Guidance on Registering for Payroll and Remitting Source Deductions

There comes a time for many small business owners when they decide that they need to hire employees. This is usually an excellent sign as it means a) the business is growing and b) the small business owner has learned to delegate. It also means that additional paperwork needs to be filled out and additional taxes need to be paid. The simplest option when deciding to augment your workforce is to have the new worker invoice the business, based on hours worked or some other formula. Unfortunately, there are very specific rules as to who qualifies as a self employed contractor. Essentially, if your have someone that works full time, has little flexibility with respect to the hours that they work and you provide the tools such as a desk/office, computer etc, then there is a good chance that the tax authorities will classify them as an employee. In this case, where your worker is clearly an employee, you must register for payroll, pay them a salary and submit regular, periodic payroll reports and payments to the Canada Revenue Agency (CRA). As usual, if you live in Quebec, you must submit to Revenue Quebec (MRQ) as well.

Information on Filing T4s/RL-1s and T4As for Small Business Owners

When I was employee, I never really gave much thought to the T4 (and the Quebec equivalent RL-1) process. I knew that sometime around February an envelope would appear on my desk with a tax document which I would need to reflect on my tax return. I suppose I thought that someone, somewhere pressed a button and the T4s were generated. When I became a small business accountant, who was now either responsible for preparing this information or providing guidance to my clients, I realized that the process was somewhat more complicated.

4 Alternatives for Preparing Your Small Business Payroll

Paying salaries to employees (or yourself) requires more than just determining the gross amount to be paid. The Canada Revenue Agency and Revenue Quebec require that employers calculate a variety of taxes on the salaries paid, remit them to the federal and provincial governments and prepare annual reports demonstrating that the calculations are correct and all salary deductions have been paid. This can be a lot of work for business owners whose time is better spent generating sales and building their businesses. Luckily there are many options for small business owners to calculate their payroll and salary remittances, many of which simplify the process:

Tax Filings for a Typical Canadian Small Business

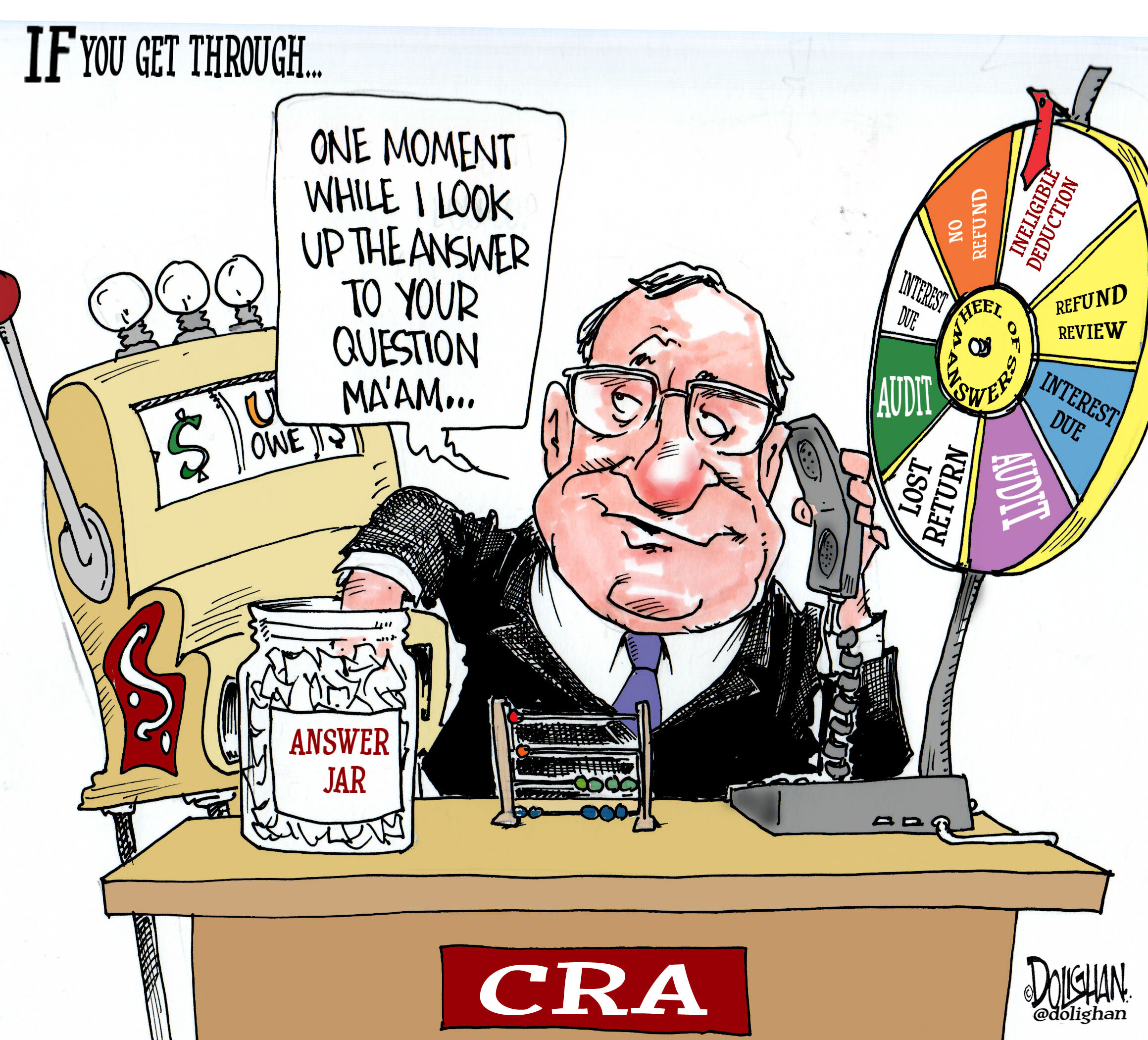

When starting a business, it can be confusing and a little overwhelming to keep on top of the different types of tax filings that need to be submitted and ensuring that deadlines are met. It isn’t always clear, particularly to a new business owner, as to what the various documents from Revenue Canada or Revenue Quebec relate to., which often contains jargon that requires decoding. (for example payroll remittances are referred to as deductions at source). It can be easy to ignore these notices in favour of more pressing business related issues, which is probably the worst thing to do since the government is extremely persistent and will usually follow up with arbitrary assessments and interest and penalties. It is therefore prudent for both sole propriertorhsips and incorporated businesses to keep on top of their tax filings

Understanding Payroll Deductions: Personal Income Tax Rates, CPP/QPP, EI and Basic Exemption

The automation of the tax preparation and filing process has been a boon to individuals and tax preparers alike. Gone are the days of struggling to find the right box on the return, adding everything up 5 times and still getting different results, and hoping that the CRA can read your chicken scrawl. Present day tax software not only guides you through every step of the process, it also helps to optimize your allocations thereby reducing your taxes payable. There is however at least one downside to automation: Since we are more removed from the actual calculations, our understanding of our tax situation is somewhat diminished. We have an idea of what we expect to pay, which we can see every week on our paycheques (or for self employed individuals, the breathtaking moment when we see the final result on our tax return), but often we are not really sure how these amounts are derived. Below is a discussion of the tax rates, deductions and maximums to improve our comprehension of this somewhat complex topic: