Excel for Small Business Owners

As a confirmed excel nerd, there is something about large amounts of data that I am inextricably drawn towards . I suppose it has something to do with an affinity for organization combined with a love of numbers and the innate desire to solve problems. As an accountant and financial consultant , I am often presented with the task of organizing and analysing data into a format that allows for greater insight into my clients businesses . And although good accounting software is important for most small business owners, especially once they reach a certain size, a great deal of analysis and reporting is done most effectively in excel.

What Types of Car Expenses Can Business Owners Deduct

Access to a car can be crucial to running a small business effectively. Costs of ownership, however, can be high, especially in the early stages when your business is not hugely profitable. Luckily, Revenue Canada and Revenue Quebec allows individuals and corporations who use their cars to generate income, to deduct the relevant expenses. Since there are many different situations that can arise with car expenses and also due to potential manipulation, both CRA and RQ provide detailed guidance on the subject. Below are some of the main provisions that impact small business owners:

7 Qualities of Highly Desirable Clients

When you are a business owner/freelancer, there are few things that are better than landing a great client. Ones that ask great questions, respect our work and make us feel happy to have chosen the entrepreneurial route. Conversely there are bad clients who have unrealistic expectations, are unimaginative and often just plain clueless.

Of course, as the service provider, it is also incumbent upon you to provide an exceptional service. Having a client is not dissimilar from being in a relationship and for both sides to get the most out of it, you must also be responsive, respectful, fair and transparent.

4 Factors to Consider When Pricing Your Small Business Services

One of the most challenging aspects of starting and maintaining a business, regardless of whether you are a freelancer or a conglomerate, is determining the right price to charge for your services. If you are an economist, the ideal price is simply the point at which demand meets supply. If a price is too high the demand for the service will go down thereby resulting in excess supply or capacity by the service provider. If the price is too low then demand will increasing leaving the supplier less availability to meet demand. Of course, pricing can be significantly more complex than this and has become a lot more sophisticated in recent years. Businesses pay thousands of dollars to pricing consultants for strategies that take numerous factors into consideration when determining pricing. One only has to look to airlines as example of a seemingly inscrutable pricing model. Unfortunately, smaller businesses, freelancers and startups don’t usually have the budget for a pricing strategist and have to make do by searching for information available on the internet, discussing it with their business associates or simply using their gut to come up with something that makes sense. As an internet source, I have set out a strategy for determining a price for your services

Tips and Tools for Working from Home

Having a home based business has many advantages - there's no wearying commute to and from work, our sleep schedule is not beholden to an alarm clock and it allows us to work, if we so choose, when we are at our most productive or creative. An additional benefit is that expenses relating to our home office are tax deductible. Working from home can, however, also present a unique set of challenges. Given the proximity of distractions including our beds, fridges , tvs and perhaps worst of all, our computers, it requires a great deal of discipline and focus to actually get any work done.

3 Online Accounting Software Options for Small Business

As cloud computing becomes ubiquitous, the number of cloud based online accounting software options continues to grow. Many small business owners want a software that has an intuitive and easy-to-use interface that allows them to bill customers, enter expenses, record bank transactions and generate financial statements and other reports,. We also want to be able to access the software from anywhere (you never know when the desire to do your accounting strikes!) and not be tied down to a specific location Below is a summary of 3 cost effective, multi functional alternatives :

Employee vs. Self Employed: Criteria and Considerations

For the majority of income earners, employment status is pretty evident. If you are going to the same place every day, have an assigned cubicle with a computer and a corporate stapler, and you have a boss that tells you what you need to do, chances are you are an employee. Conversely if you have several clients, use your own laptop, and are worried about where your next sale is going to come from, you are probably self employed.

There are, however, some workers whose status is not that apparent. For example you may work from home and use your own computer, but you report to one entity, where someone supervises and directs your work. In these cases a determination needs to be made as to whether you are an employee or self employed. It is not enough for the person paying you to determine your classification ; often, payers are biased as they may not want to take on the financial costs and responsibilities of having an employee (explained below). As such, when in doubt about your status, it is helpful to answer the following questions:

The Importance of Breakeven Analysis for Business Owners

When embarking on your new business venture, one of the first and most important concepts that you will be introduced to is break-even analysis which, very simply, is the amount of revenues you need to generate to cover your direct and indirect expenses. A good grasp of this is essential for business owners since even businesses with significant sales revenues can incur losses if they are not able to cover their costs. While break even analysis tends to be used more for businesses that sell physical products, it can also help to the determine the price for services

The Many Hats of Self Employment

Being self employed comes with many benefits. You can sleep in, work in your pyjamas and go shopping in the middle of the day. You no longer have to report to a boss who doesn't really understand what you do or deal with mindless workplace politics. It all sounds wonderful, but unfortunately there are also many challenges. Small business owners have to deal with uncertainty and risk. They need to be disciplined and deal with the many demands that being self employed can impose upon us. In the early stages of self employment, most of us have to take on the responsiblity of fulfilling the administrative functions that you find in a more established business. Some of the skills that you need to develop are:

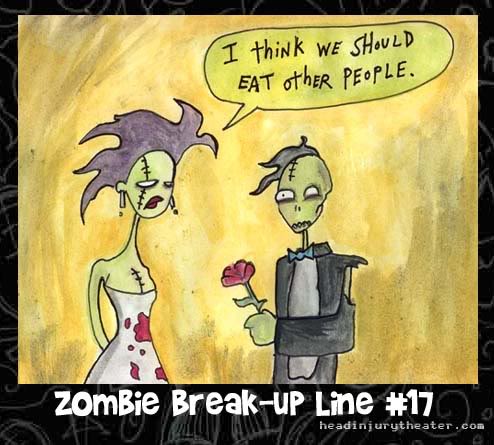

Breaking Up with a (Likeable) Client

Many of us have clients who are annoying, cheap, stupid , high maintenance or some combination thereof. As a new business owner, we are often stuck with these clients because we need them. However, we look forward to the day when we will have the thriving business that we so deserve, and fantasize about the spectacular way in which are going to fire them (you can shove your business into your rear orifice etc.) This is actually a productive fantasy as can help to channel and concentrate anger. Of course, in the majority of cases, a firing should be conducted with slightly less vigour.

CJAD Finance Segment with Tommy Schnurmacher – Everything You Want to Know about Small Business

How to Update Quickbooks for the 2011 QST Rate Increase

Update: As of January 1st, 2012 the Quebec Sales Tax (QST Rate) which had gone up from 7.5% to 8.5% on January 1, 2011 will now increase to 9.5%. The effective sales tax in Quebec will go up from 13.925% to 14.975%. Since QST is calculated on the net amount + GST, the effective rate is actually 14.975% (and not 14.5%) . In other words the effective QST rate is 9.975%. The instructions below are equally applicable, except the new QST rate to enter is 9.5%.

On January 1st, 2011, Revenue Quebec will be increasing the QST rate to 8.5% (yay!), bringing the effective rate of QST to 8.925% andtotal sales taxes (GST and QST) to 13.925% (since the QST is actually charged on the net price + GST.) This will impact anyone who charges QST including small businesses and self employed individuals, and invoicing software and processes should be updated to reflect the change. Suffice it to say that there are no major changes in the application of the rates. For those of you using Quickbooks you will need to update the QST being charged on both sales and purchases.