deductions at source is being remitted and T4s/RL1s are being issued) are entitled to a Wage Subsidy of 75% of the employees’ gross payroll up to a maximum of $847 per week referred to as Canadian Emergency Wage Subsidy or CEWS. This should prove to be very helpful to businesses who don’t want to let employees go but due to reductions (or complete stoppage) of revenues may not be able to afford to pay them. It provides for business continuity and financial relief to a significant subsection of the population.

COVID-19: Financial and Tax Relief Measures for Small Business and Individuals (UPDATED)

UPDATED APRIL 27, 2020

In response to the financial pressure being felt by small business, employees and individuals as a result of COVID-19, a number of measures have been announced by governments and banks to alleviate this difficulty These are enumerated in this post and while details relating to eligibility, how to apply etc. on the measures announced by the federal government today are still forthcoming, small businesses and individuals now know what types of financial relief they may be eligible for and can start preparing accordingly.

Small Business Tax Filing Deadlines for 2019 (UPDATED)

As the year end approaches, small businesses should be aware of the deadlines, imposed by Revenue Canada and Revenue Quebec, for their various tax obligations. Ensuring that these are done on a timely basis can result in significant savings , that can be put to better use in the business , by avoiding interest and penalties. It also helps to prevent aggressive notices from revenue agencies and reduces the red flags that tend to accompany habitually late filers. Below are the deadlines that businesses should be aware of:

Impact of COVID-19 on Small Business and Their Employees(UPDATED): EI Sickness and EI Regular Benefits

Updated on March 30, 2020 for CERB which will replace the EI benefits in the short term.

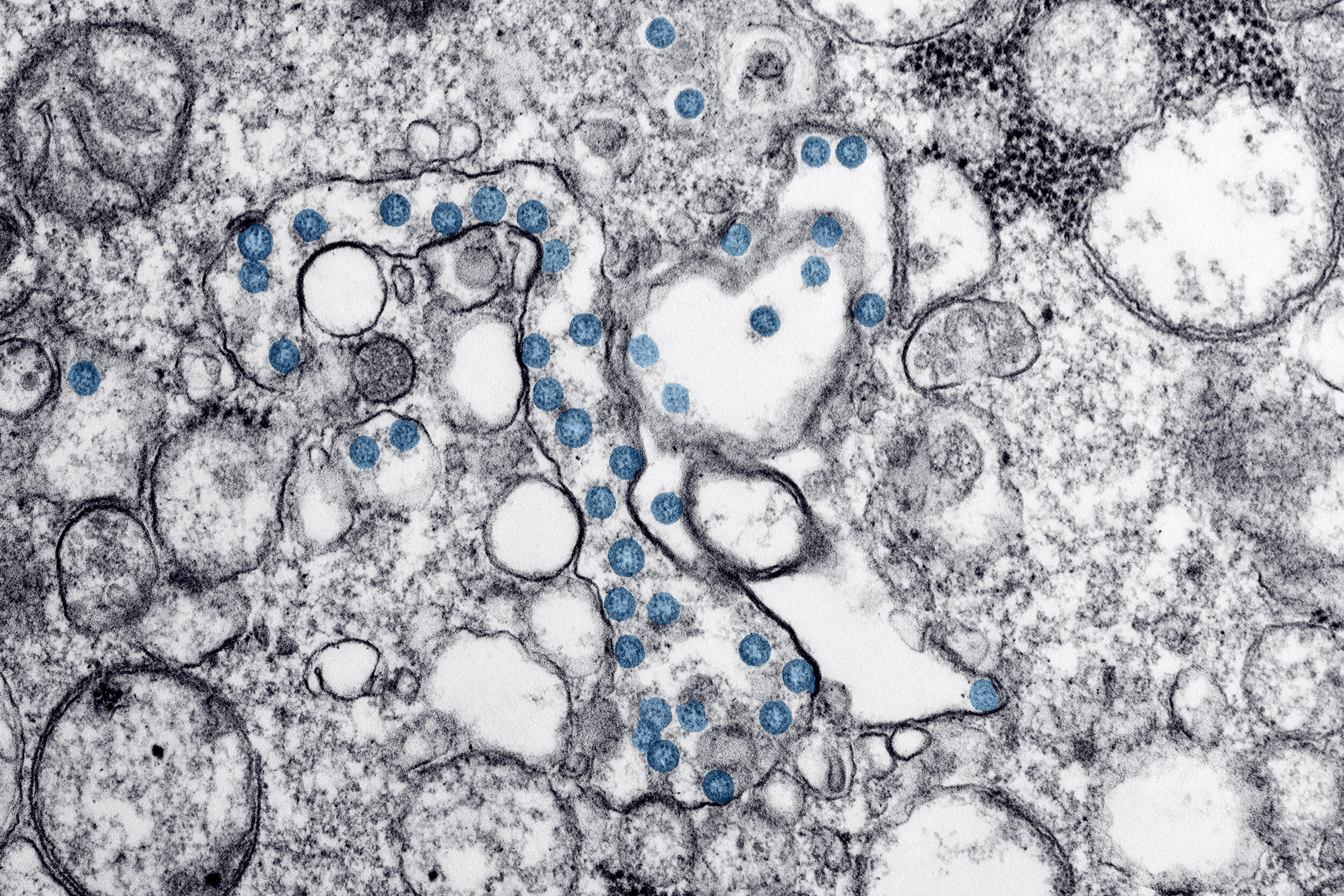

The impact of Covid 19 (caused by the CoronaVirus) is being felt deeply all across the world right now as individuals, businesses, healthcare institutions and governments try to cope with the ongoing and evolving implications. It is a difficult time as individuals try not to panic and governments are endeavouring to decide the best course of action for their citizens. Small businesses are experiencing are experiencing dramatic slowdowns or are being forced to close as customers stay at home.

Businesses who have employees that are quarantining themselves due travel or potential contact with the Coronavirus as well as employees who are laid off are entitled to EI Benefits. While there have been some changes to the sickness benefits in the face of Covid 19, EI benefits currently remain the same and are explained below:

Understanding Payroll Deductions: Personal Income Tax Rates, CPP/QPP, EI and Basic Exemption

The automation of the tax preparation and filing process has been a boon to individuals and tax preparers alike. Gone are the days of struggling to find the right box on the return, adding everything up 5 times and still getting different results, and hoping that the CRA can read your chicken scrawl. Present day tax software not only guides you through every step of the process, it also helps to optimize your allocations thereby reducing your taxes payable. There is however at least one downside to automation: Since we are more removed from the actual calculations, our understanding of our tax situation is somewhat diminished. We have an idea of what we expect to pay, which we can see every week on our paycheques (or for self employed individuals, the breathtaking moment when we see the final result on our tax return), but often we are not really sure how these amounts are derived. Below is a discussion of the tax rates, deductions and maximums to improve our comprehension of this somewhat complex topic:

Invest in RRSPs or Repay your Mortgage?

Last Minute Guidance and Information for Tax Filers

What is the Hiring Credit for Small Business?

Recently, a client received a notice from the CRA indicating that he had received a credit of $265. The explanation was simply that it was a hiring credit. Upon further research, we determined that the credit was a result of the provision in the 2011 budget that gave a credit to small business for hiring additional employees.

To be eligible for the credit, small businesses are not required to prepare any additional reporting. The small business hiring credit is simply calculated based on the increase in employment insurance (EI) premiums paid in 2011 over 2010. The maximum amount that any business is eligible to receive is $1,000.

Since the calculation is based on amounts reported on your T4 slips for 2010 and 2011, you are only eligible if the slips have been filed for these calendar years.

It appears that the amount of the credit is 100% of the excess of 2011 EI premiums over the 2010 EI premiums, up to aforementioned limit of $1,000.

The credit will not actually be paid out immediately, but applied to your payroll account.

New businesses (like my client) will receive the credit. Their 2010 EI premiums will be calculated at $0.

Note that since the EI credit should reduce your payroll expense, it will reduce your business expense and by extension, increase profits. The journal entry is as follows:

Dr. Payroll (EI) Liability

Cr. Payroll Expense

Once you receive your payroll statement from Revenue Canada indicating the amount of the credit, you may reduce the payroll liability owing to them by the same amount. You cannot, however, estimate the amount of the credit before you have received notification from Revenue Canada.

Is Facebook’s Valuation Justified? A Comparison of Key Financial Metrics to Apple and Google

The recent release of Facebook's S-1, the financial filings that are required to be publicly available prior to filing an IPO, has created a media frenzy. The report has been dissected and analyzed extensively, financial news networks can’t seem to stop talking about it and it seems that people who have never heard of an IPO are discussing it, fittingly, on their Facebook pages. The most controversial issue, of course, is whether Facebook is actually worth $100 Billion.

Although Facebook is unique in its global reach and ubiquity, the starting point for any valuation is to compare it with similar businesses. I have chosen Apple and Google, given the similarity of their business models and their respective global dominance, to compare certain key metrics:

How to Update Wave Accounting for the 2012 QST Rate Increase

As of January 1st, 2012 the Quebec Sales Tax (QST Rate) which had gone up from 7.5% to 8.5% on January 1, 2011 will now increase to 9.5%. The effective sales tax in Quebec will go up from 13.925% to 14.975%. Since QST is calculated on the net amount + GST, the rate is not 14.5% but 14.975% . In other words the effective QST rate is 9.75%. Business owners will need to update their invoicing and accounting systems accordingly to ensure that the rate is properly reflected.

If you are using Wave Accounting, the update to the rates is fairly straightforward, with one little quirk. Since Wave, unlike Quickbooks, does not allow for the QST to be calculated on the GST, the effective rate has to entered manually. This is done as follows:

To update Quickbooks for the tax rate increase, please see “Updating Quickbooks for the 2011 QST Increase”. The procedure is essentially identical except for rates.

Tax Tips: Medical Expenses Tax Credit

Private Health Service Plans (PHSPs) for Small Businesses and Sole Proprietors: How to Make Medical Expenses Tax Deductible

One of the perks of being an employee, in many cases, is that your employer will provide health insurance benefits. Whether they pay for all of the premiums or only a portion, this can help to mitigate the costs significantly. Although, Canadians do have the luxury of Medicare, this is often inadequate and as anyone who has ever waited in an emergency ward can attest, may require you to take days off just to have your condition diagnosed (if one wants to look at this positively, it can be a great time to catch up on the classics). While the discussion of our Medicare system is a discussion for another time and another blog, the point is that having health insurance of some variety can help make the process a lot less painful. If you are self employed or a small business owner, however, the cost of health insurance can be prohibitive as you do not benefit from having a policy covering a group of people (thereby spreading the cost which is essentially how insurance companies work). On a personal level, Revenue Canada does provide for a tax credit, but this is only beneficial if your costs exceed 3% of your taxable income (up to approximately $2,000). Additionally the federal credit reduces your income taxes payable by 15% of the excess of medical expenses over the three year threshold. Eg. if your taxable income is $50,000 and your medical expenses are $2,000, your net federal reduction to your taxes payable is$2000 –( $50,000X3%) = $500X 15% = $75.00. This is very small relative to the actual expenses incurred.

So, how can a small business owner or self employed individual convert their medical expenses into business expenses? The answer is to use what is known as a Private Health Insurance Plan or a PHSP.

How to Update Quickbooks for the 2011 QST Rate Increase

Update: As of January 1st, 2012 the Quebec Sales Tax (QST Rate) which had gone up from 7.5% to 8.5% on January 1, 2011 will now increase to 9.5%. The effective sales tax in Quebec will go up from 13.925% to 14.975%. Since QST is calculated on the net amount + GST, the effective rate is actually 14.975% (and not 14.5%) . In other words the effective QST rate is 9.975%. The instructions below are equally applicable, except the new QST rate to enter is 9.5%.

On January 1st, 2011, Revenue Quebec will be increasing the QST rate to 8.5% (yay!), bringing the effective rate of QST to 8.925% andtotal sales taxes (GST and QST) to 13.925% (since the QST is actually charged on the net price + GST.) This will impact anyone who charges QST including small businesses and self employed individuals, and invoicing software and processes should be updated to reflect the change. Suffice it to say that there are no major changes in the application of the rates. For those of you using Quickbooks you will need to update the QST being charged on both sales and purchases.