10 Tips for Setting up Your QBO File for the first time

The idea of using an accounting software can be a bit intimidating for some new business owners. Others are put off by the cost when a simple spreadsheet is both free and easy. In some cases a spreadsheet makes sense when you have a simple business with very few transactions per year. However, if your business requires you to invoice your clients and customers , you want to be able to analyze the performance of the business and your time is at a premium, the monthly cost of an accounting software can be well worth it.

Quickbooks Online (QBO) is the most popular software used by small businesses. And while QBO has its pros and cons that should be evaluated before signing up, once you have decided to go ahead with it there are certain best practices that should be followed when setting up your file.

Is QuickBooks Online the Right Accounting Software for Your Small Business?

The search for accounting software can be a confusing and overwhelming process. A Google search for “small business accounting software” yields over 250 million results. Trying to get recommendations from other business owners often results in passionate discussions about why a particular program is great while another one is inadequate and lacks functionality. Your accountant might point you in the right direction, but will sometimes recommend a program that they are comfortable with using, but might be too technical and not necessarily be the best solution for your business. With so many choices out there, it can be difficult to know what to do.

Guidelines For Deducting Conference and Training Expenses

Attending conferences and investing in ongoing training can be a great way for small business owners and the self employed to keep current on industry developments, ensure ongoing professional development and improve their skills. It also allows for networking opportunities and occasionally includes trips to exotic locations, which can be a welcome change in environment from working at your office. As an added bonus ,the cost of conferences, conventions and seminars as well as corresponding travel expenses are deductible against your business income, subject to specific guidelines.

A Guide to Navigating Taxes in the Gig Economy

In a recent study by H&R Block, nearly 28% of Canadians reported taking on a side hustle in the “gig economy” to boost their income. This is a significant increase from 2022 in which the analogous percentage was 13%. This is likely a result of inflationary pressures and the expansion of opportunities available for flexible work.

The gig economy, popularized by Uber, refers to work that is flexible and usually incorporates digital apps or platforms.

Gig workers tend to be independent contractors who usually decide when they are going to work, often bring their own “tools” (such as a car or a computer) and are required to report their earnings to tax authorities.

Guidance on Registering for Payroll and Remitting Source Deductions

There comes a time for many small business owners when they decide that they need to hire employees. This is usually an excellent sign as it means a) the business is growing and b) the small business owner has learned to delegate. It also means that additional paperwork needs to be filled out and additional taxes need to be paid. The simplest option when deciding to augment your workforce is to have the new worker invoice the business, based on hours worked or some other formula. Unfortunately, there are very specific rules as to who qualifies as a self employed contractor. Essentially, if your have someone that works full time, has little flexibility with respect to the hours that they work and you provide the tools such as a desk/office, computer etc, then there is a good chance that the tax authorities will classify them as an employee. In this case, where your worker is clearly an employee, you must register for payroll, pay them a salary and submit regular, periodic payroll reports and payments to the Canada Revenue Agency (CRA). As usual, if you live in Quebec, you must submit to Revenue Quebec (MRQ) as well.

Are Gifts to customers and business associates deductible expenses?

Giving gifts to clients or customers can be a great way to build goodwill, foster customer loyalty and differentiate yourself from your competition. Gifts can be anything from a simple bouquet of flowers to something a bit more personalized based on your knowledge of the customer (it can be useful to listen carefully or probe gently to find out what your customers might want as a thoughtful gift can be tremendously impactful). A gift can be given around the holidays, on birthdays, after closing a sale or any other time as a simple thank you. Of course, if you are buying gifts on behalf of your business, it is important to understand if they qualify as tax deductible expenses and it what circumstances.

How to Calculate CPP/QPP Contributions If You Are Self Employed

When you are self-employed, you are essentially taking on the role of employer and employee. As such self-employed individuals are required to remit both portions of the CPP or QPP to Revenue Canada or Revenue Quebec respectively, which is calculated on your earnings for the year. This only applies to unincorporated business who declare business income as part of their personal tax return (T1)

12 Tax Tips for the Self Employed

The self-employed lifestyle holds great promise when you first start being self employed, however you quickly find yourself doing things that you would never have dreamed of. You are expected to take on role of salesperson, market researcher, accountant, lawyer and social media expert, while not getting paid for any of it. Your available funds do not allow for outsourcing and at times you are not even aware of what you don’t know. Luckily the internet provides a wealth of tips and tricks to make these tasks easier, and you might actually find that you enjoy taking on some of these challenges. Ensuring that you keep on top of your finances and tax obligations is among the most important of these tasks for which it is essential to have a system in place so that you can maximize tax deductions, minimize taxes payable and reduce amounts that you have to pay to CRA and RQ.

Should you register for GST/HST and QST and What it Means to Be Zero Rated

When starting your new Canadian small business or launching into self employment, it is essential to determine whether you are required to register for GST/HST (and QST if you have a started a business in Quebec). The simple answer is that if you anticipate that your annual gross revenues (total sales) are going to exceed $30,000 and your products or services do not qualify as Exempt or Zero rated (explained below) , then you are required to register for GST/HST and collect sales taxes from your Canadian customers and clients. The $30,000 limit applies to the last 4 quarters of revenues. If you decide not to register for sales tax upon the inception of your business/self employment, then you must monitor your sales revenues over a rolling 4 quarter period and register once you are close.

16 Common Financial and Tax Mistakes That Affect Your Small Business’ Bottom Line

Starting a business is hard work. In addition to creating your core product or service , you also need to have a working knowledge of numerous other facets of business including marketing, IT, accounting and operations . In the early stages cost constraints may prevent you from hiring additional staff or even outside contractors to handle some of these roles may not be an option. Consequently, you are faced with the daunting task of having to learn as much as possible in a short period of time. And although there is a great deal of information available via an internet search, it is easy to overlook something or make mistakes given a lack of experience and expertise or simply the right questions to ask. This is especially true with respect to the more technical aspects of business such as accounting and tax.

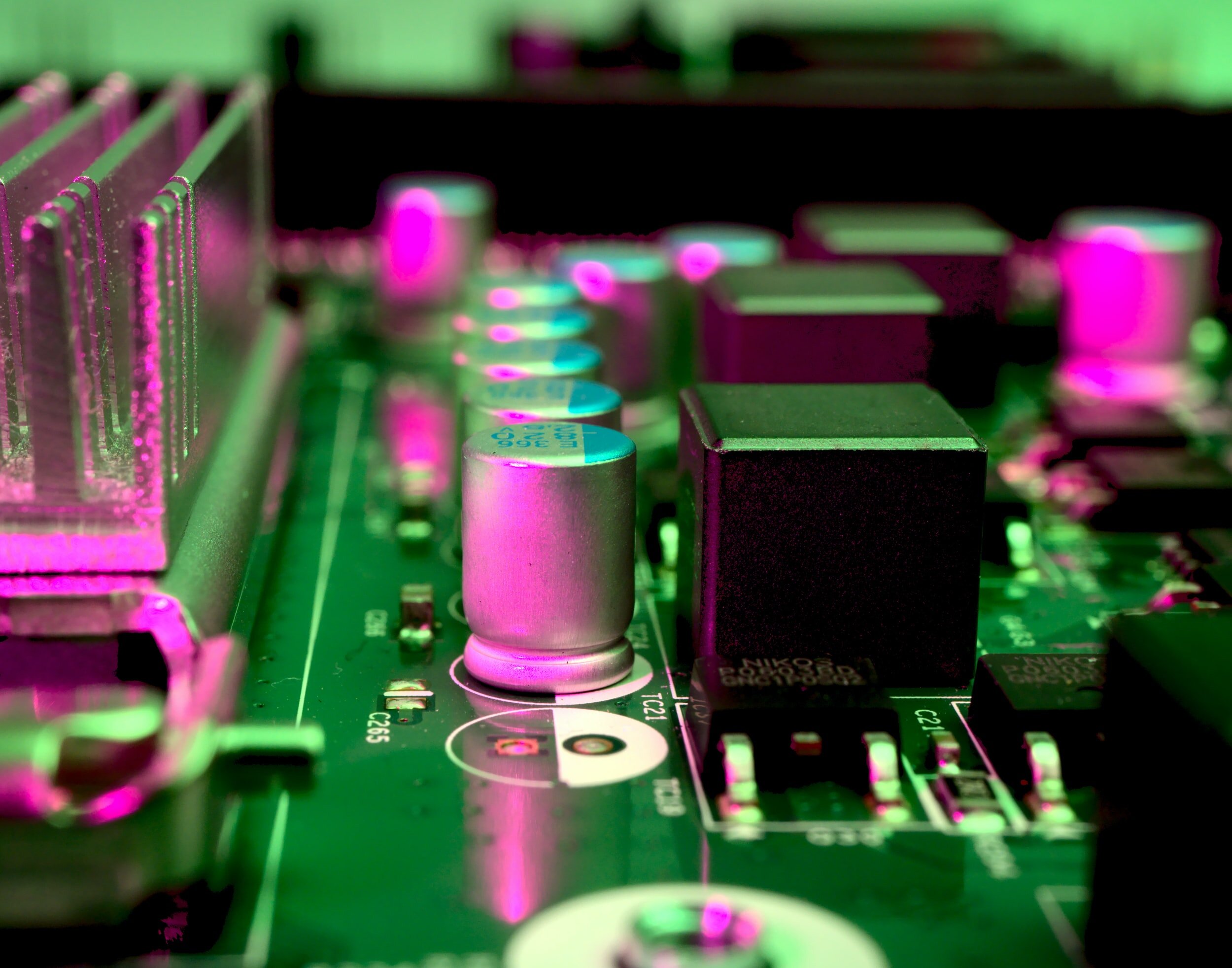

Accounting and Tax Treatment of Computer Hardware and other Fixed Assets

Investment in capital items such as computers, furniture, equipment and cars can cause confusion for small business owners. Since these are purchases that affect the cash flow of the business, it seems that they should be accounted for as expenses similar to office supplies or rent. There are however special rules for any acquisitions that qualify as “fixed assets”. A fixed asset, simply speaking, is an acquisition that provides a long term economic benefit to the business. In other words, any business purchases that has a useful life that extends beyond one year, will usually qualify as a fixed asset. Below I discuss the accounting and tax treatment of fixed assets.

Excel for Small Business Owners

As a confirmed excel nerd, there is something about large amounts of data that I am inextricably drawn towards . I suppose it has something to do with an affinity for organization combined with a love of numbers and the innate desire to solve problems. As an accountant and financial consultant , I am often presented with the task of organizing and analysing data into a format that allows for greater insight into my clients businesses . And although good accounting software is important for most small business owners, especially once they reach a certain size, a great deal of analysis and reporting is done most effectively in excel.

13 Ways an Effective Accounting System Can Improve Business Decisions

An accounting system can be an extremely powerful tool for business owners. When structured with the specific needs of the business in mind, it has the power (through the magic of debits and credits) to convert data into a format that tells an interactive, completely personalized story about your business. By providing feedback on how your business is doing it allows you to understand its strengths and weaknesses which ultimately helps you to improve profitability, cash flow and growth of your business.

Should You Transition to a Paperless Office (and What CRA Has to Say about It)

Imagine having an office without clutter, free from sad looking boxes and filing cabinets filled to the brim, where you don’t have to rifle through unlabeled containers to find a receipt for a computer that you bought three years ago. . An office where you can make Marie Kondo proud by getting rid of (almost) anything that does not bring you joy and surrounding it instead with items that inspire (or at least improve productivity). This is all possible with a few apps, sufficient digital space and a shift in your mindset and processes.